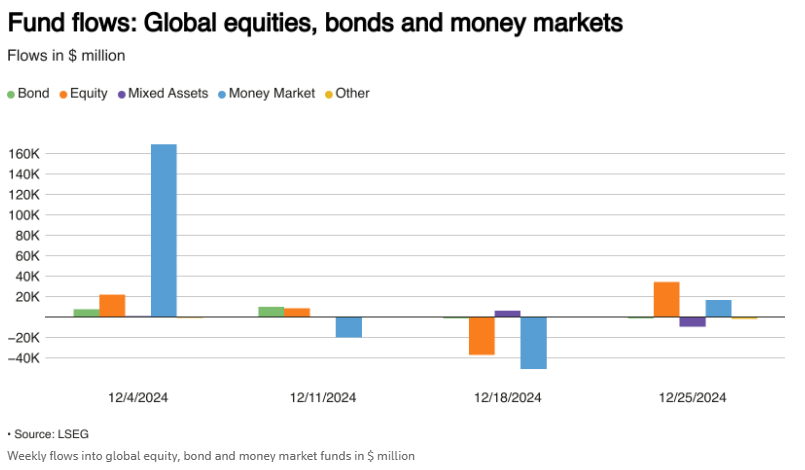

LSEG's data shows that Global Equity Funds experienced a significant Inflow in the week ending December 25, rebounding from substantial net sales in the previous week.

According to the data from LSEG as of the week ending December 25, Global Equity Funds witnessed significant inflows, reversing the previous week's large-scale net sell-off. The moderate inflation report released by the USA and news of the government avoiding a shutdown boosted investor confidence, encouraging them to embrace riskier assets again.

According to LSEG data, investors injected a massive $34.38 billion into Global Equity Funds, marking the largest inflow in six weeks, preceded by a net sell-off of $36.84 billion the previous week.

A report released by the USA Department of Commerce showed that the Personal Consumption Expenditures Price Index rose by 0.1% in November, lower than analysts' expectations, rekindling hopes in the market for further rate cuts by the Federal Reserve next year.

A report released by the USA Department of Commerce showed that the Personal Consumption Expenditures Price Index rose by 0.1% in November, lower than analysts' expectations, rekindling hopes in the market for further rate cuts by the Federal Reserve next year.

The USA Equity Funds attracted an inflow of $20.56 billion, marking the seventh net inflow in eight weeks. Meanwhile, Europe and Asia Funds also received substantial inflows, attracting $5.11 billion and $2.84 billion respectively.

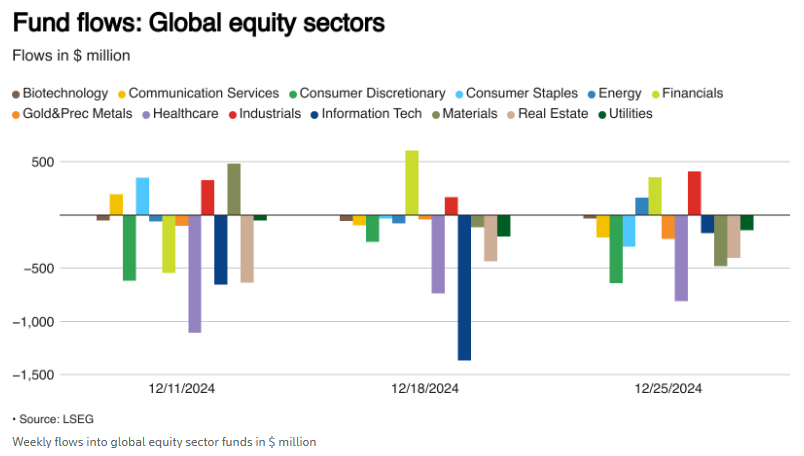

Global Industry Equity Funds experienced net outflows for the third consecutive week, totaling $2.48 billion. Specifically, investors withdrew $0.81 billion from Medical Care Funds, $0.639 billion from Consumer Non-cyclicals Funds, and $0.48 billion from Metal and Mining Funds.

Global Bond Funds experienced a net Outflow of $1.47 billion for the second consecutive week, following a continuous inflow of funds over 51 weeks up to December 11.

Global High Yield Bond Funds saw their largest Outflow in eight months, with a net Sell of $2.99 billion this week. In contrast, investors injected $1.78 billion into short-term Bond Funds.

Investors had a net inflow of $16.95 billion into Money Market Funds, reversing two weeks of net selling.

In terms of CSI Commodity Equity Index, Gold and Precious Metals Funds attracted a net inflow of $1.25 billion, marking the largest single-week inflow in nine weeks, while Energy Funds recorded a net Sell of $0.212 billion.

Meanwhile, data covering 29,565 Emerging Markets Funds indicates that Stock Funds continued the trend with a net Sell of $1.75 billion for the seventh consecutive week, and Bond Funds also experienced a total net Outflow of $0.957 billion.

美国商务部发布的报告显示,11月份个人消费支出价格指数上涨0.1%,低于分析师预期,这让市场对美联储明年进一步降息重燃希望。

美国商务部发布的报告显示,11月份个人消费支出价格指数上涨0.1%,低于分析师预期,这让市场对美联储明年进一步降息重燃希望。