Deep-pocketed investors have adopted a bullish approach towards Amgen (NASDAQ:AMGN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMGN usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 14 extraordinary options activities for Amgen. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 42% bearish. Among these notable options, 9 are puts, totaling $525,048, and 5 are calls, amounting to $288,709.

Projected Price Targets

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $245.0 and $320.0 for Amgen, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $245.0 and $320.0 for Amgen, spanning the last three months.

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Amgen options trades today is 139.83 with a total volume of 1,014.00.

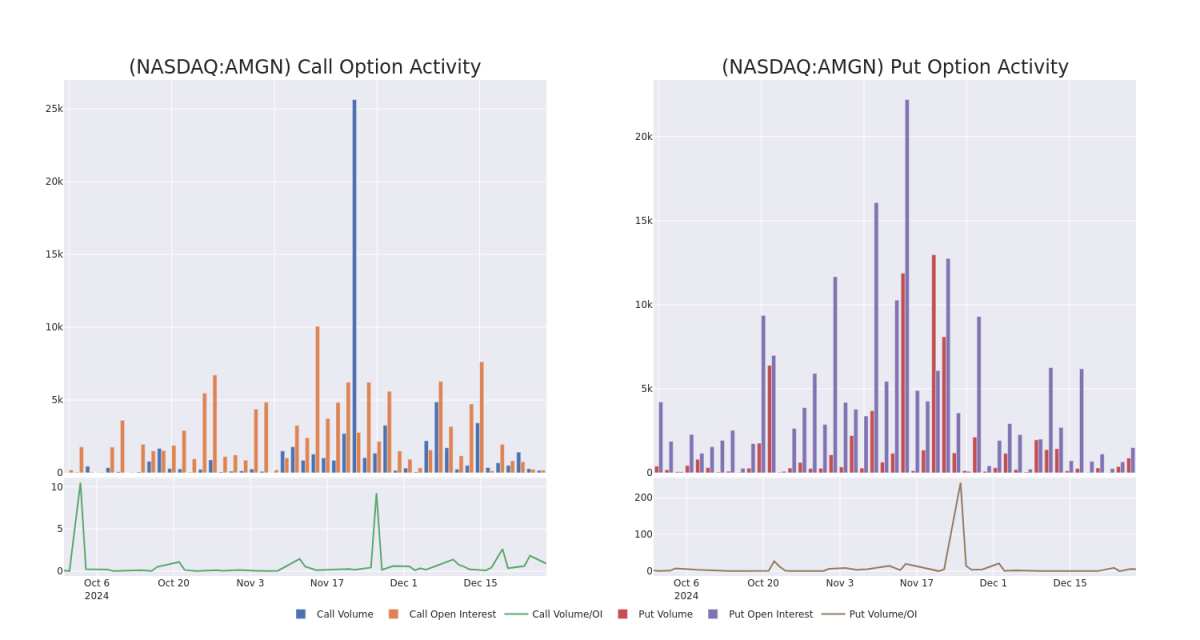

In the following chart, we are able to follow the development of volume and open interest of call and put options for Amgen's big money trades within a strike price range of $245.0 to $320.0 over the last 30 days.

Amgen Option Activity Analysis: Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | TRADE | BEARISH | 12/19/25 | $34.8 | $34.25 | $34.8 | $280.00 | $191.3K | 110 | 55 |

| AMGN | CALL | SWEEP | BULLISH | 07/18/25 | $17.35 | $17.3 | $17.35 | $270.00 | $104.0K | 18 | 64 |

| AMGN | CALL | TRADE | BEARISH | 01/15/27 | $24.7 | $22.3 | $22.8 | $310.00 | $57.0K | 33 | 28 |

| AMGN | PUT | SWEEP | BEARISH | 01/16/26 | $30.85 | $30.65 | $30.85 | $270.00 | $52.4K | 289 | 18 |

| AMGN | PUT | SWEEP | BULLISH | 02/21/25 | $35.1 | $34.5 | $34.67 | $295.00 | $52.0K | 97 | 24 |

About Amgen

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

Amgen's Current Market Status

- Trading volume stands at 582,871, with AMGN's price down by -0.55%, positioned at $261.73.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 39 days.

What The Experts Say On Amgen

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $256.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from B of A Securities downgraded its action to Underperform with a price target of $256.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Amgen with Benzinga Pro for real-time alerts.