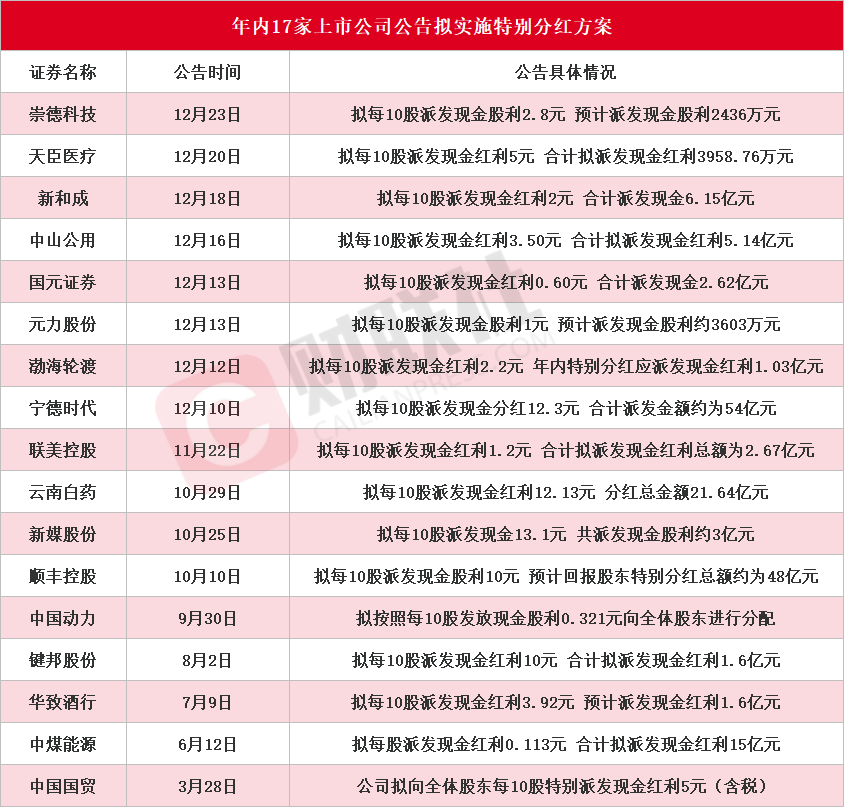

According to incomplete Statistics, as of the time of reporting, 17 A-share listed companies have announced special dividend plans for 2024 this year (see table), setting a new historical high for the year. Among them, Contemporary Amperex Technology, Yunnan Baiyao Group, and S.F. Holding have special dividend amounts exceeding 2 billion yuan.

According to Financial Association on December 28 (Editor: Ping Fang), A-share listed companies have shown strong enthusiasm for dividends this year. According to incomplete Statistics, as of the time of reporting, 17 listed companies including Chongde Technology, Touchstone International Medical Science Co., Ltd., Zhejiang Nhu, Zhongshan Public Utilities Group, Guoyuan, Fujian Yuanli Active Carbon, Bohai Ferry Group, Contemporary Amperex Technology, Luenmei Quantum, Yunnan Baiyao Group, Guangdong South New Media, S.F. Holding, China Shipbuilding Industry Group Power, Jianbang Stock, Vats Liquor Chain Store Management Joint Stock, China Coal Energy, and China World Trade Center have announced special dividend plans for 2024, marking the highest number for the year (only 7 listed companies announced special dividend plans in 2023), as detailed in the image below. Among them, Contemporary Amperex Technology, Yunnan Baiyao Group, and S.F. Holding are expected to have special dividend amounts exceeding 2 billion yuan. Additionally, companies like Fuhua Jia, Three Squirrels Inc., and Chongqing Qin'an M&E PLC. have announced special dividend plans before the Spring Festival.

Investment banking professionals state: "When listed companies declare dividends, especially special dividends, it is usually seen as a good signal of the company's financial condition, which can boost investor confidence. If a company declares a special dividend, investors may perceive it as a strong ability to generate profits, thus increasing demand for the company's stocks and driving up the stock price. If special dividends exceed market expectations, it may attract more investors to Buy, providing certain support to the stock price."

On December 10, global leading Battery producer Contemporary Amperex Technology announced its special dividend plan for 2024. The company intends to use 15% of the Net income attributable to the shareholders of the listed company in the consolidated financial statements for the first three quarters of 2024, amounting to 5.4 billion yuan as the total distribution for dividends. With a total share capital of 4.403 billion shares, after excluding the 15.9915 million shares bought back in the repurchase special securities account, the base capital is 4.387 billion shares, and a cash dividend of 12.3 yuan will be distributed to all shareholders for every 10 shares held. This dividend does not include bonus shares or capital reserve conversion to increase share capital.

On December 10, global leading Battery producer Contemporary Amperex Technology announced its special dividend plan for 2024. The company intends to use 15% of the Net income attributable to the shareholders of the listed company in the consolidated financial statements for the first three quarters of 2024, amounting to 5.4 billion yuan as the total distribution for dividends. With a total share capital of 4.403 billion shares, after excluding the 15.9915 million shares bought back in the repurchase special securities account, the base capital is 4.387 billion shares, and a cash dividend of 12.3 yuan will be distributed to all shareholders for every 10 shares held. This dividend does not include bonus shares or capital reserve conversion to increase share capital.

Contemporary Amperex Technology stated that the company has always placed high importance on returning to investors since its listing, insisting on providing stable cash dividends to reward investors. In this year's implementation of the 2023 annual dividend plan, the company further increased the dividend ratio, totaling 22.06 billion yuan in cash dividends, and this was completed by April 2024.

HAITONG SEC Analyst Yu Meihan and others pointed out in their Research Reports on December 11 that Contemporary Amperex Technology has implemented special dividends for two consecutive years. In 2023, a 20% annual dividend + 30% special dividend was distributed. This time, the dividends were based on the quarterly report, increasing frequency of dividend payouts. This reflects the company's emphasis on shareholder returns and confidence in future financial and capital arrangements. Additionally, industry insiders noted that the emphasis on investor returns by listed companies not only conveys Bullish Signals to investors but also showcases the company's good operational status and profitability, which helps stabilize market expectations. In the secondary market, since the low point in January, the stock price of Contemporary Amperex Technology has increased by up to 120%.

Known as the leading brand of Traditional Chinese Medicine, Yunnan Baiyao Group announced on October 29 that the company intends to optimize the dividend distribution rhythm by increasing the frequency of dividends to enhance investors' sense of gain, boost investor confidence, and continuously increase both the company's intrinsic and market value. The company proposes to distribute a cash dividend of 12.13 yuan (after tax) for every 10 shares held, with 0 bonus shares (after tax), and not increasing share capital by capital reserve, for a total dividend amount of 2.164 billion yuan, accounting for 50.02% of the company's net profit attributable to shareholders for the first three quarters.

On December 6, during a survey, Yunnan Baiyao stated that the company has always focused on providing continuous and reasonable returns to investors while sharing the fruits of corporate development with them. In 2023, Yunnan Baiyao's dividend plan was 20.77 yuan for every 10 shares, totaling cash dividends of 3.706 billion yuan, which accounted for 90.53% of the net income attributable to shareholders for 2023. The company completed the annual dividend distribution on May 10, 2024. The special dividend plan for 2024 was completed on November 25. Since its listing in 1993 until 2024, the company has continuously distributed dividends for 31 years, with a total cash dividend amount exceeding 26.5 billion yuan. In the secondary market, since the low point in February, the stock price of Yunnan Baiyao has increased by up to 55.2%.

On October 10, S.F. Holding, a leading domestic courier company, announced that it had initiated the process for a public offering of overseas listed foreign shares (H shares) after approval from the first extraordinary general meeting of shareholders in 2023, and will be listed on the Main Board of the Hong Kong Stock Exchange. To reward the long-term strong support from shareholders, the company plans to implement a one-time special cash dividend for all shareholders (i.e., A-share shareholders) before this issuance and listing, proposing to distribute a cash dividend of RMB 10 (including tax) for every 10 shares, with an expected total amount of approximately 4.8 billion yuan to return to shareholders.

On the same day, S.F. Holding announced its mid-term dividend plan for 2024, proposing to distribute a cash dividend of RMB 4 (including tax) for every 10 shares. This plan needs to be approved at the first extraordinary general meeting of shareholders in 2024 before it can be implemented. The expected total amount for the mid-term dividend in 2024 is approximately 1.92 billion yuan, accounting for about 40% of the company's net income attributable to shareholders in the first half of 2024.

According to a research report by Zhao Xudong from Yuanta Securities on October 19, the mid-term + special dividend boosts market confidence, as S.F. Holding announced a dual dividend scheme of "special dividend + mid-term dividend." It is calculated that a total dividend of 14 yuan (before tax) will be distributed for every 10 shares, with a total distribution amount of approximately 6.72 billion yuan. Based on the closing price on October 10, the dividend yield is about 3.4%. Combined with the dividends already distributed in the first half of the year (cash dividend of RMB 6 for every 10 shares), the company's estimated annual dividend yield for 2024 is about 4.8%. In the secondary market, since the low point in February, S.F. Holding's stock price has increased by a maximum of 52.39%.