Driven by robust consumer spending, the USA's economic growth significantly outpaces that of other G7 countries; despite high borrowing costs suppressing housing and manufacturing developments, resulting in a slowdown in hiring activities, the USA economy, supported by strong consumer spending data, is approaching the Federal Reserve's ideal of a "soft landing" for the economy.

In recent years, although the growth rate of the USA economy has slowed down, it has unexpectedly maintained a "better-than-expected growth model", and 2024 is no exception. Despite the long-term high borrowing costs suppressing the development of housing and manufacturing, leading to a slowdown in hiring activities, the USA economy, backed by strong Consumer spending data, is infinitely close to the "soft landing" that Federal Reserve officials long for.

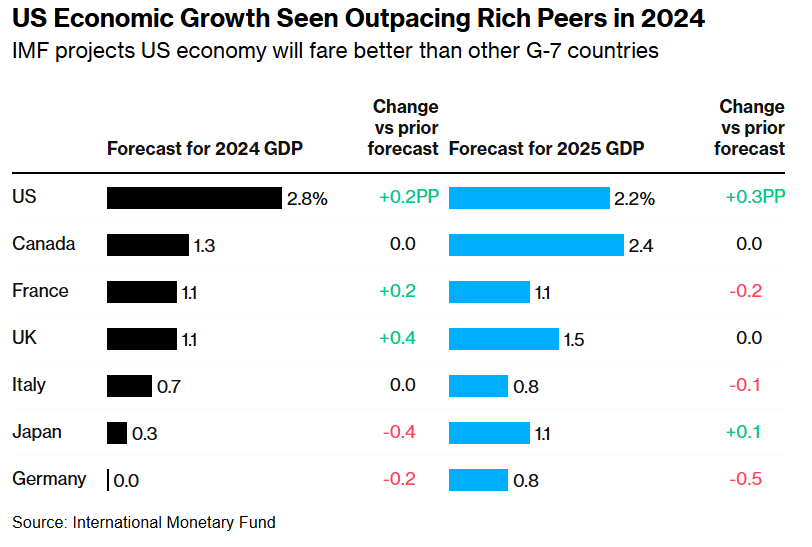

Despite the uncertainties surrounding the presidential election and the persistently high benchmark Interest Rates in the USA, significant signs of cooling in the labor market have emerged. However, thanks to exceptionally strong Consumer spending levels, the growth rate of the USA economy remains robust this year, surpassing all economists' outlooks for the USA economy at the end of 2023. According to the International Monetary Fund (IMF) forecast, the USA is expected to be the best-performing developed country in the G7 in 2024.

In 2024, the USA is expected to significantly outpace other wealthy countries in economic growth—according to the International Monetary Fund forecast, the USA economy will perform better than other G7 members.

In 2024, the USA is expected to significantly outpace other wealthy countries in economic growth—according to the International Monetary Fund forecast, the USA economy will perform better than other G7 members.

However, even as the USA economy gets closer to a "soft landing", the economic situation is far from perfect. It has proved that inflation is receding slowly, prompting the Federal Reserve to adopt a "higher-for-longer" hawkish monetary strategy. Under the heavy pressure of high borrowing costs, the USA housing and manufacturing sectors continue to struggle, while cracks are appearing in the once-booming job market since the pandemic, with rising default rates among consumers burdened with credit card debt, mortgages, and other loans.

The following is a detailed review of the USA economy's performance this year:

Consumer spending is quite resilient.

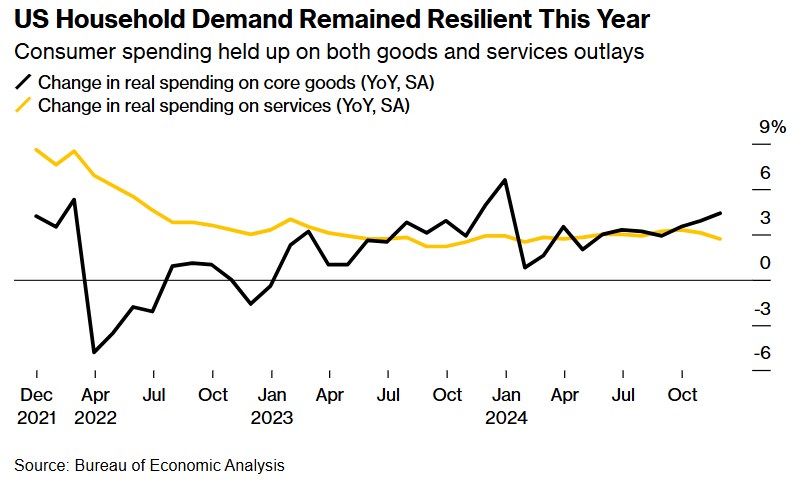

In 2024, the performance of the USA economy exceeded economists' expectations, thanks to the strong USA Consumer. Although the pace of hiring in the labor market has slowed, wage growth in the USA continues to surpass the inflation rate, and household wealth has reached new records alongside the record-high USA stock market, supporting the continued strong expansion of household spending.

USA household demand remains strong this year — consumers' spending on both commodities and services remains stable.

Forecast data from Bloomberg Economics predicts that USA household spending will increase by 2.8% throughout 2024 — faster than in 2023, which is nearly double what economists broadly expected at the beginning of the year.

However, cracks are appearing regarding consumer spending. Although consumers remain strong, some of the primary drivers of this notable resilience have started to show signs of weakening this year. Some USA individuals, including a portion of high-income groups, have already exhausted all their cash savings accumulated during the COVID-19 pandemic, and typically save a small portion of their income each month, a habit that has not been observed in the USA for a long time.

Consumers across income levels are gradually distancing themselves — retail spending growth categorized by household income.

According to a statistical report released by the National Retail Federation (NRF) in the USA, the total Consumer spending from November 1 to December 31 this year is expected to reach a record between 979.5 billion and 989 billion dollars, indicating that this year's holiday shopping season is likely to continue setting historical highs for Consumer spending in the USA.

In addition, according to revised USA government statistics released in September of this year, the rebounding momentum of the USA economy from the short-term recession caused by the COVID-19 pandemic is much stronger than economists expected and the previous data announced by the USA government, mainly driven by the larger scale of Consumer spending growth from USA Consumers in 2022 and 2023. These revised data have seemingly overturned many economists' perceptions of the USA economy, with Consumer spending in the USA remaining consistently strong since the pandemic. Overall, this round of unparalleled economic rebound process in the USA, which began in the second quarter of 2020, is one of the strongest economic expansion cycles in the USA since World War II.

Meanwhile, Consumer spending in the USA is increasingly being driven by the high-net-worth group, who are enjoying the so-called wealth accumulation effect brought on by rising housing prices and stock markets. At the same time, many low-income Consumers are relying on credit cards and other loans to support their daily spending, with some even showing significant signs of financial pressure, such as rising default and delinquency rates.

The labor market is showing "cracks", with hiring activities significantly slowing down.

In 2024, the main supporting force for Consumer spending—the previously booming labor market—has also begun to show warning signs. USA hiring activities have slowed down throughout the year, and the unemployment rate has slightly risen, with the unexpected rise in the unemployment rate in July even triggering the widely watched leading recession indicator - the Sam Rule. Furthermore, the number of job vacancies in the USA has significantly decreased, and compared to the COVID-19 pandemic period, it has become increasingly difficult for unemployed individuals in the USA to find new jobs, which is why recent data on continuing unemployment claims in the USA has remained high.

Statistical data shows that in the week ending December 14, the number of continuing unemployment claims unexpectedly increased by 0.046 million, seasonally adjusted to approximately 1.91 million, reaching the highest level since November 2021, exceeding economists' general expectation of 1.88 million. This data aligns with other economic indicators showing that unemployed individuals in the USA are finding it increasingly difficult to secure jobs compared to the high inflation period of the past two years.

Federal Reserve officials began a new round of interest rate cuts in September due to concerns that the core factors supporting the USA economy—the labor market—might be approaching a dangerous tipping point. However, as the unemployment rate in the USA stabilizes at historically low levels, Fed officials have become more optimistic in the final months of this year, slightly raising the PCE inflation forecast in the latest "Federal Reserve Economic Summary," while maintaining a very optimistic outlook for the unemployment rate.

Regarding future benchmark interest rate expectations, Fed officials have moderated their outlook for the benchmark rates in 2025 and 2026. The latest "dot plot" indicates that the expectations for rate cuts in 2025 have been significantly reduced from four cuts at the end of last quarter to two, and the rate expectations for 2026, along with the market's focus on the "neutral rate," have been adjusted upwards. Following the release of the dot plot and the press conference by Powell, swap contract pricing for next year's rate cuts has also been significantly reduced, with even some contracts starting to price in no cuts next year. A recent forecast from Deutsche Bank indicates that the bank expects the Federal Reserve to pause interest rate cuts throughout the next year, and the Fed's easing cycle is effectively stagnated.

One piece of good news for the USA economy is that wage growth continues to stabilize around 4%, which should continue to support the financial situation of households, particularly the spending of high-net-worth individuals.

The process of fighting inflation has stagnated.

After a rapid decline in 2023 and further positive progress in the first half of 2024, the progress towards achieving the Federal Reserve's 2% inflation target has stagnated in recent months. One of the preferred inflation indicators of the Federal Reserve—the Personal Consumption Expenditures price index excluding food and energy (the so-called core PCE)—was up 2.8% year-on-year in November.

The inflation metric favored by the Federal Reserve stabilizes in 2024—the so-called core PCE index grew at an annual rate of 2.8% in November.

Although Federal Reserve officials have chosen to lower interest rates by a full percentage point this year to relieve economic pressure, officials, including Fed Chair Jerome Powell, have recently stated that the Fed officials need to see more positive progress in combating inflation before further rate cuts in 2025.

High interest rates continue to harm the USA Real Estate market.

Although the Federal Reserve lowered interest rates by 100 basis points, the USA Real Estate market continues to struggle under the heavy pressure of persistently high borrowing costs in recent years. Mortgage rates fell to a two-year low in September, but due to the Interest Rates market's expectation that the Federal Reserve will need to maintain high rates for a longer period, mortgage rates approached 7% again after the Federal Reserve's "hawkish" rate cut in December. Some contractors continue to offer incentives to attract USA buyers, including so-called progressive mortgage payments and down payment assistance, as well as occasional price reductions.

Housing affordability in the USA remains at a historically low level - an Index below 100 indicates that moderately priced homes have become difficult to afford.

Although the USA Real Estate market sales have stabilized somewhat after a slight rate cut this year, they are still significantly below pre-COVID-19 levels. In the used housing market, which occupies most of the home buying market, the National Association of Realtors estimates that the 2024 housing sales data may even be lower than last year, which was already the worst year for the USA Real Estate market since 1995.

A year of stagnation in manufacturing.

Manufacturing can be considered another major victim of the USA's persistently high borrowing costs. Sustained high interest rates and weak overseas manufacturing demand have hindered investment in new buildings and manufacturing facilities, with many factories opting for significant layoffs to save costs. Except for one month this year, employment in durable goods manufacturing has been significantly declining.

The USA manufacturing sector experienced a historically weak year, with factory employment in November declining compared to the same period last year.

Economists point out that the upcoming economic agenda of the next president, Donald Trump, who is returning to the White House, may continue to exert significant pressure on the USA manufacturing sector in 2025. Although Trump has promised to boost domestic manufacturing, some economists expect that his plans to raise tariffs, expel millions of immigrants, and cut taxes could significantly raise inflation, suppress labor market expansion, and disrupt Global supply chains. Amid this uncertainty, economists expect the overall capital expenditure of USA manufacturers to grow at a relatively moderate pace next year, with the possibility of a slight contraction.