AMD can be described as the strongest force to impact Nvidia's monopoly position in the AI infrastructure sector in the next few years.

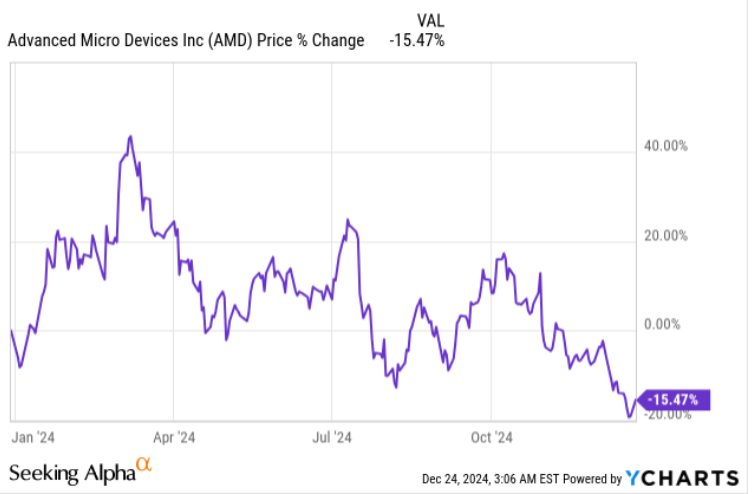

The stock price of AMD (AMD.US), a leader in PC and data center chips, recently plummeted below $120. Despite negative effects on investor sentiment, some institutions still consider its risk situation to be attractive for investment. Even some Wall Street investment institutions are betting that AMD's stock price is expected to hit a historic high of $200 within the next 12 months. Furthermore, there are still a group of “AI believers” that AMD's data center business unit will show huge growth potential with the MI300X and subsequent updated and iterative AI product lines, making it able to compete with Nvidia's absolute dominance in the data center AI GPU market.

The Asian Investor, a well-known writer at Seeking Alpha, recently published an article stating that obsession with valuation is meaningless for AMD, which is likely to achieve a sharp increase in performance in the short term. When it continues to be sold sharply, it is an excellent opportunity to “buy on dips”. The current capital flow shows that buying on dips continues to pour into the stock, driving AMD's recent excessive decline and rebound; and there has been a strong trend in betting that it will encroach on Nvidia's long-term share of up to 90% in the data center chip AI field. This is also the logic of its high valuation.

AMD's increasingly mature software and hardware collaboration ecosystem, and more and more cloud computing giants, such as Oracle and Microsoft giants, are increasing their acquisition of AMD ecosystem's AI hardware infrastructure, such as AMD's AI GPUs, server CPUs, etc., and AMD can be described as the strongest force impacting Nvidia's monopoly position in the AI infrastructure field in the next few years. The Asian Investor published an article stating that AMD's upcoming M300X AI GPU upgrade, the MI325X, and the MI350 series and MI400 series in the next year or so, and the booming data center business dominated by server CPUs are expected to significantly increase AMD's revenue, gross profit, and free cash flow in the 2025 fiscal year.

AMD's increasingly mature software and hardware collaboration ecosystem, and more and more cloud computing giants, such as Oracle and Microsoft giants, are increasing their acquisition of AMD ecosystem's AI hardware infrastructure, such as AMD's AI GPUs, server CPUs, etc., and AMD can be described as the strongest force impacting Nvidia's monopoly position in the AI infrastructure field in the next few years. The Asian Investor published an article stating that AMD's upcoming M300X AI GPU upgrade, the MI325X, and the MI350 series and MI400 series in the next year or so, and the booming data center business dominated by server CPUs are expected to significantly increase AMD's revenue, gross profit, and free cash flow in the 2025 fiscal year.

Since AMD announced its third-quarter earnings report in October, its stock price performance has greatly disappointed investors. Although AMD reports that the data center business unit's revenue for the third quarter ending September more than doubled year-on-year, the relatively moderate overall revenue outlook for the fourth quarter brought significant negative sentiment among investors in the US stock market.

AMD's series of major AI products may drive a sharp increase in performance. Has the opportunity to “buy on dips” arrived?

Storage giant Micron Technology (MU.US), which has benefited from the AI boom, recently released a revenue forecast for the current fiscal quarter far below market expectations, further exacerbating downward pressure on valuations and stock prices of many semiconductor giants, including AMD. This has undoubtedly exacerbated the negative sentiment in the market. However, as AMD's stock price recently fell to around $120, and AI ASIC leader Broadcom (AVGO.US) is extremely optimistic about AI infrastructure such as AI chips, the latest risk situation of semiconductor giant AMD, which has vowed to impact Nvidia's monopoly position, seems very attractive, and “buying forces on dips” may pour into the stock on a large scale.

After AMD submitted its financial results report for the third fiscal quarter, the Asian Investor from Seeking Alpha strongly recommended buying AMD shares on dips, and the well-known financial writer emphasized that the strong expectations of “AI believers” and some investment institutions about the revenue growth rate of AMD's data center business were hardly reflected in AMD's stock price and market value pricing after the recent sharp decline.

The Asian Investor wrote, “AMD has strong momentum in the data center business, but I don't think investors are fully aware of this... Currently, more than half of the company's total revenue comes from data centers. As AMD plans to increase the delivery volume of MI300X Instinct AI GPU products in the fourth quarter and fiscal year 2025, AMD has considerable potential to encroach on Nvidia's near-monopoly data center AI GPU market share, which has occupied an absolute dominant position in the data center AI infrastructure hardware market for the past two years. AMD's continued high valuation doesn't mean anything to me, and I think its current risk situation is extremely attractive for investment.

AMD has been developing late in the field of data center AI infrastructure hardware, so it has been lagging behind Nvidia for a long time, but recently it has finally caught up with the MI300X, a data center AI GPU with performance that surpasses Nvidia's Hopper architecture and has an increasingly complete ecosystem based on software and hardware collaboration acceleration. This AI GPU provides data center operators with a hardware replacement that surpasses the comprehensive performance of Nvidia's H100/H200 AI GPUs. Given the current Nvidia H100/H200, and the continued tight supply of Blackwell GPUs, cloud computing giants such as Oracle have begun to switch to configuring AMD AI hardware infrastructure, and the MI300X shipment prospects have become more and more optimistic.

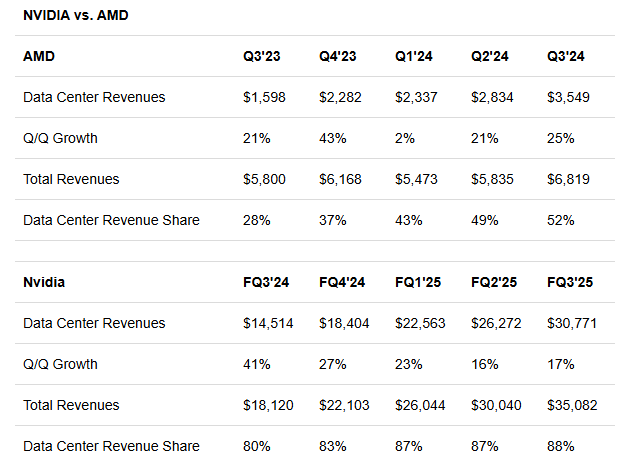

The Asian Investor said that although Nvidia's revenue, gross profit, and profit have increased dramatically due to the outstanding success of the H100/H200 and Blackwell in the data center field, Nvidia still has a clear advantage over AMD, that is, its booming data center business accounts for a much higher share of its total revenue: in the most recent quarter, the data center business accounted for 88% of comprehensive revenue, compared to just 52% of AMD. However, The Asian Investor emphasized that AMD's share of data center business revenue has increased dramatically in the past year, almost doubling year over year, which indicates that if this trend continues, AMD's comprehensive revenue will also accelerate growth. These are all underpriced parts of the market.

AMD's product line is very complete. It plans to release new AI GPUs — the MI325X and MI350 series AI accelerators — in 2025. Wall Street agencies generally expect this to drive a significant increase in the company's data center business revenue. Since more than half of AMD's total revenue currently comes from data centers (compared to only about a quarter in the third quarter of 2023), the acceleration in data center business revenue growth will also significantly drive AMD's comprehensive revenue growth, as well as the size of gross profit and free cash flow, thereby continuing to increase valuation and stock prices.

AMD, Nvidia's strongest competitor in the field of PC independent graphics cards and data center server AI GPUs, can be described as making every effort to quickly launch a new server AI GPU and an end-side AI chip suitable for the AI PC side, in an attempt to weaken Nvidia's absolute dominance of the lucrative data center AI chip market of up to 90%, while at the same time gaining a first-mover advantage over its chip peers in the end-side AI market.

The Mi300x AI accelerator built by AMD has strong advantages over Nvidia Hopper AI GPUs in terms of memory bandwidth and capacity, and is particularly suitable for generative AI model training and inference tasks that require high AI parallel computing power loads. The collaboration between Oracle and AMD to build an AI supercomputing center shows that AMD already has strong competitiveness in hardware design and AI-related software ecosystem support, especially in terms of software and hardware collaboration systems required for high-performance computing and AI workloads. For AMD, which currently has less than 10% of the data center AI GPU market, AMD has an opportunity to use Oracle's strong influence in the global cloud computing service market to expand the MI300X market share in the data center AI GPU field.

The AMD M300X upgraded version, the MI325X, which is used in data center AI servers, began mass production and sales in the fourth quarter. AMD's more advanced MI350 series will be launched in 2025, while the MI400 series will be launched one year later. In terms of AMD's newly launched MI325X performance indicators, the MI325X, which is based on TSMC's 3nm manufacturing process, will continue AMD's powerful cDNA 3 architecture, and will also use the fourth-generation HBM storage system, HBM3E, like the Nvidia H200. The memory capacity will be greatly increased to 288GB, and the bandwidth will also be increased to 6Tb/s. The overall performance will be further improved. Other benchmark specifications and compatibility are basically consistent with the MI300X, making it easier for AMD customers to upgrade and transition.

Su Zifeng pointed out that the MI325X AI performance increase is the biggest in AMD history. Compared with the competitor Nvidia H200, it will be more than 1.3 times better; the AMD MI325X peak theory FP16 is about 1.3 times the H200, 1.3 times the memory bandwidth of the H200, and the model size based on each server is 2 times that of the H200.

Some Wall Street analysts pointed out that in terms of gross profit, Nvidia's profitability still far exceeds that of AMD, but AMD's gross profit trend also shows signs of significant improvement, which is directly related to the company's success in the data center AI GPU market. When next year's more expensive next-generation artificial intelligence GPU products are launched, AMD may even have more potential to expand its gross profit margin if AMD accelerates its encroachment on Nvidia's market share.

Nvidia's free cash flow increased 138% in the last quarter, while AMD's free cash flow increased 67%. Nvidia's important indicator grew twice as fast as AMD. However, AMD has the potential to catch up with Nvidia, mainly because its data center business has begun to show strong growth in the second and third quarters of 2024. The Asian Investor said that although AMD currently clearly lags behind Nvidia in terms of data center business growth, AMD's sharp increase in MI300X, MI325X, and MI350X shipments may have a significant impact on the semiconductor giant's performance in 2025.

Bain, a world-renowned strategy consulting firm, predicts that as the rapid spread of artificial intelligence (AI) technology disrupts businesses and economies, the size of all markets related to artificial intelligence is expanding and will reach 990 billion dollars by 2027. The consulting firm stated in its fifth annual “Global Technology Report” released on Wednesday that the overall AI market size, including artificial intelligence-related services and basic hardware, will grow 40% to 55% each year from last year's $185 billion. This means it will bring in revenue of 780 billion to 990 billion US dollars by 2027.

AMD, whose stock price has continued to be weak since this year, is accumulating energy to hit $200?

The Asian Investor said that in addition to having a promising product line for the MI300X, MI325X, and MI350X AI acceleration hardware, AMD's valuation itself now also has a certain competitive advantage over the expensive Nvidia.

Undoubtedly, Nvidia remains the highest-valued semiconductor company in the US stock market, with an expected price-earnings ratio of 31.5x. On the other hand, AMD's current expected price-earnings ratio of about 24.4x far exceeds industry estimates, but compared to AMD's long-term benchmark, the 3-year average price-earnings ratio is about 24% off, compared to Nvidia's latest valuation, it unexpectedly shows a 22% discount. Just about three months ago, Nvidia and AMD had roughly the same expected price-earnings ratio. However, Nvidia has a very strong investment allocation and performance expectations that continue to heat up, which is why Wall Street believes investors should seize the opportunity to buy Nvidia on dips.

AMD's outlook for the fourth quarter of 2024 has disappointed investors — the semiconductor company expects revenue of around 7.5 billion dollars, fluctuating 0.3 billion dollars, and the market forecast is 7.6 billion dollars — this has caused negative market sentiment, causing AMD's stock price to continue to plummet. The decline since this year has surpassed the S&P 500 index by 15%, which is incomparable to Nvidia's 180% increase, but some analysts believe this pricing is unreasonable. First, AMD's expectations are only minor deviations (estimated revenue base of 7.5 billion US dollars, compared to expectations of 7.6 billion US dollars). Second, AMD's data center business division has seen a sharp increase in revenue, which is directly related to MI300X Instinct.

The Asian Investor said in its latest publication that based on the expected fair value of the 36x price-earnings ratio and the expected earnings range of 6-7 US dollars per share in fiscal year 2025, the fair value of AMD's shares is between 216-252 US dollars per share. Currently, the market expects earnings per share to be only 5.10 US dollars next year. AMD's latest closing price was $126.290, which has broad upward potential compared to The Asian Investor's expectations.

Given the semiconductor giant's encouraging growth in data center AI infrastructure, and AI GPU shipments are increasing substantially, particularly in the first half of 2025, The Asian Investor believes the market's expectations may be too conservative. The financial writer believes that AMD's current stock price and earnings per share expectations are unreasonable, considering the potential significant growth drivers of AMD's data center business and strong execution by its management in 2024.

Looking at current prices and valuations, some analysts pointed out that buying AMD on dips will not only reap “Christmas and New Year's Eve gifts,” but the semiconductor giant is on the cusp of a sharp increase in data center-related revenue. This should also increase AMD's gross profit and free cash flow in the 2025 fiscal year. AMD's AI product line is probably the company's best product line for many years. In particular, the company targets artificial intelligence GPUs for data center operations and the ROCM software ecosystem that is continuously optimized and improved. Through its MI300X AI accelerator+ROCM software acceleration ecosystem, AMD can be described as the “strongest combat force” to challenge Nvidia's dominance in the field of data center AI infrastructure.

Although Nvidia's stock price has also recently consolidated, from the perspective of the expected price-earnings ratio, AMD's stock price is now clearly about 22% cheaper than Nvidia. This may cause more US stock investors focusing on the AI investment boom to buy AMD at a low price before the market recovers in 2025. In particular, AMD's data center business has multiple catalysts. Most importantly, next-generation artificial intelligence AI accelerator hardware will be launched in fiscal year 2025, which may become the core catalyst for the significant expansion of AMD's data center business.

On Wall Street, there are not a few investment institutions that are bullish on AMD. Roth MKM, Citigroup, and Benchmark are all optimistic that AMD will hit $200 in the next 12 months and have reaffirmed the “buy” rating; the international bank UBS (UBS) is bullish to $205, while Rosenblatt Securities, another well-known investment institution, is even bullish to $250. The target price range given by The Asian Investor is 216-252. These target price expectations, which are optimistic that AMD's stock price will enter a bullish curve, mean that the stock is likely to hit the $200 mark again after a lapse of 10 months, and AMD is poised for a new round of “main upward wave”.

AMD愈发成熟的软硬件协同生态系统以及越来越多云计算巨头,比如甲骨文、微软巨头等加码购置AMD的AI GPU、服务器CPU等AMD生态的AI硬件基础设施,AMD可谓未来几年内冲击英伟达在AI基础设施领域垄断地位的最强势力。The Asian Investor发文表示,AMD即将推出的M300X AI GPU升级版本——MI325X,以及未来一年左右的MI350系列与MI400系列,加之服务器CPU主导的蓬勃发展数据中心业务有望在2025财年显著提升AMD营收、毛利润以及自由现金流。

AMD愈发成熟的软硬件协同生态系统以及越来越多云计算巨头,比如甲骨文、微软巨头等加码购置AMD的AI GPU、服务器CPU等AMD生态的AI硬件基础设施,AMD可谓未来几年内冲击英伟达在AI基础设施领域垄断地位的最强势力。The Asian Investor发文表示,AMD即将推出的M300X AI GPU升级版本——MI325X,以及未来一年左右的MI350系列与MI400系列,加之服务器CPU主导的蓬勃发展数据中心业务有望在2025财年显著提升AMD营收、毛利润以及自由现金流。