Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

Macro Matters

U.S. Stock Futures Dip, Retail Spending Rises, and Corporate Updates

US stock futures modestly declined on Friday after a quiet post-holiday session on Wall Street Thursday, with jobless claims data having minimal impact on altering expectations for the Fed's outlook. New figures showed a slight drop in unemployment claims, down by 1,000 to 219,000, contrary to the expected rise of 4,000. Meantime, holiday consumer data indicated a 3.8% rise in US retail spending from November 1 to December 24, according to a Mastercard SpendingPulse. Most megacaps retreated overnight, though Apple Inc. outperformed after a bullish note from Wedbush. United States Steel slipped 3.0% as its potential buyer, Nippon Steel of Japan, postponed the targeted acquisition from Q4 of 2024 to Q1 of 2025. Conversely, GameStop Corp. rallied after an X post from Keith Gill, the online persona known as Roaring Kitty.

Japan's Retail Sales Surge in November, Exceeding Expectations

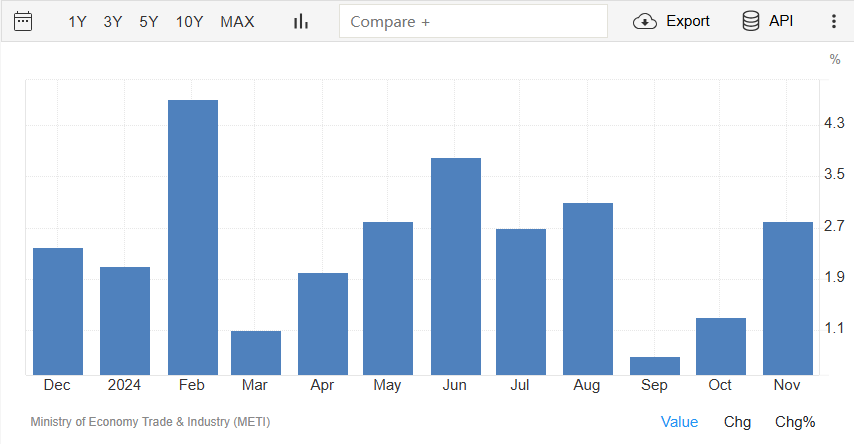

Japan's Retail Sales Surge in November, Exceeding Expectations

Retail sales in Japan grew by 2.8% year-on-year in November 2024, up from a downwardly revised 1.3% rise in October, easily beating market expectations of a 1.7% gain. This marked the 32nd straight month of expansion in retail sales and the fastest growth since August, with rising wages continuing to support consumption. Sales growth was robust textiles, clothing & personal goods (10.7%), other retailers (5.7%), non-store retailers (5.5%), fuel (3.6%), machinery & equipment (2.6%), pharmaceuticals & cosmetics (1.8%), food & beverage (1.4%), and department stores (0.9%). By contrast, sales declined in automobiles (-1.9%). On a monthly basis, retail sales rose by 1.8% in November, marking the first increase in three months and the most since September 2021, rebounding from a revised 0.2% fall in October.

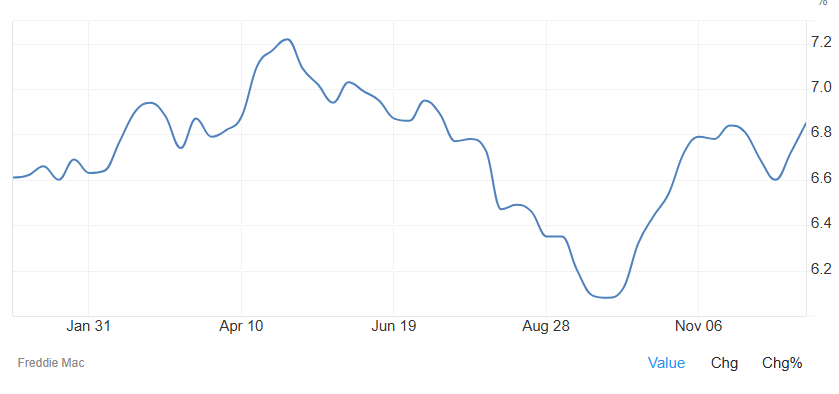

U.S. Mortgage Rates Climb to Six-Month High Amid Economic Uncertainty

The average rate on a 30-year fixed mortgage surged to 6.85% as of December 26th, 2024, rebounding for the second consecutive week to the highest level since early June. The rise aligned with soaring US Treasury yields, as markets adjusted expectations for fewer Federal Reserve rate cuts, influenced by hawkish projections, weaker economic data, and inflation concerns. “Mortgage rates increased for the second straight week, rebounding after a decline from earlier this month. While a slight improvement in new and existing home sales is encouraging, the market remains plagued by an overwhelming undersupply of homes. A strong economy can help build momentum heading into the new year and potentially boost purchase activity,” said Sam Khater, Freddie Mac’s Chief Economist.

Smart Money Flow

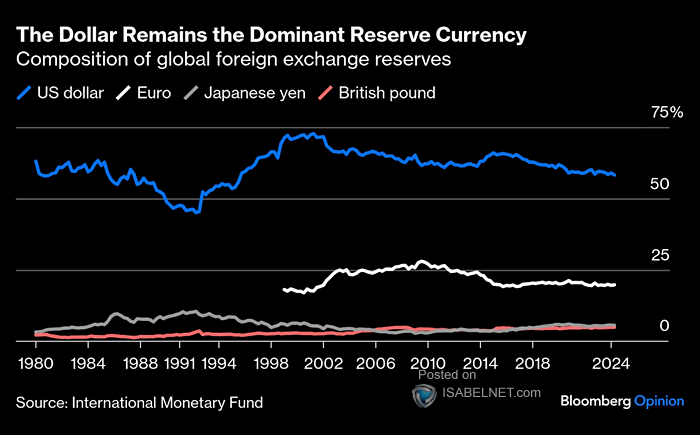

Despite some countries seeking to reduce their dependence on the US dollar, it remains the dominant global reserve currency, accounting for 58% of total reserves, significantly surpassing the euro at 19.8% and the yen at 5.6%.

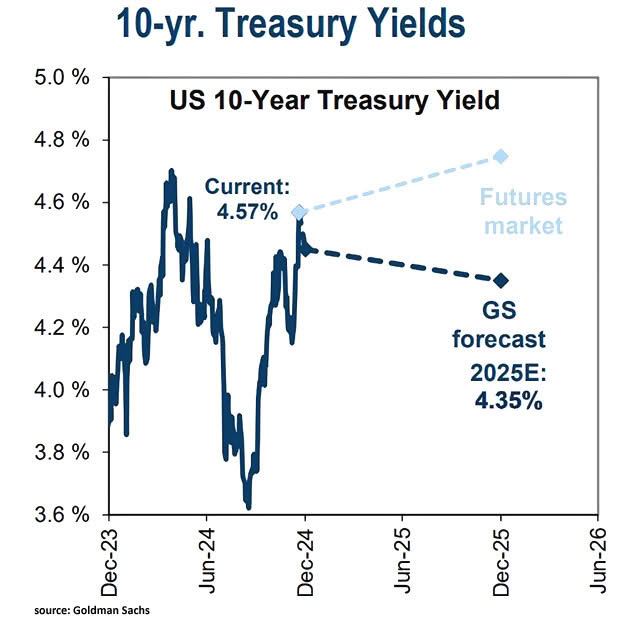

Goldman Sachs forecasts the 10-year US Treasury yield to hit 4.35% by the end of 2025, diverging from current futures market expectations.

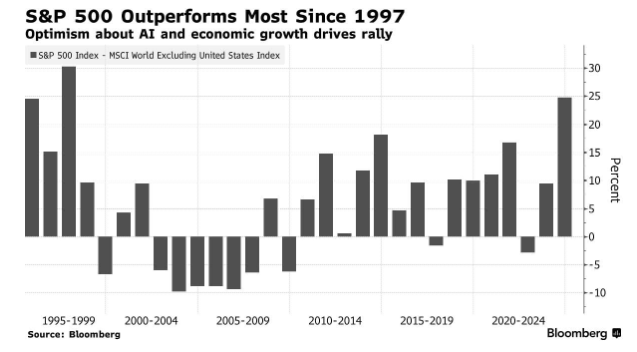

S&P 500 is outperforming the rest of the world by the largest margin since 1997.

Top Corporate News

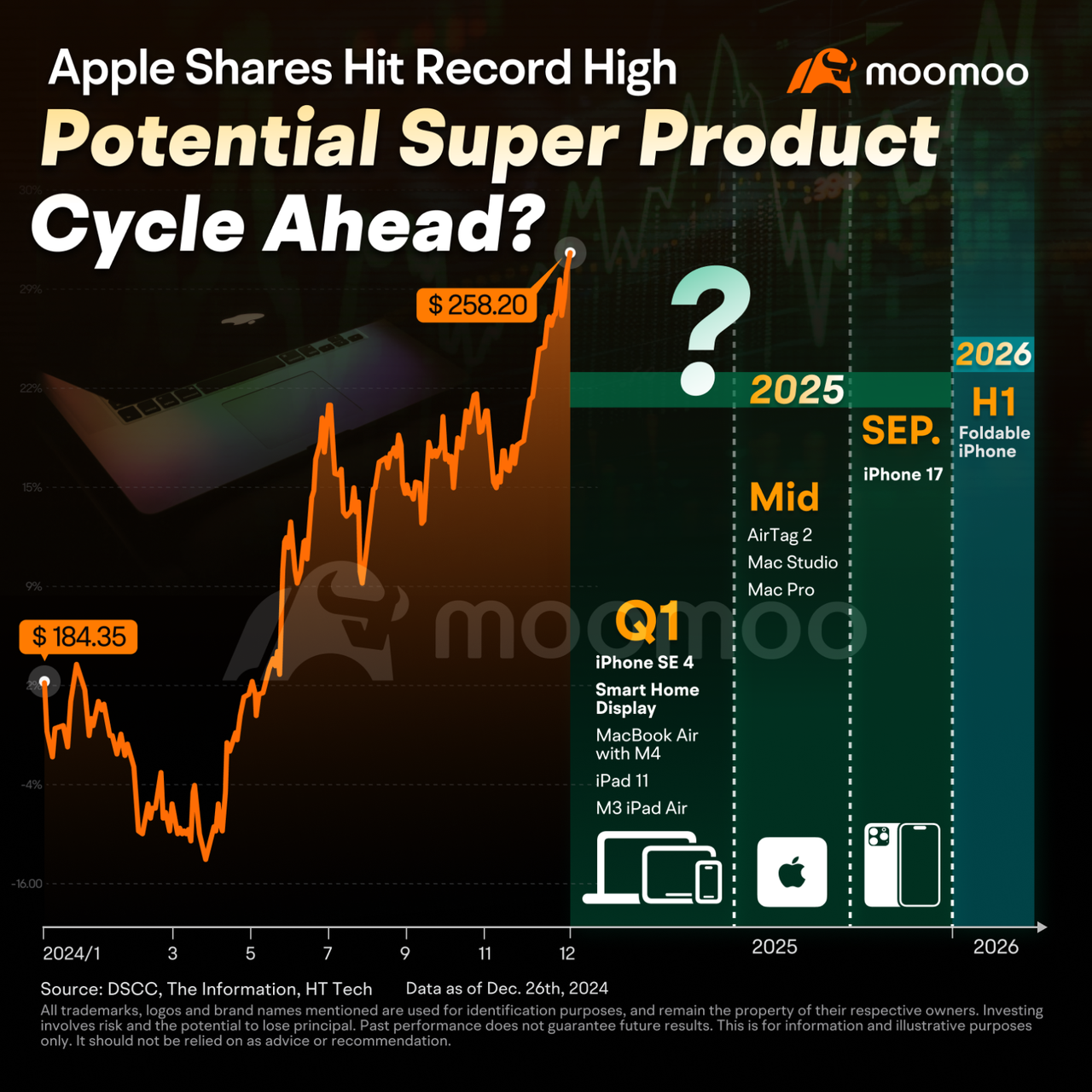

Apple Poised to Become First $4 Trillion Company

With a market cap of $3.9 trillion, Apple maintains its position as the most valuable publicly traded U.S. company, surpassing the combined market caps of stock exchanges in countries such as the UK, Canada, and Germany. A modest 2.5% increase would elevate Apple's valuation to $4 trillion, positioning it as the likely first company to reach that milestone.

Since November, Apple shares have surged about 15%, adding nearly $500 billion in market value. This growth is fueled by investor enthusiasm for AI and anticipation of a major iPhone upgrade cycle. According to tech journalist Mark Gurman, Apple plans to pivot toward three major growth areas in 2025—artificial intelligence, robotics, and smart homes—after shelving its 2024 car project and receiving a tepid response to its Vision Pro headset.

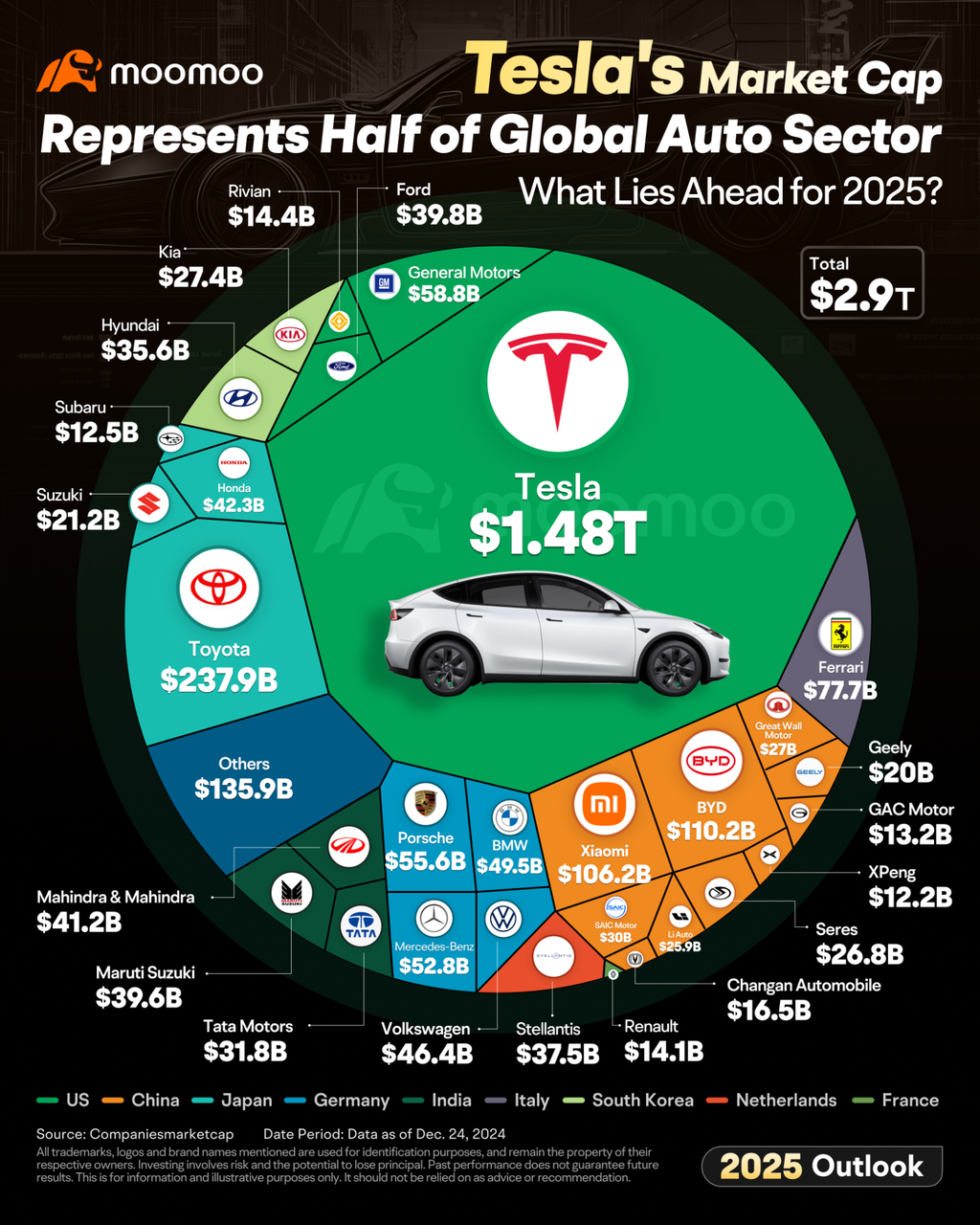

2025 Marks A Pivotal Year for Autonomous Driving. Potential Gains for Tesla Shares?

Tesla's shares surged more than 80% after Donald Trump's win in the 2024 presidential election, propelling its market capitalization to $1.5 trillion. This valuation accounts for half of the combined worth of global automakers. A key factor behind Tesla's recent surge is investor optimism that its autonomous driving technology will advance swiftly under Trump's favorable regulatory environment.

Investors are also paying close attention to Tesla's upcoming Q4 delivery report, expected on January 2nd. While Tesla's Q4 deliveries are anticipated to reach record levels, Barclays analysts suggest that these figures may not significantly influence the stock's movement, holding the views that a slight beat on 4Q is likely immaterial to the majority of the current Tesla bull case.

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.