① The Hong Kong stock market is picking up, and is there any improvement in terms of capital? ② Why are semiconductor stocks stronger today?

Financial Services Association, December 27 (Editor: Hu Jiarong) The Hong Kong stock market was closed on Wednesday and Thursday this week due to the Christmas holidays, and the overall performance of the three major stock indexes was better than last week.

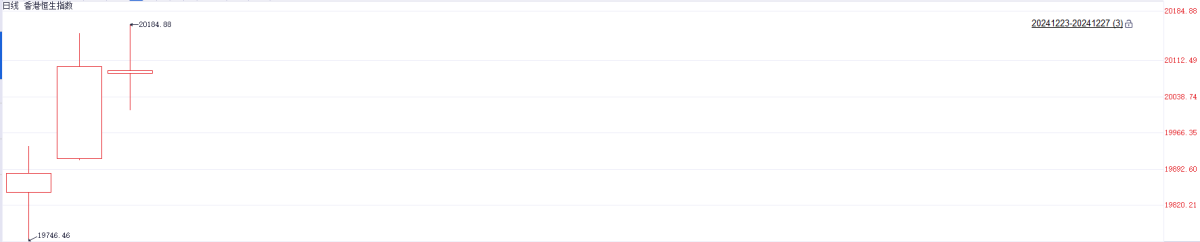

By the close, the Hang Seng Index had a cumulative increase of 1.87% to close at 2009 0.46 points; the Technology Index had a cumulative increase of 2.12% to close at 4538.59 points; and the State-owned Enterprises Index had a cumulative increase of 2.26% to close at 7305.36 points.

Note: Hang Seng Index's performance this week

Note: Hang Seng Index's performance this week

Judging from the performance in the chart above, the Hang Seng Index stood at 20,000 points. It is worth noting that compared to 19720.70 points last Friday, the Hang Seng Index rose by nearly 370 points.

There has also been some recovery in capital in the Hong Kong stock market. From December 12 to December 18, the net outflow of allocation-type foreign capital according to the EPFR scale narrowed slightly, and the net inflow to ADR increased. Among them, the net outflow of allocation-type foreign capital narrowed slightly to 0.505 billion US dollars (vs net outflow of 0.516 billion US dollars in the previous week); the net ADR inflow expanded to 1.356 billion US dollars (vs net inflow of 0.217 billion US dollars in the previous week).

Tencent concept stocks lead the way

Judging from this week's performance, Jinshanyun (03896.HK), Weimeng Group (02013.HK), and Oriental Selection (01797.HK) rose 44.02%, 30.35%, and 21.61% respectively.

First, the sharp rise in Jinshan clouds is related to a piece of news. According to UI News, Xiaomi is starting to build its own GPU 10,000 card cluster and will invest heavily in AI models.

The strengthening of the WeMeng Group is related to WeChat's small stores. According to reports, recently there was news that WeChat plans to fully open the WeChat store's “gift delivery” function before the Spring Festival. At present, the function has been tested in grayscale for a period of time. Less than a week after it was released to the public on a large scale, the number of whitelisted users has reached more than 0.3 billion, reaching more than 40 million users.

Also stimulated by the benefits of WeChat's small store is Oriental Selection. The company's cumulative increase this week was over 20%. In terms of news, Dongfang Selection's official account recently announced that the WeChat store has launched a new “send gifts” feature and recommended Dongfang Select's own related products.

Today's market

Judging from market performance, semiconductor, consumer electronics, and automobile stocks had the highest gains.

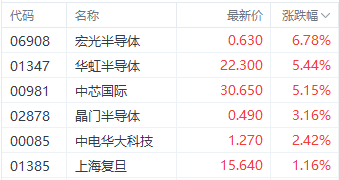

Most semiconductor stocks rebounded, Huahong Semiconductor rose more than 5%

Among semiconductor stocks, Huahong Semiconductor (01347.HK), SMIC (00981.HK), and Shanghai Fudan (01385.HK) rose 5.44%, 5.15%, and 1.16% respectively.

Note: Performance of semiconductor stocks

On the news side, on the news side, semiconductor industry observation agency TechInsights released the 2025 semiconductor manufacturing market outlook. IC sales are expected to increase 26% in 2025 due to improved terminal demand and rising prices. As the number of devices sold increases, IC sales are expected to jump 17%, which will drive a corresponding 17% increase in silicon demand because ICs are the main consumers of silicon. To support this growth, continued investment is critical to increasing manufacturing capacity and advancing technology. As a result, semiconductor capital spending is expected to surge 14%.

Some consumer electronics strengthened, and BYD Electronics rose nearly 4%

Among consumer electronics stocks, BYD Electronics (00285.HK), Ruisheng Technology (02018.HK), and Fuzhikang Group (02038.HK) rose 3.83%, 2.14%, and 1.16% respectively.

Note: Performance of consumer electronics stocks

In terms of news, Apple continued to hit a record high for the fourth consecutive trading day, with a total market capitalization of 3.92 trillion US dollars. At the close, it was up 0.32% to close at $259.02.

Auto stocks picked up, Ideal Auto rose more than 6%

Among auto stocks, Ideal Automobile-W (02015.HK), Brilliance China (01114.HK), and NIO-SW (09866.HK) rose 6.13%, 5.07%, and 3.41% respectively.

Note: The performance of auto stocks

In terms of news, according to data released by the China Association of Automobile Manufacturers, sales in the Chinese automobile market reached 3.316 million vehicles in November, an increase of 8.6% over the previous month and an increase of 11.7% over the previous month. This sales volume reached a new high, surpassing the same period last year. Furthermore, recently, Li Xiang announced that Ideal Auto is no longer just an automobile manufacturer, but an AI company.

Changes in individual stocks

[Cross-border increased by more than 20%, and the company has launched 27 models of collaborative robots]

Yuejiang (02432.HK) rose 23.18% to close at HK$23.70. In terms of news, Yuejiang Technology is mainly engaged in the design, development, manufacture and commercialization of collaborative robots. According to the Insight Consulting Report, in terms of shipments in 2023, Yuejiang Technology ranked in the top two in the global collaborative robot industry and ranked first among all collaborative robot companies in China, with a global market share of 13%.

[Hongteng Precision rose by nearly 18%, AI development drives computing power infrastructure construction]

Hongteng Precision (06088.HK) rose 17.76% to close at HK$3.78. According to the news, Lightcounting expects high-speed cable AEC/DAC sales to more than triple in the next five years, reaching 6.7 billion US dollars by 2029. Manufacturers such as Nvidia and Amazon are already using high-speed copper connections to achieve short-distance interconnection.

注:恒生指数的本周表现

注:恒生指数的本周表现