The Jinhai Medical Technology Limited (HKG:2225) share price has softened a substantial 30% over the previous 30 days, handing back much of the gains the stock has made lately. The good news is that in the last year, the stock has shone bright like a diamond, gaining 177%.

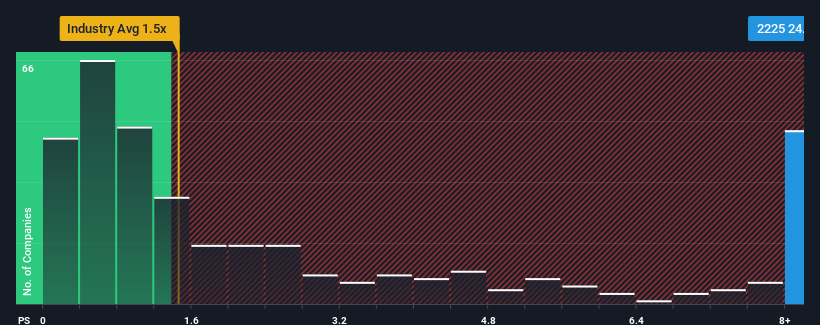

Although its price has dipped substantially, given around half the companies in Hong Kong's Professional Services industry have price-to-sales ratios (or "P/S") below 0.4x, you may still consider Jinhai Medical Technology as a stock to avoid entirely with its 24x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Jinhai Medical Technology's P/S Mean For Shareholders?

With revenue growth that's exceedingly strong of late, Jinhai Medical Technology has been doing very well. Perhaps the market is expecting future revenue performance to outperform the wider market, which has seemingly got people interested in the stock. If not, then existing shareholders might be a little nervous about the viability of the share price.

Although there are no analyst estimates available for Jinhai Medical Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Jinhai Medical Technology?

Jinhai Medical Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

Jinhai Medical Technology's P/S ratio would be typical for a company that's expected to deliver very strong growth, and importantly, perform much better than the industry.

If we review the last year of revenue growth, the company posted a terrific increase of 205%. The strong recent performance means it was also able to grow revenue by 226% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

When compared to the industry's one-year growth forecast of 10%, the most recent medium-term revenue trajectory is noticeably more alluring

With this in consideration, it's not hard to understand why Jinhai Medical Technology's P/S is high relative to its industry peers. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

The Bottom Line On Jinhai Medical Technology's P/S

Jinhai Medical Technology's shares may have suffered, but its P/S remains high. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of Jinhai Medical Technology revealed its three-year revenue trends are contributing to its high P/S, given they look better than current industry expectations. At this stage investors feel the potential continued revenue growth in the future is great enough to warrant an inflated P/S. If recent medium-term revenue trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Jinhai Medical Technology you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.