Anyuan Coal Industry Group Co., Ltd. (SHSE:600397) shares have continued their recent momentum with a 32% gain in the last month alone. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

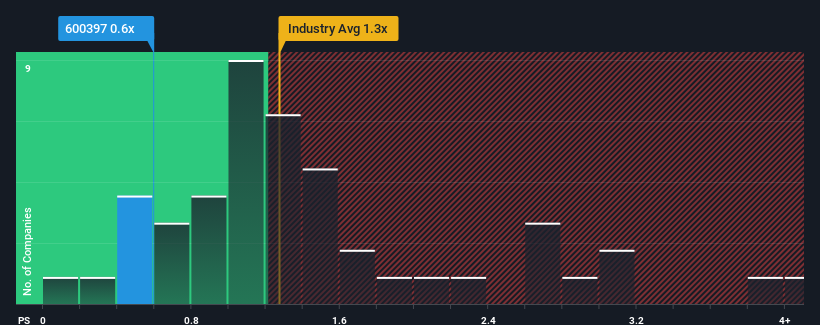

In spite of the firm bounce in price, it would still be understandable if you think Anyuan Coal Industry Group is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.6x, considering almost half the companies in China's Oil and Gas industry have P/S ratios above 1.3x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

How Has Anyuan Coal Industry Group Performed Recently?

For example, consider that Anyuan Coal Industry Group's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the recent revenue performance isn't good enough to keep up the industry, causing the P/S ratio to suffer. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Anyuan Coal Industry Group's earnings, revenue and cash flow.Is There Any Revenue Growth Forecasted For Anyuan Coal Industry Group?

The only time you'd be truly comfortable seeing a P/S as low as Anyuan Coal Industry Group's is when the company's growth is on track to lag the industry.

The only time you'd be truly comfortable seeing a P/S as low as Anyuan Coal Industry Group's is when the company's growth is on track to lag the industry.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 16%. As a result, revenue from three years ago have also fallen 45% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

In contrast to the company, the rest of the industry is expected to grow by 6.5% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

With this in mind, we understand why Anyuan Coal Industry Group's P/S is lower than most of its industry peers. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

What Does Anyuan Coal Industry Group's P/S Mean For Investors?

Anyuan Coal Industry Group's stock price has surged recently, but its but its P/S still remains modest. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

Our examination of Anyuan Coal Industry Group confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price moving strongly in either direction in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Anyuan Coal Industry Group that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.