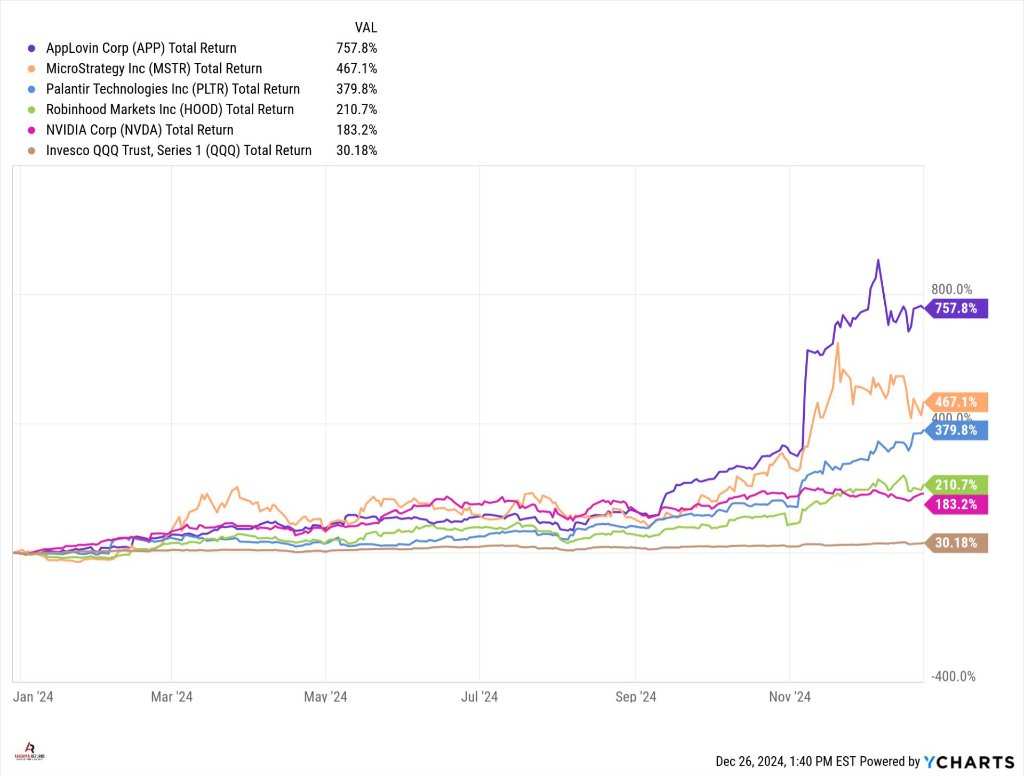

AppLovin successfully transformed into an AI advertising engine and topped the list of tech stocks with an astonishing increase of 758%. Additionally, MicroStrategy, which is betting on Bitcoin, Palantir, which supports data analysis with AI, and Robinhood, which is popular in the crypto trading business, surpassed Nvidia by 467%, 380%, and 210% respectively.

In 2024, technology stocks will continue to lead US stocks, and AI and cryptocurrency have become the two main forces driving US technology stocks. The top five technology companies that have increased all come from these two fields.

As of December 25, the NASDAQ, which is dominated by technology stocks, had surged 39% during the year, surpassing the S&P 500 and the Dow. Among them, AppLovin topped the list of technology stocks with an astonishing increase of 758%, while MicroStrategy, Palantir, and Robinhood also surpassed Nvidia's performance. In terms of market capitalization growth, Nvidia increased the most, increasing its market capitalization by $2.2 trillion.

AppLovin: From mobile gaming to AI advertising engine

AppLovin rose 758% to become the best-performing tech stock in 2024.

AppLovin rose 758% to become the best-performing tech stock in 2024.

As AppLovin transformed from a mobile gaming service company to an AI-driven online advertising giant, its market capitalization also soared from $13 billion at the beginning of the year to over $110 billion, surpassing well-known companies such as Starbucks, Intel, and Airbnb.

AppLovin's success is mainly due to its upgraded ad search engine. Last year, the company released version 2.0 of its advertising search engine AXON, a technology that helps deliver more accurate ads on gaming apps.

Driven by this transformation, AppLovin software platform revenue increased 66% year over year to $0.835 billion in the third quarter, net profit increased 300%, and profit margin increased from 12.6% to 36.3%.

MicroStrategy: Betting on Bitcoin's Big Winners

MicroStrategy continued its 346% increase in 2023, and its stock price rose again by 467% this year, mainly due to the company's Bitcoin purchase strategy.

MicroStrategy began large-scale Bitcoin purchases in mid-2020. Currently, it holds more than 0.444 million bitcoins, worth nearly 44 billion US dollars. It is the fourth largest Bitcoin holder in the world, and its market capitalization has also grown from 1.1 billion US dollars to 80 billion US dollars.

After Trump won the election in November, MicroStrategy's shares rose 57%, while Bitcoin rose 44% during the same period. Company founder Michael Saylor said that with the establishment of the “digital asset framework”, the entire digital asset industry will usher in a new round of growth.

Palantir: AI demand drives performance growth

Palantir's stock price has risen 380% since this year, making it another big winner in the market. With the support of AI, its data analysis tools have been widely used in defense and commercial fields.

In 2024, Palantir's stock price experienced multiple sharp increases. Last month, Palantir's third-quarter results announced the day before the presidential election exceeded expectations. Palantir also raised revenue expectations for 2024. Its fourth quarter results guidance far exceeded analysts' expectations.

CEO Alex Karp said in the earnings report: “We have performed very well this quarter, thanks to the ongoing demand for AI, and that demand is not slowing down.”

Palantir's stock jumped 23% after the earnings report was released, and rose 8.6% the day after Trump won the election. Peter Thiel, co-founder and board member of Palantir, was a strong supporter of Trump during the 2016 election campaign.

Robinhood: Cryptocurrency Deals Drive Growth

Although Robinhood's stock price fell 17% on October 31 due to poor earnings reports, its stock price has risen more than 200% this year.

After Trump won the election, Robinhood rose 20% within a few days. Cryptocurrency trading has become an important growth engine for Robinhood, and users can trade more than 20 cryptocurrencies, including Bitcoin, on the platform.

Robinhood's third-quarter crypto-related revenue increased 165% year over year to $61 million. Analysts expect the company's revenue to increase by more than 70% year over year in the fourth quarter to reach $0.8057 billion, which will be the fastest growth rate since its listing in 2021.

Nvidia: Demand for AI chips continues to be strong

Following a sharp rise of 239% last year, Nvidia's stock price rose again by 183% this year, increasing its market capitalization by 2.2 trillion US dollars to 3.4 trillion US dollars, second only to Apple.

In terms of performance, Nvidia is still the biggest beneficiary of the AI boom. The company's annual revenue growth rate over the past six quarters has exceeded 94%, with over 200% in three quarters.

CEO Hwang In-hoon said that the next-generation AI chip Blackwell has entered the “full production” stage. Financial director Colette Kress expects Blackwell's revenue to reach “several billion dollars” in the fourth quarter.

However, for a company the size of Nvidia, a slowdown in growth is inevitable. Analysts expect Nvidia's year-on-year growth rate to slow in the next few quarters and drop to around 45% by the second half of next year.

AppLovin以758%的涨幅成为2024年表现最佳的科技股。

AppLovin以758%的涨幅成为2024年表现最佳的科技股。