1. The introduction of the Guizhou Eco-friendly Concept Fund by Jinsha Road Environment is beneficial for improving its overall asset-liability structure, reducing the debt-to-asset ratio, and helping to supplement working capital to meet business development needs, aligning with its long-term development Global Strategy. 2. Recently, several subsidiaries of listed companies plan to raise funds by introducing strategic investors, including many state-owned background strategic investment parties.

According to the Star Daily on December 27 (Reporter: Qiu Siyu), on December 26, Road Environment announced that its wholly-owned subsidiary, Jinsha Road, intends to increase registered capital by introducing investors.

The announcement shows that the Guizhou Provincial Ecological and Environmental Development Private Equity Fund Partnership (Limited Partnership) (hereinafter referred to as 'Guizhou Eco-friendly Concept Fund') intends to subscribe for an additional registered capital of 32 million yuan in cash for Jinsha Road, and Road Environment waives its preemptive rights in this capital increase.

After this capital increase, Jinsha Road's registered capital will increase to 0.112 billion yuan, with the Guizhou Eco-friendly Concept Fund holding 28.57% equity in Jinsha Road, while Road Environment holds 71.43% equity in Jinsha Road, which remains a controlled subsidiary within the consolidated financial statements of Road Environment.

After this capital increase, Jinsha Road's registered capital will increase to 0.112 billion yuan, with the Guizhou Eco-friendly Concept Fund holding 28.57% equity in Jinsha Road, while Road Environment holds 71.43% equity in Jinsha Road, which remains a controlled subsidiary within the consolidated financial statements of Road Environment.

Regarding the impact of this trade, Road Environment stated: 'The Guizhou Eco-friendly Concept Fund is a green ecological and environmental protection fund. The introduction of the Guizhou Eco-friendly Concept Fund by Jinsha Road is beneficial for improving its overall asset-liability structure, reducing the debt-to-asset ratio, and helping to supplement working capital to meet its business development needs, aligning with its long-term development Global Strategy.'

The subsidiary has turned losses into profits in the first three quarters, with significant year-on-year growth in production and sales.

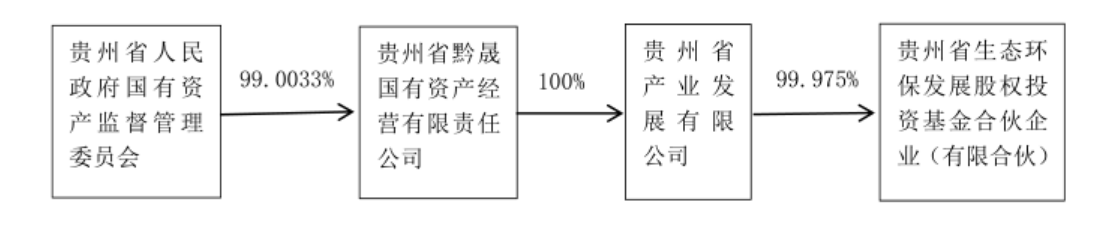

The Guizhou Eco-friendly Concept Fund was established in 2021, and from the partner information, Guizhou Provincial Industrial Development Co., Ltd holds a 99.975% contribution ratio, while Guizhou Guixinrui and Venture Capital Management Co., Ltd holds a 0.025% contribution ratio, with the actual controller being the Guizhou Provincial Government's State-owned Assets Supervision and Administration Commission.

Image: Guizhou Eco-friendly Concept Fund partner information; Source: Road Environment announcement on December 26.

Jinhua Road Environment was established in 2021, with a registered capital of 80 million yuan. Before this transaction, Road Environment held 100% equity. In terms of performance, Jinhua Road achieved revenue of 82.9246 million yuan and net income of 2.601 million yuan in the first three quarters, turning a profit compared to the same period last year.

In Road Environment's half-year report this year, it was also mentioned that with the production capacity of Jinhua Road's Baijiu(Chinese Liquor) pomace biological fermentation fodder plant being steadily released, both production and sales have significantly increased compared to the same period last year. It is reported that Jinhua Road's capacity planning reaches 0.15 million tons/year, with a pomace processing volume of 0.375 million tons/year, and its first-phase capacity of 0.1 million tons/year has already been put into production.

The main raw materials of the Baijiu(Chinese Liquor) pomace biological fermentation fodder business are a large number of by-products generated during the brewing process of the upstream Baijiu(Chinese Liquor) industry, including pomace, high-concentration brewing water, etc. Guizhou is known as the "hometown of Baijiu(Chinese Liquor)", and this area contains abundant pomace materials.

Today (December 27), a reporter from the Star newspaper called the securities office of Road Environment as an investor to inquire whether both parties have reached a cooperation agreement on raw materials. The relevant staff replied: "The company has not reached a business cooperation with the Guizhou Ecological Fund at this time. The Guizhou Ecological Fund is a fund specifically investing in ecological and environmental protection enterprises. This fund has also invested in other ecological and environmental companies besides ours, and there may be resource synergy in this area in the future."

According to Tianyancha, this fund has made a total of 24 external investments, including ecological and environmental enterprises such as Guizhou Yunshang Ecological Environment Technology Co., Ltd., Guizhou Qingrun Environment Engineering Co., Ltd., Guizhou Linmao Ecological Development Co., Ltd., Guizhou Zhongwei Resource Recycling Industrial Development Co., Ltd., and others.

In addition, the equity expansion agreement signed by both parties this time also includes performance commitments, with the project performance assessment period from 2025 to 2030.

Specifically, Jinhua Road is expected to achieve undistributed profits of no less than A during the period from 2025 to 2026; undistributed profits of no less than B during 2027 to 2028; undistributed profits of no less than C in 2029; and undistributed profits of no less than D in 2030. The performance commitment requires that 5 million yuan ≤ A.

It is worth mentioning that this is not the first time Road Environment has introduced state-owned capital for its subsidiary. Just on December 6, the company announced that another wholly-owned subsidiary, Zunyi Road, introduced Nongfa Fodder as a strategic shareholder.

Agricultural Development Fodder will increase its capital in Zunyi Road Environment Technology Co., Ltd. through Cash and sign a long-term large-scale procurement Order for biological fermented Fodder. After the capital increase, Zunyi Road Environment's registered capital will increase to 80 million yuan, and Agricultural Development Fodder will Hold 25% equity in Zunyi Road Environment. Agricultural Development Fodder is a wholly-owned subsidiary of Hubei Agricultural Development Group Co., Ltd., and the actual controller is the Hubei Provincial State-owned Assets Supervision and Administration Commission.

Several subsidiaries of listed companies have introduced state-owned capital strategic investors.

Reporters from Star observed that recently, several subsidiaries of listed companies intend to increase capital and introduce strategic investors, including many with state-owned capital backgrounds.

For example, Fujian Tianma Science And Technology Group's wholly-owned subsidiary Guangdong Fuma plans to introduce the Guangdong Agricultural Supply-Side Structural Reform Fund Partnership (Limited Partnership) through capital increase and expansion, with actual control by the Guangdong Provincial State-owned Assets Supervision and Administration Commission; Zhejiang Daily Digital Culture Group's holding subsidiary Communication Brain Technology Company plans to increase capital and introduce Zhejiang Industrial Fund Co., Ltd. and so on.

"The introduction of strategic investors into the subsidiaries of listed companies is mainly to optimize the equity structure, enhance the company's strength, and expand business areas," said Wu Gaobin, Secretary-General of the New Quality Productivity Committee of the China民协, in an interview with reporters from Star. He stated, "Recently, state-owned capital strategic investment has become mainstream, partly because state-owned capital has advantages in funding, resources, and policies, providing strong support for subsidiaries. On the other hand, state-owned capital strategic investments help improve the state-owned enterprise attributes of listed companies, which is advantageous for gaining more policy support in industry competition."

Wu Gaobin further added that compared to investing in listed companies, the valuation of investing in equity of subsidiaries is relatively low, investment risks are smaller, and exit options are more varied. Zhi Peiyuan, Vice President of the China Investment Association's Special Committee for Listed Company Investments, also mentioned to reporters, "Compared to equity investments in the parent company, intervention at the subsidiary level often enjoys more customized cooperation terms, balancing lower risk and moderate returns. Exit channels include equity transfer, mergers and reorganizations, and separate listings, providing greater flexibility than directly holding parent company shares."

"Overall, for listed companies, introducing strategic investments can enhance the company's Market Cap and optimize the equity structure, which is beneficial for financing in the Capital Markets. For subsidiaries, the introduction of strategic investments helps enhance company strength, expand business areas, and improve market competitiveness. For strategic investors, investing in subsidiaries can yield certain investment returns while also benefiting their strategic layout," Wu Gaobin stated.

However, multiple experts also warned that during the process of introducing state-owned capital strategic investors into subsidiaries, attention needs to be paid to the compliance of processes, the potential competitive landscape of the industry where the invested enterprise is located, and clarifying the investment cycle and exit arrangements in order to avoid the risk of excessive capital lock-up.

本次增资完毕后,金沙路德注册资本增加至1.12亿元,

本次增资完毕后,金沙路德注册资本增加至1.12亿元,