①During the localization substitution process, how the company can achieve profitability improvement and sustainable growth of self-produced products will be a topic of widespread market concern; ②Hengkun New Materials stated that during the introduction process, the company must fully follow up on customer sample testing, etc., to introduce customized Lithography materials, reflecting the company's core technology and competitive strength in product application.

On December 30, according to the "Star Daily" (Reporter Wu Xuguang), Xiamen Hengkun New Materials Technology Co., Ltd. (hereinafter referred to as "Hengkun New Materials") has had its IPO accepted on the Star.

The company plans to issue 67.39794 million new shares to raise 1.2 billion yuan for projects such as phase II of integrated circuit precursors, SiARC development and industrialization, and advanced materials for integrated circuits.

The specific criteria for its listing are: an expected Market Cap of no less than 1 billion yuan, positive Net income for the last two years with a cumulative Net income of no less than 50 million yuan, or an expected Market Cap of no less than 1 billion yuan, positive Net income for the last year, and revenue of no less than 0.1 billion yuan.

The specific criteria for its listing are: an expected Market Cap of no less than 1 billion yuan, positive Net income for the last two years with a cumulative Net income of no less than 50 million yuan, or an expected Market Cap of no less than 1 billion yuan, positive Net income for the last year, and revenue of no less than 0.1 billion yuan.

It is worth noting that in this IPO, the proportion of revenue generated from self-produced products by Hengkun New Materials is relatively low, and some self-produced products still have negative gross margin. In the future, how the company can achieve profitability improvement and sustainable growth of self-produced products during the localization substitution process is a topic of widespread market concern.

The proportion of revenue from introduced products is nearly 40%.

Hengkun New Materials is committed to the research and commercialization application of key materials in the integrated circuit field, and is one of the few companies in China capable of researching and producing key materials for 12-inch integrated circuit wafer manufacturing, mainly engaged in the research, production, and sales of products such as Lithography materials and precursor materials.

From 2021 to June 2024, the operating income of Hengkun New Materials at the end of each period was 0.141 billion yuan, 0.322 billion yuan, 0.368 billion yuan, and 0.238 billion yuan, with Net income of 30.1286 million yuan, 0.101 billion yuan, 89.8493 million yuan, and 44.0992 million yuan respectively.

Behind the performance growth of Jiangsu Nata Opto-electronic Material, the proportion of government subsidies and other factors accounted for the total profit is quite high.

At the end of each reporting period, the government subsidies recorded in the profit and loss of the current period for Jiangsu Nata Opto-electronic Material were 30.5466 million yuan, 19.1172 million yuan, 16.762 million yuan, and 8.3151 million yuan, accounting for 100.78%, 15.24%, 16.05%, and 15.56% of the company's total profit respectively.

Jiangsu Nata Opto-electronic Material stated that if future government subsidy policies change, or if the company fails to meet relevant requirements leading to the inability to obtain government subsidies or a reduction in the obtained subsidies, it may have a certain adverse effect on the company's profit level.

Specifically, from the income structure of the company's products, the main business revenue of Jiangsu Nata Opto-electronic Material comes from self-produced products and introduced products.

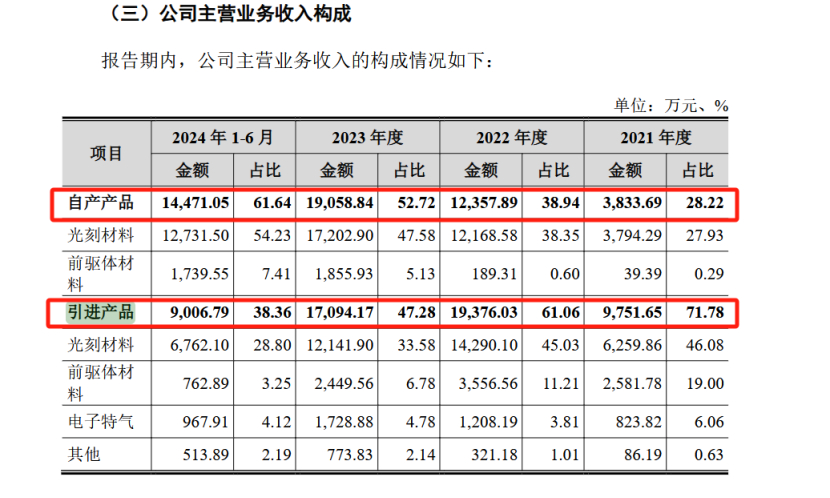

During the reporting period, Jiangsu Nata Opto-electronic Material's sales revenue from self-produced products were 38.3369 million yuan, 0.124 billion yuan, 0.191 billion yuan, and 145 million yuan, accounting for 28.22%, 38.94%, 52.72%, and 61.64% of the main business revenue respectively.

As for introduced products, they specifically include Lithography materials, precursor materials, electronic specialty gases, and other wet electronic Chemicals.

During the reporting period, Jiangsu Nata Opto-electronic Material's income from introduced products was 97.5165 million yuan, 0.194 billion yuan, 0.171 billion yuan, and 90.0679 million yuan, accounting for 71.78%, 61.06%, 47.28%, and 38.36% of the main business revenue respectively. Although the proportion decreased year by year, it is still relatively high.

According to industry insiders, in each reporting period, the company's main business revenue composition of nearly 40% or more may not adequately reflect the company's Technology innovation attributes.

Hengkong New Materials stated that during the introduction process, the company needs to fully follow up with customers on sample testing, etc., for the introduction of customized Lithography materials, reflecting the company's core technology and competitive strength in product applications.

The gross margin of self-operated precursor materials is negative.

According to the prospectus, the main products manufactured by Hengkong New Materials include SOC, BARC, KrF Lithography resin, i-Line Lithography resin, and other Lithography materials as well as TEOS and other precursor materials, primarily used in the manufacturing processes of advanced NAND and DRAM storage chips and 90nm technology nodes and below for Lithography and thin film deposition.

Regarding the shipment situation of the company's Lithography resin materials, Hengkong New Materials stated that by the end of the reporting period, the company's self-produced KrF Lithography resin and i-Line Lithography resin had cumulatively supplied over 2,100 gallons in mass production. At the same time, more than 15 types of i-Line Lithography resin, KrF Lithography resin, and ArF Lithography resin have entered the verification process, and some products have passed verification.

An insider in the Semiconductor New Materials Industry told the Star Daily reporter that from the perspective of process technology, KrF Lithography resin and i-Line Lithography resin are considered mid- to low-end Lithography resins. Currently, the technical threshold for these products in the domestic market is not high, and many companies, including Peking Kehua, Crystal Clear Electronic Material, and Jiangsu Nata Opto-electronic Material, have already achieved mass production, and the scale is not small.

"Currently, the technical difficulty of i-Line Lithography resin is not high. As early as 2018, the company completed customer acceptance for its i-Line Lithography resin products and achieved batch shipments," added a person from the board secretary's office of a Lithography resin listed company in Central China.

An investment person from a new materials industry Fund told the Star Daily reporter that from the perspective of the development level of domestic Lithography resin, raw materials and formulations are the key Indicators restricting the development of the industry. Cost reduction, performance indicator breakthroughs, and matching downstream customers all need to rely on these two indicators to achieve breakthroughs. On this basis, progress in production processes, equipment, etc., will directly affect localization replacements like cost reductions.

The Star Daily reporter noticed that Hengkong New Materials mainly relies on imports for its primary raw material supply.

Hengkun New Materials stated that the raw materials needed for the company's products mainly include Resin, additives, etc. The required equipment mainly consists of Lithography, defect scanning instruments, testing equipment, and production equipment for lithography materials and precursor materials, which mainly still needs to be imported, greatly affected by international trade conditions.

It should be noted that as a precursor material product of Hengkun New Materials' self-industry business, there is a risk of negative gross margin.

It is reported that in the field of precursor materials, Hengkun New Materials currently produces materials mainly using TEOS. Hengkun New Materials' subsidiary, Dalian Hengkun, has realized self-production by introducing production management technology for TEOS from South Korea's Soulbrain Company, with product purity reaching 9N level.

During the reporting period, the gross margin of self-produced precursor materials by Hengkun New Materials were -644.76%, -329.59%, -19.91%, and -8.67% respectively, with the gross margin continuously rising but still negative.

Hengkun New Materials stated that this is mainly because the products are in the market promotion period, with relatively low production and high unit fixed costs.

Regarding the localization level of Hengkun New Materials' lithography products, client-side verification progress, and the embodiment of the company's core technology, a reporter from the Star Daily sent an email to Hengkun New Materials' Securities Department, but no relevant reply has been received as of the time of publication.

其选择上市的具体标准为:预计市值不低于10亿元,最近两年净利润均为正且累计净利润不低于5000万元,或者预计市值不低于10亿元,最近一年净利润为正且营业收入不低于1亿元。

其选择上市的具体标准为:预计市值不低于10亿元,最近两年净利润均为正且累计净利润不低于5000万元,或者预计市值不低于10亿元,最近一年净利润为正且营业收入不低于1亿元。