In the last few days of a record-breaking year for digital Assets, the upward momentum of Bitcoin is increasingly weakening.

According to Zhitong Finance APP, in the last few days of a record-breaking year for digital Assets, the momentum of Bitcoin's rise is weakening, as investors assess the remaining impetus brought by the support of incoming President Donald Trump for the Cryptos Industry.

As of the time of writing, Bitcoin is trading at $95,914, down 0.12% from the previous day. Smaller tokens, including Ether and Dogecoin, are also struggling to attract market attention.

Trump is pushing for a commitment to create a Crypto-friendly environment in the USA and supports the idea of establishing a national Bitcoin reserve. Traders are watching to see if such a reserve is feasible.

Trump is pushing for a commitment to create a Crypto-friendly environment in the USA and supports the idea of establishing a national Bitcoin reserve. Traders are watching to see if such a reserve is feasible.

Major brokerage FalconX stated that a large number of Bitcoin and Ether Options contracts in the Crypto market will expire on Friday, marking one of the largest such events in the history of digital Assets. Sean McNulty, trading director at liquidity provider Arbelos Markets, noted that the market may experience "volatility" as these derivative positions expire.

Although MicroStrategy (MSTR.US) hinted this week at the possibility of expanding its Bitcoin purchasing plan, Bitcoin's performance remains unstable. The company has transformed from a Software manufacturer into a Bitcoin accumulator, currently holding over $40 billion in digital Assets.

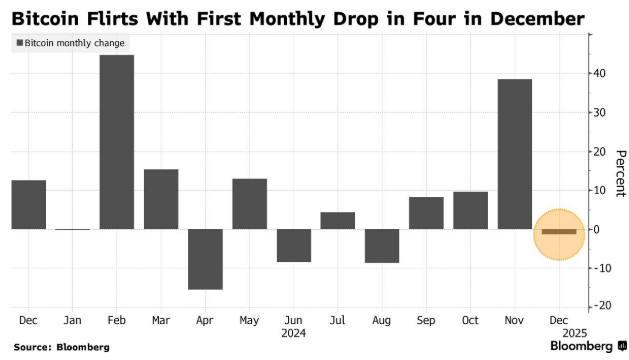

According to data compiled by Bloomberg, Bitcoin will experience a decline in December, marking its first monthly drop in four months. Bitcoin reached an all-time high of $108,316 on December 17, and then fell back.

特朗普正在推进一项承诺,即在美国创造一个对加密货币友好的环境,并支持建立一个国家比特币储备的想法。交易员们正在观望这样的储备是否可行。

特朗普正在推进一项承诺,即在美国创造一个对加密货币友好的环境,并支持建立一个国家比特币储备的想法。交易员们正在观望这样的储备是否可行。