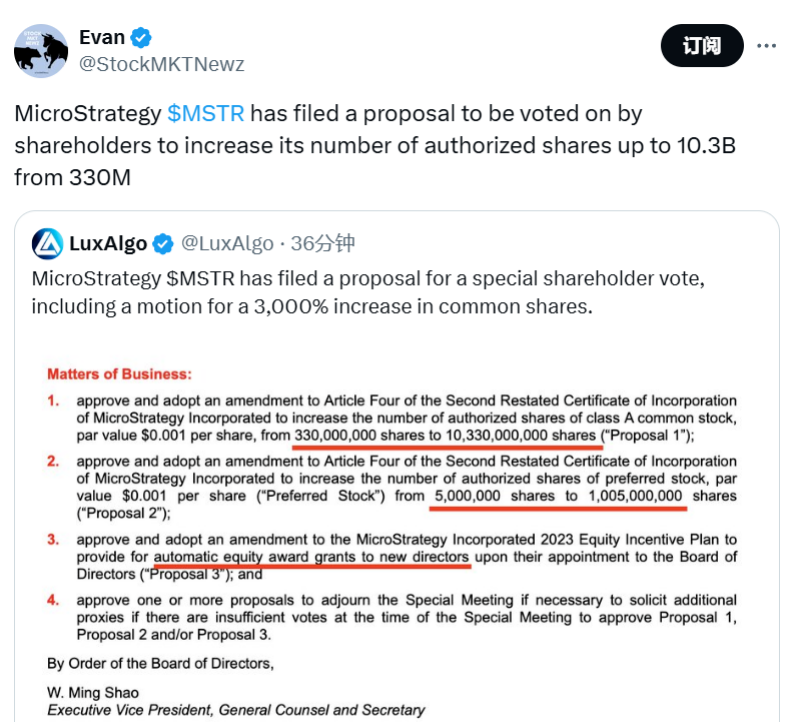

MicroStrategy is seeking shareholder approval to increase the authorized share count, increasing Class A shares from the current 0.33 billion to 10.33 billion shares. The company stated in the documents that the pace of Bitcoin acquisitions "is much faster than initially expected."

The cryptocurrency giant MicroStrategy recently announced plans to continue increasing its Bitcoin holdings by issuing additional stocks.

According to the preliminary proxy statement submitted by the company to the SEC later on Monday, MicroStrategy is seeking shareholder approval to increase the number of authorized shares for Class A common stock and preferred stock. This will provide more financial support for the company, which has transformed from a software manufacturer into a Bitcoin accumulator.

MSTR plans to significantly issue more stocks.

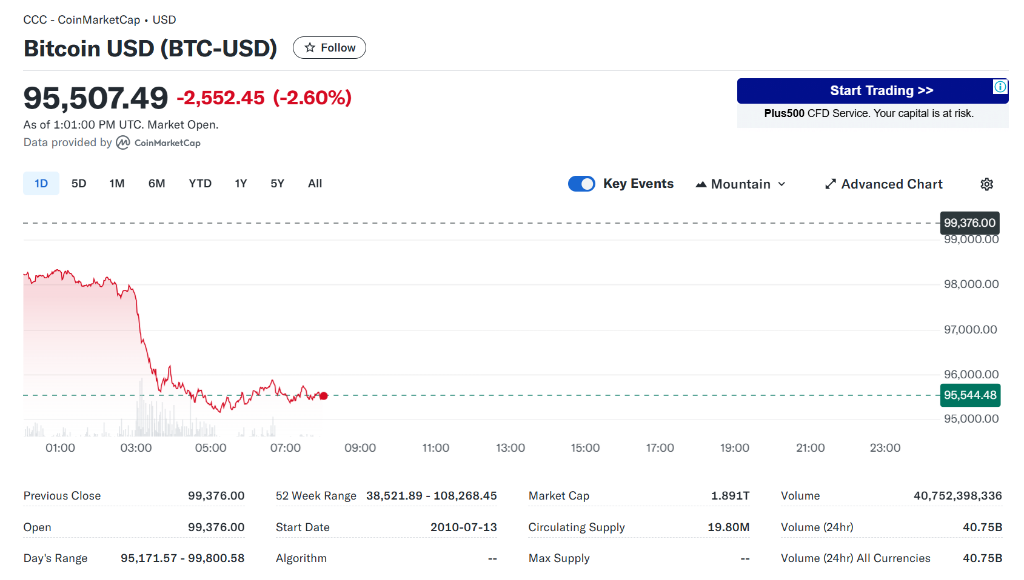

On Thursday, the price of Bitcoin fell by about 2.6%. Meanwhile, the SSE Conglomerates Index, which includes other cryptocurrencies such as Ethereum, Solana, and Dogecoin, also dropped by approximately 3%.

On Thursday, the price of Bitcoin fell by about 2.6%. Meanwhile, the SSE Conglomerates Index, which includes other cryptocurrencies such as Ethereum, Solana, and Dogecoin, also dropped by approximately 3%.

Sean McNulty, the trading director at Arbelos Markets, stated:

The market has a forward-looking attitude towards MicroStrategy's Bitcoin purchasing behavior, which is the biggest reason for the previous market rise. Following MicroStrategy's dynamics has now become a part of daily work.

Some traders express concerns about market volatility in the coming days. A record $43 billion in open contracts will expire at the Deribit derivatives exchange, including $13.95 billion in Bitcoin options and $3.77 billion in Ethereum options. McNulty predicts:

Market makers may unwind their hedges and short Bitcoin positions, which could lead to severe market volatility.

The ambitions of MicroStrategy

MicroStrategy noted in its filing that the speed of the company's Bitcoin acquisitions is "much faster than initially expected."

Since announcing its plan to raise $21 billion through issuing additional stocks and Bonds at the end of October last year, MicroStrategy has started aggressive Bitcoin acquisition actions. So far, MicroStrategy has issued approximately $13 billion in Stocks and $3 billion in convertible Bonds under this plan, using all of these funds to purchase Bitcoin.

Currently, MicroStrategy has become the largest corporate holder of Bitcoin globally, holding approximately 0.439 million Bitcoins, with a Market Cap of about $42 billion, accounting for more than 2% of the total global Bitcoin supply.

It is worth noting that future stock issuance by MicroStrategy may further dilute the shareholding ratio of existing Shareholders. Currently, the company has issued approximately 0.223 billion Class A common stocks, with fully diluted shares being around 0.26 billion. If the current issuance plan is successfully implemented, the number of MicroStrategy's circulating shares next year may approach its authorized limit of 0.33 billion shares.

MicroStrategy CEO Michael Saylor has long been known for promoting Bitcoin investments. Analysis suggests that the plan to significantly increase the number of shares issued shows his ambition to make MicroStrategy the 'absolute leader' in the Bitcoin market.