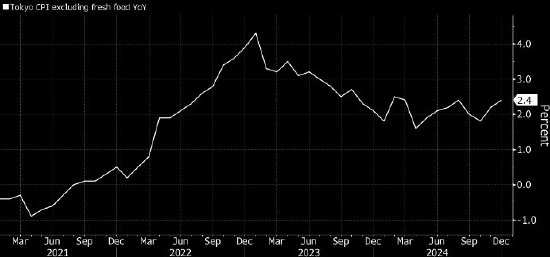

Inflation in Tokyo accelerated for the second consecutive month in December, due to the government's gradual removal of utility subsidies, which may support expectations for interest rate hikes next year.

The Japanese Ministry of Internal Affairs released data on Friday showing that consumer prices in Tokyo, excluding fresh food, increased by 2.4%, up from 2.2% the previous month. This data is the highest since August, but slightly below economists' expectations of 2.5%.

The acceleration in inflation is primarily due to rising Energy prices following the gradual removal of subsidies for Henry Hub Natural Gas and electricity.

Tokyo's inflation data is typically viewed as a leading indicator of the national inflation trend in Japan. Additional data indicates that the labor market remained relatively tight in November.

Tokyo's inflation data is typically viewed as a leading indicator of the national inflation trend in Japan. Additional data indicates that the labor market remained relatively tight in November.

Although the rise in inflation is mainly due to the gradual reduction of subsidies, the data suggests that price increases remain firm, possibly prompting the Bank of Japan to consider interest rate hikes in the coming months.

Bank of Japan Governor Kazuo Ueda reiterated on Wednesday that the timing and pace of adjustments to monetary easing will depend on the development of economic activity and prices, as well as future financial conditions. While he has retained the possibility of a rate hike in January, some market participants and economists have begun to shift their basic scenario for a rate hike to March.

Labor market data indicates that the employment market remains tight, with companies continuing to face pressure to raise wages to retain and attract employees. According to data from the Ministry of Health, Labour and Welfare, the job-to-applicant ratio in November remained unchanged at 1.25, and the unemployment rate still stands at 2.5%.

东京通胀数据通常被认为是日本全国通胀趋势的领先指标。另外数据显示11月劳动力市场保持相对吃紧。

东京通胀数据通常被认为是日本全国通胀趋势的领先指标。另外数据显示11月劳动力市场保持相对吃紧。