Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We note that Hytera Communications Corporation Limited (SZSE:002583) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

What Is Hytera Communications's Net Debt?

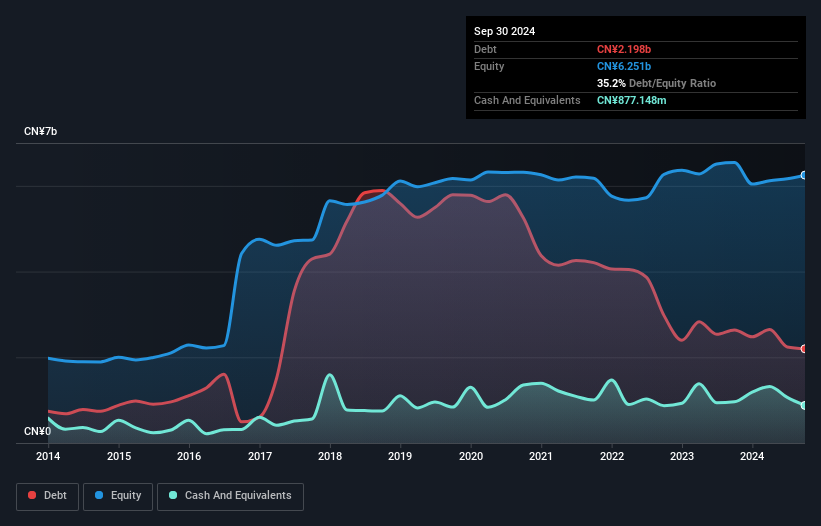

The image below, which you can click on for greater detail, shows that Hytera Communications had debt of CN¥2.20b at the end of September 2024, a reduction from CN¥2.64b over a year. However, it does have CN¥877.1m in cash offsetting this, leading to net debt of about CN¥1.32b.

How Healthy Is Hytera Communications' Balance Sheet?

The latest balance sheet data shows that Hytera Communications had liabilities of CN¥4.48b due within a year, and liabilities of CN¥1.15b falling due after that. Offsetting this, it had CN¥877.1m in cash and CN¥3.04b in receivables that were due within 12 months. So it has liabilities totalling CN¥1.71b more than its cash and near-term receivables, combined.

The latest balance sheet data shows that Hytera Communications had liabilities of CN¥4.48b due within a year, and liabilities of CN¥1.15b falling due after that. Offsetting this, it had CN¥877.1m in cash and CN¥3.04b in receivables that were due within 12 months. So it has liabilities totalling CN¥1.71b more than its cash and near-term receivables, combined.

Of course, Hytera Communications has a market capitalization of CN¥26.7b, so these liabilities are probably manageable. But there are sufficient liabilities that we would certainly recommend shareholders continue to monitor the balance sheet, going forward.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With a debt to EBITDA ratio of 1.6, Hytera Communications uses debt artfully but responsibly. And the fact that its trailing twelve months of EBIT was 8.1 times its interest expenses harmonizes with that theme. Even more impressive was the fact that Hytera Communications grew its EBIT by 156% over twelve months. If maintained that growth will make the debt even more manageable in the years ahead. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately the future profitability of the business will decide if Hytera Communications can strengthen its balance sheet over time. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Over the last two years, Hytera Communications actually produced more free cash flow than EBIT. That sort of strong cash generation warms our hearts like a puppy in a bumblebee suit.

Our View

Happily, Hytera Communications's impressive conversion of EBIT to free cash flow implies it has the upper hand on its debt. And the good news does not stop there, as its EBIT growth rate also supports that impression! Considering this range of factors, it seems to us that Hytera Communications is quite prudent with its debt, and the risks seem well managed. So the balance sheet looks pretty healthy, to us. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Hytera Communications is showing 1 warning sign in our investment analysis , you should know about...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.