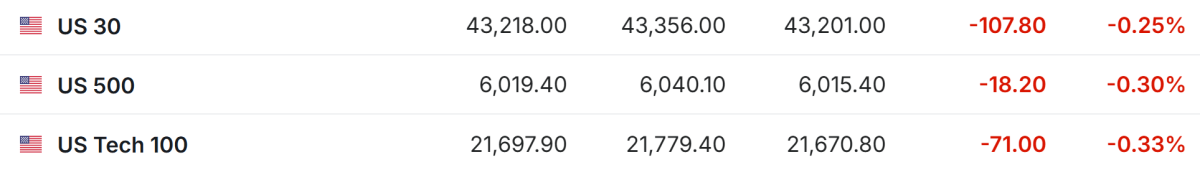

On December 27 (Friday) during Pre-Market Trading, the three major Equity Index futures in the U.S. all fell.

On December 27 (Friday), during Pre-Market Trading, the three major US stock index futures fell simultaneously. As of the time of writing, Dow futures were down 0.25%, S&P 500 Index futures dropped 0.30%, and Nasdaq futures declined 0.33%.

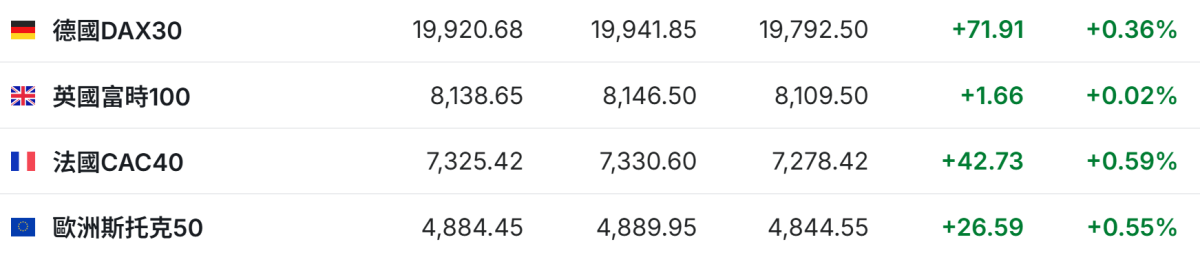

As of the time of writing, the DEGUODAXZHISHU rose 0.36%, the UK FTSE100 Index increased by 0.02%, the France CAC40 Index went up 0.59%, and the Europe Stoxx 50 Index was up 0.55%.

As of the time of writing, Crude Oil rose 0.86%, priced at $70.22 per barrel. Brent crude oil increased by 0.74%, priced at $73.39 per barrel.

As of the time of writing, Crude Oil rose 0.86%, priced at $70.22 per barrel. Brent crude oil increased by 0.74%, priced at $73.39 per barrel.

Market News

Wells Fargo & Co: The disconnection between the US stock market and economic data is worsening, and there may be a "hangover" risk in the near term. For the US stock market, 2024 is set to be an excellent year. However, according to Wells Fargo & Co, the optimistic post-election rally may lead to a "hangover" for the US stock market in the short term, with the S&P 500 Index possibly falling by 7%. The bank noted in a report on Monday that the disconnection between the stock market and the economy is intensifying, with US stock indices rising after the presidential election while economic data remains lukewarm. The Bloomberg US Economic Surprise Index hovers just above zero, tracking the relationship between economic data releases and market expectations. This indicates that although optimistic sentiment has driven the market higher, there have been almost no surprises in economic data in recent months.

As the prosperous year for the US stock market comes to a close, is the "Santa Claus Rally" still worth looking forward to? For the US stock market, 2024 is set to be an excellent year. However, according to Wells Fargo & Co, the optimistic post-election rally may lead to a "hangover" for the US stock market in the short term, with the S&P 500 Index possibly falling by 7%. The bank noted in a report on Monday that the disconnection between the stock market and the economy is intensifying, with US stock indices rising after the presidential election while economic data remains lukewarm. The Bloomberg US Economic Surprise Index hovers just above zero, tracking the relationship between economic data releases and market expectations. This indicates that although optimistic sentiment has driven the market higher, there have been almost no surprises in economic data in recent months.

Former Chair of the Council of Economic Advisers: The Fed's rate cut in December is perplexing but thought-provoking. Former Chair of the US National Economic Council, Jason Furman recently expressed that the Fed's decision to cut rates in December is perplexing, yet also thought-provoking. Furman pointed out that traditional arguments against rules-based monetary policy require Fed officials to predefine too many contingencies. He believes that the Fed's judgment is also better than most of its critics perceive. After making a significant mistake by failing to raise rates in time, resulting in inflation exceeding 5%, the Fed has responded to this issue more aggressively than most of its hawkish critics might expect. The current economic situation in the USA is not flawless, and a soft landing remains difficult to achieve, but it has improved significantly. However, Furman argues that in terms of the Fed replacing rules with its judgment, rules appear to be better than judgment.

The Bank of Japan's cautious stance on rate hikes leaves the yen hovering around a five-month low. Due to the stark contrast between the Fed's hawkish rhetoric and the Bank of Japan's cautious approach towards further tightening, the yen traded near a five-month low against the dollar on Friday. As of the time of writing, the exchange rate for the dollar against the yen was 157.62, close to the daily low of 158.09, the lowest level since July 17. The excerpts from the Bank of Japan's December policy meeting released on Friday indicated that some officials are becoming more confident about recent rate hikes, while others remain cautious about wage trends and uncertainties surrounding the Trump administration's policies. Similarly, the inflation data for Japan released on Friday supports further rate hikes. Economists believe the deregulation, tax cuts, increased tariffs, and tightened immigration policies proposed by Trump are beneficial for both economic growth and inflation. The dollar is expected to appreciate by 5.4% against the yen this month and by 11.9% for the year.

As the glorious performance draws to a close, Bitcoin's year-end rally dwindles. In the last days of a record-breaking year for digital assets, Bitcoin's upward momentum is increasingly weakening as investors assess the remaining boost from President-elect Donald Trump's support for the cryptocurrency industry. At the time of writing, Bitcoin was trading at $95,914, down 0.12% from the previous day. Smaller tokens, including Ether and Dogecoin, are also struggling to attract market attention. Trump is pushing for a commitment to create a cryptocurrency-friendly environment in the USA and supports the idea of establishing a national Bitcoin reserve. Traders are watching whether such a reserve is feasible.

Stock News

Is Honda Motor (HMC.US) the biggest beneficiary of the merger? Investors opt to sell Nissan Motor. Due to speculation on the share transfer ratio of the planned transaction between Nissan Motor and Honda Motor, Nissan Motor's stock price is poised to experience its biggest drop since the sell-off in August. On Friday, Nissan's stock plummeted 15%, marking the largest intraday drop in 26 years. Since news emerged about a possible collaboration between Nissan and Honda, the stock has been volatile, surging over 23% on the day of the news release on December 18. Data shows that Nissan's 30-day historical volatility has surged to the highest level in 16 years since then, and its 14-day relative strength index has reached 81.6 after recent gains, surpassing the threshold that indicates the stock is overbought. The Nikkei reported on Friday morning estimating the share ratio between Honda and Nissan to be 5:1.

Netflix (NFLX.US) had a successful Christmas NFL live broadcast, breaking viewership records. On Christmas Day, Netflix live streamed two National Football League (NFL) games, providing users with a smooth streaming experience that received high praise from them. Importantly, these two highly anticipated games brought strong viewership to Netflix. According to reports, the two NFL games streamed during Christmas had an average of 24.2 million viewers. The game between the Kansas City Chiefs and the Pittsburgh Steelers attracted 24.1 million viewers, while the Baltimore Ravens' victory against the Houston Texans drew in 24.3 million viewers. During halftime of the Ravens and Texans game, Beyoncé's performance attracted 27 million viewers, peaking in viewership. It is noteworthy that Netflix broke all streaming viewership records for NFL games and also set a record for viewers in the important demographic of 18 to 34 years old.

Will 2025 see a surge of AI agents? Giants like Microsoft (MSFT.US) and NVIDIA (NVDA.US) are all entering the fray. Many major tech companies have begun to lay out their strategies in the field of AI agents. Companies ranging from NVIDIA and Microsoft to Salesforce are increasingly discussing AI agents, claiming that they will change how businesses and consumers perceive AI technology. If 2024 is the year when AI chatbots become more useful, then 2025 will be the year when AI agents start to take over. AI agents are akin to powerful AI robots that can act on behalf of users, such as extracting data from received emails and importing it into different applications. The development of AI agents aims to reduce those tasks that are often both troublesome and time-consuming, such as filing expense reports. In the future, not only will there be more AI agents, but also more large tech giants expected to invest in developing this technology.

Important economic data and event forecasts.

Beijing time 21:30: The U.S. November wholesale inventory month-on-month initial value (%).

The next day at Beijing time 02:00: The total number of active U.S. drilling rigs as of the week ending December 27.

3. 截至发稿,WTI原油涨0.86%,报70.22美元/桶。布伦特原油涨0.74%,报73.39美元/桶。

3. 截至发稿,WTI原油涨0.86%,报70.22美元/桶。布伦特原油涨0.74%,报73.39美元/桶。