① The number of A-share listed companies receiving special loan support is continually expanding. According to incomplete Statistics, as of the time of writing, 26 listed companies have disclosed related information about Share Buyback and increased shareholding through re-loans this week (see attached table); ② Hangzhou Hikvision Digital Technology has the highest amount of special loan funding, not exceeding 1.75 billion yuan. Senci Electric Machinery Co., Ltd. announced plans to use special loans for buybacks, leading to a stock price limit increase the next day.

According to Financial Link on December 28 (Editor: Square), the number of A-share listed companies receiving support for buyback and increased shareholding special loans has been continuously expanding. Data show that as of December 27, since the release of the "Notice on the Establishment of Relevant Matters for Stock Buyback and Increased Shareholding Re-loans," a total of 249 listed companies have issued announcements stating that the company and its important shareholders have received special loans for buyback and increased shareholding. Based on the loan amount cap, the total loan amount involved exceeds 52.7 billion yuan.

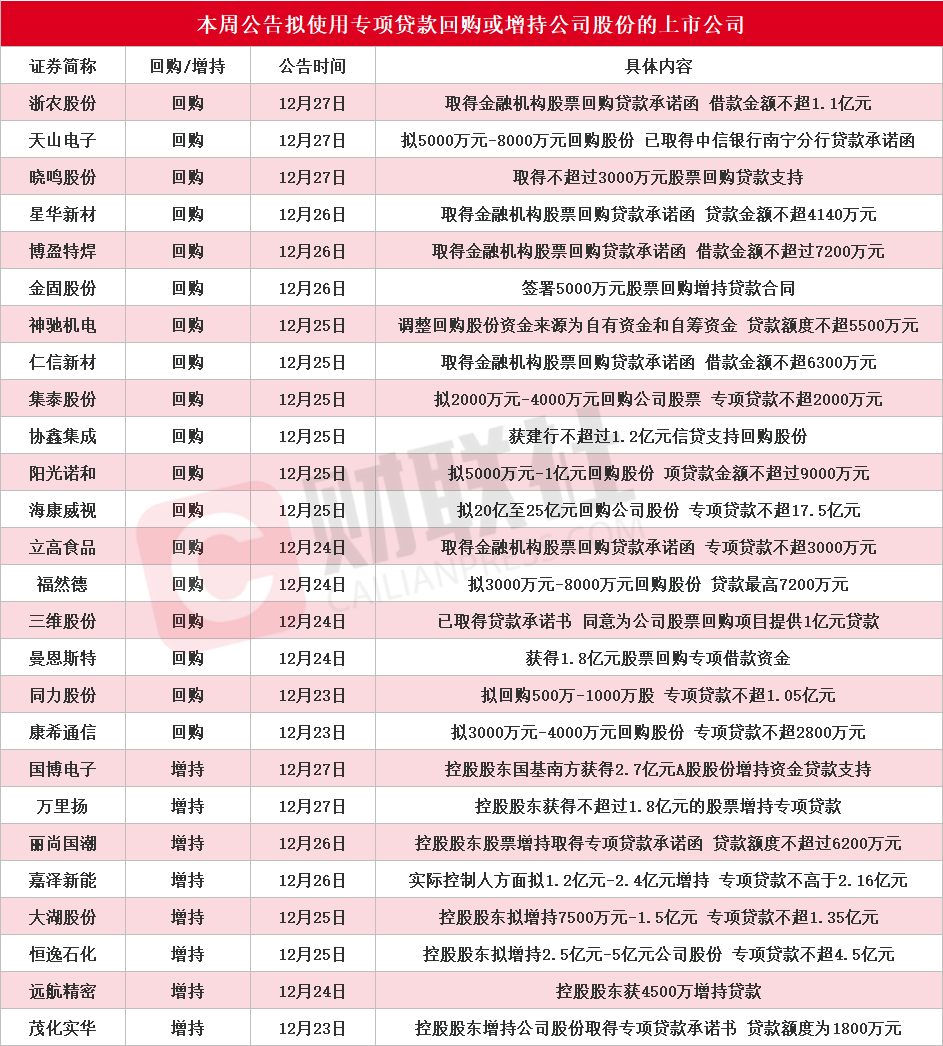

According to incomplete Statistics from Financial Link, as of the time of writing, this week (from December 23 to December 28), 26 listed companies including ZJAMP Group, Tianshan Electronics, Xiaoming Co., Xinhua New Materials, Boying Special Welding, Zhejiang Jingu, Senci Electric Machinery Co., Ltd., Renxin New Materials, Guangzhou Jointas Chemical, GCL System Integration Technology, Sunshine Nuohai, Hangzhou Hikvision Digital Technology, Lihigh Food, Friend Co., Ltd., Sanwei Holding Group, Mannesmann, Tongli Co., Kangxi Communication, Guobang Electronics, Zhejiang Wanliyang, Lanzhou Lishang Guochao Industrial Group, Ningxia Jiaze Renewables Corporation, Dahu Aquaculture, Hengyi Petrochemical, Yuanhang Precision, and Maohua Industrial have disclosed relevant information about buyback and increased shareholding re-loans. The specific details are shown in the picture below:

Among the listed companies that use special loans for buyback or increased shareholding plans, Hangzhou Hikvision Digital Technology has the highest special loan amount, with the upper limit of the loan amount not exceeding 1.75 billion yuan.

Among the listed companies that use special loans for buyback or increased shareholding plans, Hangzhou Hikvision Digital Technology has the highest special loan amount, with the upper limit of the loan amount not exceeding 1.75 billion yuan.

Hangzhou Hikvision Digital Technology, the largest supplier of security video surveillance products in China, released a buyback report on December 25. The company plans to use a total buyback amount not exceeding 2.5 billion yuan (inclusive) and not lower than 2 billion yuan (inclusive). The buyback price shall not exceed 40 yuan/share (inclusive), and the funds required for the buyback will come from the company's own funds and special loans for stock buyback. The shares repurchased will be legally canceled to reduce registered capital. The buyback implementation period is not more than twelve months from the date the company’s shareholders’ meeting approves this buyback plan. Recently, a "Loan Commitment Letter" was obtained from Agricultural Bank Of China, under which the Jiangsu branch of China Agricultural Bank will provide the company with a loan not exceeding 1.75 billion yuan specifically for stock buyback, with a loan period not exceeding 3 years. The company will apply for special funds for the buyback loan as needed, and the applied loan funds will not exceed 70% of the actual buyback amount.

Senci Electric Machinery Co., Ltd., which ranks among the top in the export volume of general gasoline generators, announced on December 25 that it plans to change the source of funds for the buyback from "own funds" to "own funds and self-raised funds." The company plans to repurchase its shares at a price not exceeding 13 yuan/share (inclusive) through a centralized bidding method, with a total buyback amount of not less than 50 million yuan and not exceeding 80 million yuan. In addition, the company received a "Stock Buyback Loan Notification Letter" issued by Hengfeng Bank Chongqing Branch, promising a loan limit not exceeding 55 million yuan, with a loan period not exceeding 36 months. In the secondary market, Senci Electric Machinery Co., Ltd.'s stock price hit the limit increase the next trading day after the announcement.

Yuanhang Precision, with the highest market share of nickel belt products in China, announced on December 24 that its major shareholder Jiangsu Yuanhang Times Holding Group Co., Ltd. received a "Loan Commitment Letter" from Hua Xia Bank, with the loan limit not exceeding 45 million yuan. The loan period for the above loan is not more than 3 years, and the interest rate shall be in accordance with the relevant provisions of Hua Xia Bank, generally not exceeding 2.25%. In addition, the major shareholder plans to increase its shareholding by 1 million to -2 million shares within six months from the announcement date, with a planned increase amount not exceeding 50 million yuan. In the secondary market, Yuanhang Precision's stock price surged by 15.3% the day after the announcement.

In addition, related parties of Guobang Electronics, Ningxia Jiaze Renewables Corporation, Hengyi Petrochemical, and other listed companies announced this week that they have obtained special loans for buyback and increased shareholding with a limit exceeding 0.2 billion yuan. Guobang Electronics, which specializes in active phased array T/R components and RF integrated circuits, announced on December 27 that its major shareholder Guoji Southern and its concerted parties plan to increase their shareholding by 0.4 billion to 0.7 billion yuan, with a special loan limit of 0.27 billion yuan, and a loan period not exceeding 3 years. Ningxia Jiaze Renewables Corporation, which integrates wind power, photovoltaic power generation, and smart microgrid, announced on December 26 that its actual controller Chen Bo's concerted party Jin Yuan Rong Tai plans to increase its shareholding by 0.12 billion to 0.24 billion yuan, with a special loan limit not exceeding 0.216 billion yuan. Hengyi Petrochemical, a global leading integrated enterprise in the "PTA—polyester" and "CPL—nylon" industry chain, announced on December 25 that its controlling shareholder Hengyi Group plans to increase its shareholding by 0.25 billion to -0.5 billion yuan, with a special loan not exceeding 0.45 billion yuan.

上述公告使用专项贷款进行回购或增持计划的上市公司之中,

上述公告使用专项贷款进行回购或增持计划的上市公司之中,