The most oversold stocks in the utilities sector presents an opportunity to buy into undervalued companies.

The RSI is a momentum indicator, which compares a stock's strength on days when prices go up to its strength on days when prices go down. When compared to a stock's price action, it can give traders a better sense of how a stock may perform in the short term. An asset is typically considered oversold when the RSI is below 30, according to Benzinga Pro.

Here's the latest list of major oversold players in this sector, having an RSI near or below 30.

National Grid plc (NYSE:NGG)

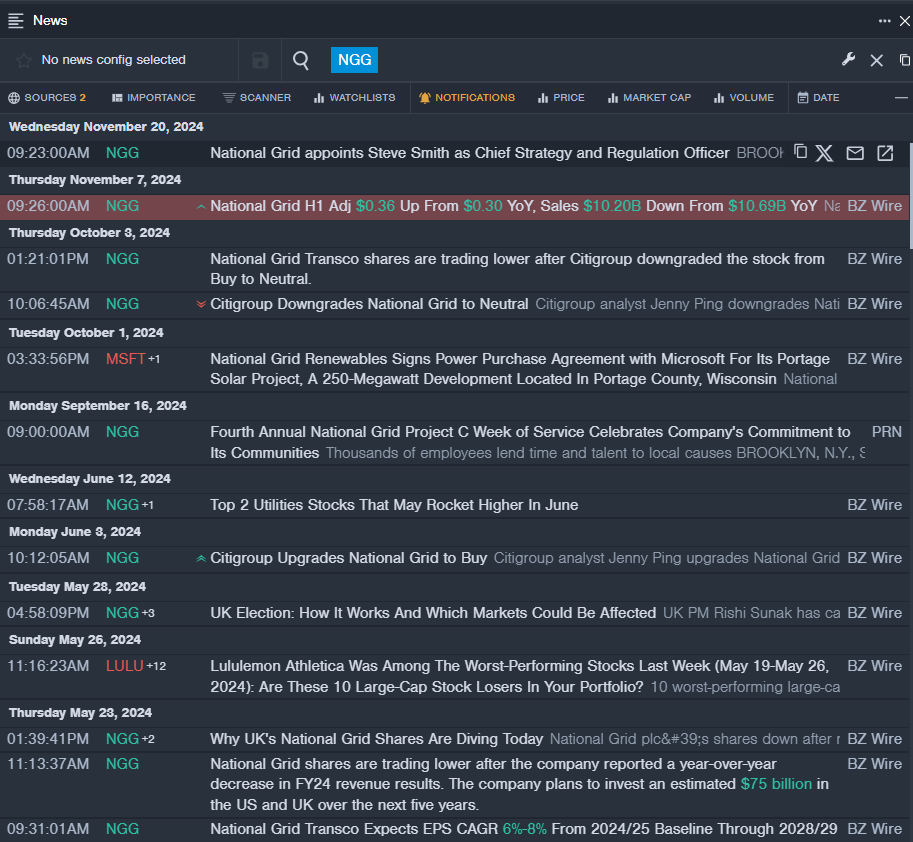

- On Nov. 20, National Grid named Steve Smith as Chief Strategy and Regulation Officer. "It's a privilege to be appointed to this role at the most exciting time for the energy sector in decades," said Steve Smith "The strategy and regulation teams already deliver outstanding work to ensure National Grid is set up for success and that we continue to put our customers first. I am very much looking forward to continuing to build on this, as I take up the role on a permanent basis." The company's stock fell around 6% over the past month and has a 52-week low of $55.13.

- RSI Value: 24

- NGG Price Action: Shares of National Grid fell 0.3% to close at $58.86 on Tuesday.

- Benzinga Pro's real-time newsfeed alerted to latest NGG news.

American Electric Power Company Inc (NASDAQ:AEP)

- On Dec. 12, JP Morgan analyst Jeremy Tonet downgraded American Electric Power from Overweight to Neutral and lowered the price target from $109 to $102. The company's stock fell around 7% over the past month and has a 52-week low of $75.22.

- RSI Value: 29

- AEP Price Action: Shares of American Electric Power fell 0.5% to close at $92.37 on Tuesday.

- Benzinga Pro's charting tool helped identify the trend in AEP stock.

NextEra Energy Inc (NYSE:NEE)

NextEra Energy Inc (NYSE:NEE)

- On Dec. 12, Scotiabank analyst Andrew Weisel maintained NextEra Energy with a Sector Outperform and raised the price target from $92 to $96. The company's stock fell around 6% over the past month and has a 52-week low of $53.95.

- RSI Value: 27

- NEE Price Action: Shares of NextEra Energy gained 0.6% to close at $72.91 on Tuesday.

- Benzinga Pro's signals feature notified of a potential breakout in NEE shares.

Read This Next:

- Wall Street's Most Accurate Analysts Give Their Take On 3 Utilities Stocks With Over 4% Dividend Yields