Financial giants have made a conspicuous bullish move on Deere. Our analysis of options history for Deere (NYSE:DE) revealed 9 unusual trades.

Delving into the details, we found 77% of traders were bullish, while 11% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $326,635, and 3 were calls, valued at $152,110.

Projected Price Targets

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $400.0 to $470.0 for Deere during the past quarter.

Insights into Volume & Open Interest

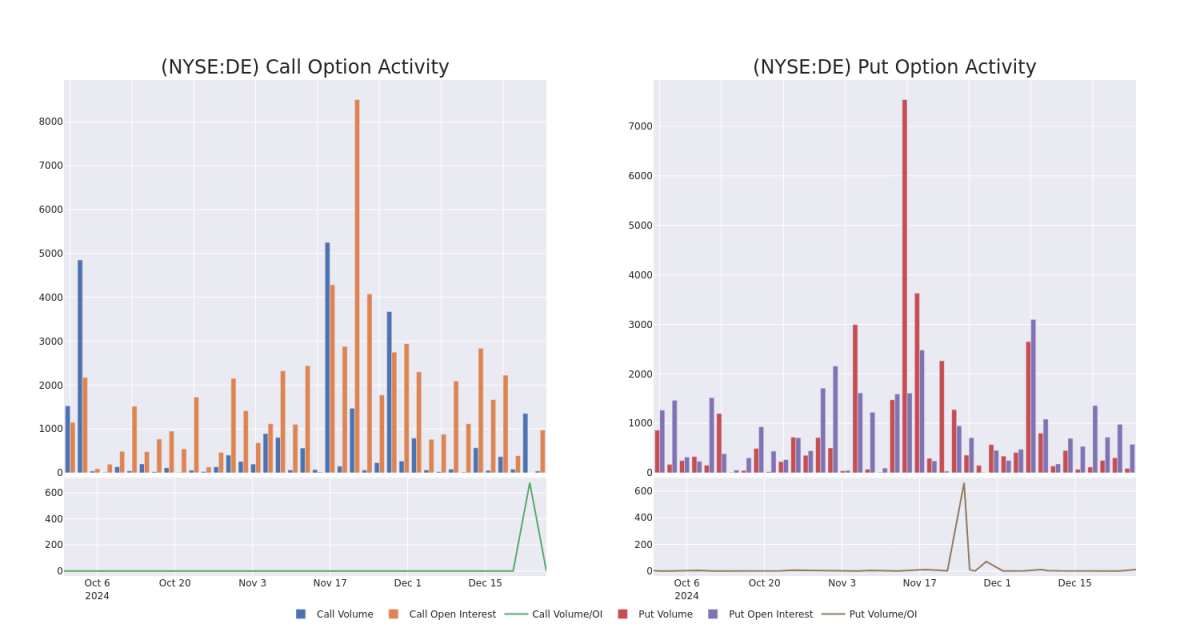

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Deere's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Deere's substantial trades, within a strike price spectrum from $400.0 to $470.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Deere's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Deere's substantial trades, within a strike price spectrum from $400.0 to $470.0 over the preceding 30 days.

Deere 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DE | PUT | SWEEP | BULLISH | 03/21/25 | $26.85 | $26.8 | $26.8 | $450.00 | $160.8K | 282 | 0 |

| DE | CALL | TRADE | BULLISH | 09/19/25 | $34.35 | $33.55 | $34.15 | $450.00 | $81.9K | 68 | 25 |

| DE | PUT | TRADE | BULLISH | 09/19/25 | $46.55 | $46.1 | $46.1 | $460.00 | $41.4K | 6 | 24 |

| DE | PUT | TRADE | BULLISH | 09/19/25 | $47.45 | $46.9 | $46.9 | $460.00 | $37.5K | 6 | 15 |

| DE | CALL | TRADE | BEARISH | 01/15/27 | $62.0 | $60.2 | $60.2 | $470.00 | $36.1K | 24 | 6 |

About Deere

Deere is the world's leading manufacturer of agricultural equipment, producing some of the most recognizable machines in the heavy machinery industry in their green and yellow livery. The company is divided into four reportable segments: production and precision agriculture, small agriculture and turf, construction and forestry, and John Deere Capital. Its products are available through an extensive dealer network, which includes over 2,000 dealer locations in North America and approximately 3,700 locations globally. John Deere Capital provides retail financing for machinery to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Deere product sales.

Following our analysis of the options activities associated with Deere, we pivot to a closer look at the company's own performance.

Deere's Current Market Status

- With a trading volume of 122,952, the price of DE is up by 0.4%, reaching $434.56.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 49 days from now.

What The Experts Say On Deere

3 market experts have recently issued ratings for this stock, with a consensus target price of $510.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Maintaining their stance, an analyst from Truist Securities continues to hold a Buy rating for Deere, targeting a price of $550. * Reflecting concerns, an analyst from Jefferies lowers its rating to Hold with a new price target of $510.* An analyst from Citigroup persists with their Neutral rating on Deere, maintaining a target price of $470.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Deere options trades with real-time alerts from Benzinga Pro.