The Bitcoin market is currently facing multiple challenges. On one hand, institutional investors like MicroStrategy continue to Buy heavily, injecting confidence into the market; on the other hand, the upcoming massive Options expiration may trigger short-term volatility. In addition, Binance's Bitcoin reserves plunging may indicate a potential rise in Bitcoin prices.

As 2024 is about to end, the Bitcoin market is facing a critical moment, with a large-scale Options expiration today, and Binance's Bitcoin reserves plummeting.

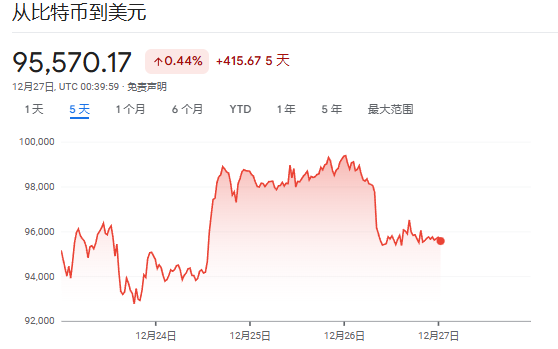

On Thursday, after three consecutive days of gains, Bitcoin corrected, dropping 3.4% to $95,110, previously reaching a historical high of $108,000 on December 17. Moreover, the Index of Cryptos, including Ethereum, Solana, and Dogecoin, also fell about 3.5%.

In response, Zaheer Ebtikar, founder of the Cryptos Fund Split Capital, stated:

In response, Zaheer Ebtikar, founder of the Cryptos Fund Split Capital, stated:

This is a mixed result of year-end and holiday risk Shareholding. The market is hovering around $0.1 million, and it seems that large funds are satisfied with this level, preparing to conclude this year's Trade.

The Bitcoin market is currently facing multiple challenges. On one hand, institutional investors like MicroStrategy continue to Buy heavily, injecting confidence into the market; on the other hand, the upcoming massive Options expiration may trigger short-term volatility. In addition, Binance's Bitcoin reserves plunging may indicate a potential rise in Bitcoin prices.

MicroStrategy continues to increase its Bitcoin holdings.

Despite the price correction, MicroStrategy Inc. (MSTR) announced plans to expand its Bitcoin purchase program on Monday evening. The company holds over 40 billion dollars in Bitcoin, making it the largest Bitcoin holder among publicly traded companies.

Sean McNulty, the trading director at Arbelos Markets, stated:

The market is looking forward to MicroStrategy's Bitcoin purchases, which is one of the main reasons for the market rise. Following news about MicroStrategy has become an important part of daily work.

According to filings submitted to the USA Securities and Exchange Commission on December 23, MicroStrategy is seeking to increase the authorized share count for Class A common stock and preferred stock. This move will provide the company with more funding support to continue accumulating Bitcoin. Earlier this week, MicroStrategy announced the additional purchase of 0.561 billion dollars in Bitcoin at an average price close to last week's record high, marking the company's seventh consecutive week of purchases.

Large options expiration may trigger market volatility.

As the year-end approaches, some traders warn that the market may experience fluctuations in the coming days due to the massive open contracts of Bitcoin and Ethereum derivatives nearing expiration.

According to media reports, on December 27, Bitcoin will face an options expiration worth 14.27 billion dollars, with the largest open interest at a strike price of 90,000 dollars. Derivatives exchange Deribit, which accounts for 72% of the Bitcoin options market, shows that the open contracts for call options are 8.45 billion dollars, while the open contracts for put options are 5.82 billion dollars.

Data shows that Deribit will face a record expiration of 43 billion dollars in open contracts on Friday, including 13.95 billion dollars in Bitcoin options and 3.77 billion dollars in Ethereum options.

Sean McNulty stated:

Market makers may close their hedging positions and short positions on Bitcoin, which could make the market volatile on Friday.

Regarding the impact of Options expiration on Bitcoin prices:

If the price of Bitcoin remains above $95,000: Call Options with a strike price of $90,000 will remain "in-the-money", and holders may choose to exercise them, creating buying pressure. Market makers may need to buy Bitcoin on the spot or futures market to cover their exposure, which could add short-term upward pressure on the price.

If the price of Bitcoin drops below $90,000: Call Options with a strike price of $90,000 will turn "out-of-the-money", which could lead to these Options losing value. Put Option holders may choose to exercise them, which could increase selling pressure and exacerbate the downward momentum of Bitcoin.

Binance Bitcoin reserves plummet.

The change in Bitcoin reserves has also drawn market attention, as the global leading cryptocurrency Exchange Binance's Bitcoin reserves have dropped to the lowest level since January of this year, raising expectations in the market for a significant increase in Bitcoin prices.

At the beginning of this month, as Binance's reserves fell to around 564,000, the price of Bitcoin broke the $100,000 mark for the first time, and then the reserves began to rise slightly, while the price of Bitcoin started to decline.

According to research by CryptoQuant Analyst Darkfrost, Binance's Bitcoin reserves have fallen to 0.57 million coins, a decline similar to the situation earlier this year when Bitcoin's price soared to nearly 0.07 million USD.

Darkfrost pointed out that the decrease in Binance's reserves indicates that investors are confident in Bitcoin's long-term prospects, choosing to withdraw their Bitcoin holdings from the Exchange instead of leaving them for short-term selling. This viewpoint suggests that the market may be brewing a bullish trend.

对此,加密货币基金Split Capital的创始人Zaheer Ebtikar表示:

对此,加密货币基金Split Capital的创始人Zaheer Ebtikar表示: