Stepping onto the field by running on the shoulders of AI giants.

"AI + Medical" is entering a fast track of development at an unprecedented speed.

Public data shows that more than 30 generative AI models in the medical field have been released in China, with application scenarios covering important areas such as patient consultations, doctor assistants, new drug development, and health management. From auxiliary diagnosis and medical imaging to innovative drug research and development, AI technology is gradually penetrating every aspect of the Medical Industry. This is not only driving the efficiency and accuracy of Medical Services to continuously improve but also bringing more personalized and precise treatment plans for patients.

Amidst this wave, investors face a critical question: how can they identify and seize the deterministic opportunities in the AI medical field.

Amidst this wave, investors face a critical question: how can they identify and seize the deterministic opportunities in the AI medical field.

The answer to this question may be found by gaining some insights from Iflytek Medical.

Today, Iflytek Medical was officially listed on the Main Board of the Hong Kong Stock Exchange, with an offering price of HK$82.8 per share and a stock code of "2506.HK." According to Frost & Sullivan data, if based on the 2023 revenue scale, the company ranks first in China's Medical AI industry, which reflects its market position and leadership within the AI medical field.

The support of multiple well-known investment Institutions also fully demonstrates the favor that various industries and capital have for Iflytek Co.,ltd. This time, the company introduced five cornerstone investors who together subscribed for shares worth 35.57 million USD (approximately 0.277 billion HKD), including CHINA MERCHANTS, Da'an (China Chengxin Investment), Hengqin Investment Fund, Xunyi (Hefei State-owned Assets Fund Hefei Xunyi Venture Capital), and Costone China Growth (Cornerstone Asset Management).

It can be said that relying on the AI giant Iflytek Co.,ltd. with a market cap of hundreds of billions, the timing of Iflytek Medical's listing is quite appropriate, as it can further attract attention in the Capital Markets, while also providing a window for investors to capture this high-growth sector.

To comprehensively understand the future potential and market prospects of Iflytek Medical, it may be beneficial to further analyze the company's value evolution pathway. This provides a valuable reference for investors and serves as a model worth referencing for the entire industry.

01

The burgeoning AI medical sector.

Under the logic of "big water raises big fish," the breadth of the sector directly relates to the sustainability of the company's long-term performance and the limits of its growth. Based on this concept, exploring the investment value of Iflytek Medical requires first analyzing the development prospects of its industry.

The medical industry has long been recognized by the market as having broad market prospects, especially against the backdrop of an aging population and increasingly diversified health demands, where the industry value continues to be released.

Strong support at the policy level continuously instills confidence in the market and becomes an important driving factor for the industry's rapid growth.

For example, the "Guidelines for Reference Scenarios of AI Applications in the Health and Medical Industry" jointly released by the National Health Commission and other departments provides clear directions for the application scenarios of AI in the medical field; the "Health China Action - Cancer Prevention and Control Action Implementation Plan (2023-2030)" emphasizes the importance of actively utilizing Internet Plus-Related and AI technologies to conduct telemedicine services, continuously accelerating the integration and application of AI in healthcare.

At the same time, numerous brokerage firms have issued research reports, bullish on the growth potential of AI in healthcare. Among them, Zhongyou Securities pointed out that this year's "Government Work Report" first mentioned "AI+", indicating that "AI+ Medical" is an inevitable trend and an important development direction in the healthcare field, signaling that related industries will encounter significant development opportunities.

In addition, the "Future Doctor White Paper (2024)" indicates that currently, clinical medical personnel in China are leading the world in AI technology adoption, with over one-third of personnel applying AI tools in their daily work, far exceeding the global average level of 26%.

It can be seen that driven by policy, China's AI medical industry is displaying a rapidly growing trend, which can also be corroborated by data.

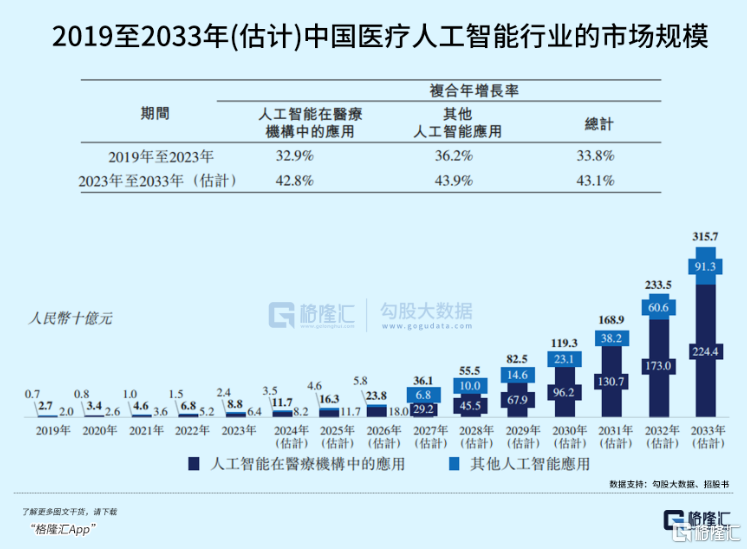

Frost & Sullivan data shows that from 2019 to 2023, the market size of China's medical AI industry grew from 2.7 billion yuan to 8.8 billion yuan, with a compound annual growth rate of 33.8%, and is expected to further increase to 315.7 billion yuan by 2033, with a compound annual growth rate of as high as 43.1% from 2023 to 2033.

It is not difficult to see that Iflytek Medical's strategic layout demonstrates profound insight into future development trends; by choosing this 'good track', the company is expected to achieve good business growth opportunities in the future, helping it maintain a favorable position in intense market competition.

02

Three major advantages lay the foundation for the sustainability and certainty of future growth.

Of course, the high growth potential of the industry significantly elevates the long-term value of enterprises, which is especially evident for those companies that are already leading in the industry and continuously consolidating their core competitiveness; they are undoubtedly the core beneficiaries of the industry's growth dividends.

So what is the quality of Iflytek's Medical Services? It can be viewed from three dimensions: industry position, past performance, and future growth expectations.

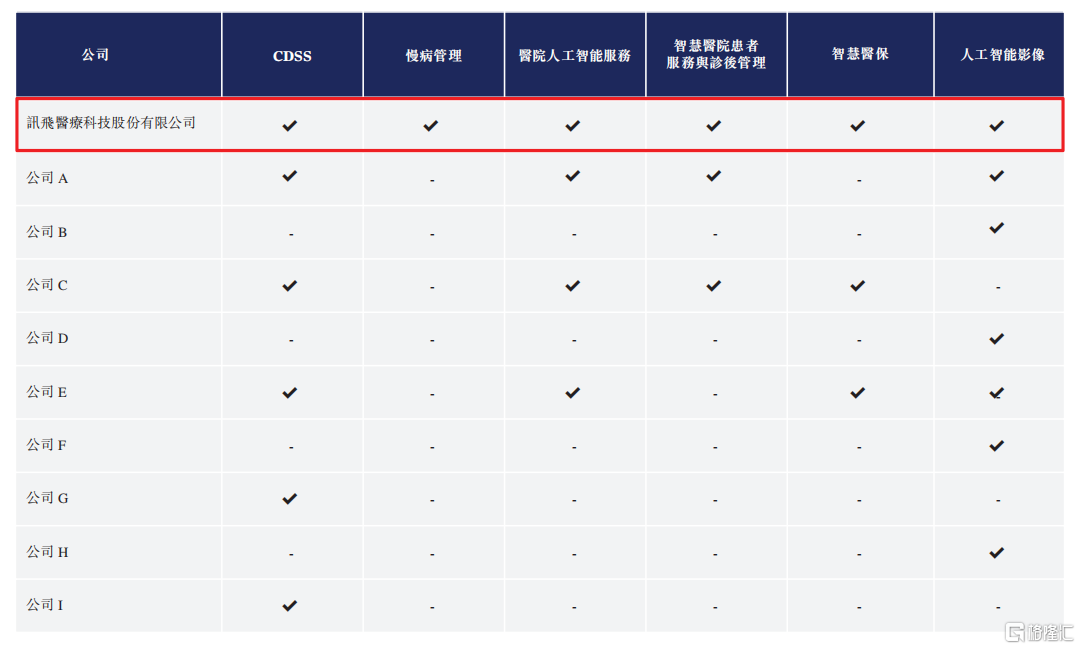

First, as a leading provider of AI-enabled medical solutions in China, Iflytek's Medical Services holds the top spot in market share due to its comprehensive products and services. According to Frost & Sullivan data, by revenue, Iflytek Medical ranked first in China's medical AI industry in 2023, with its AI Medical Assistant ranking first in the CDSS market of China's primary medical institutions.

Iflytek Medical relies on its self-developed Iflytek Spark Medical Model, establishing a comprehensive product and service system that allows widespread customer coverage from primary medical institutions to hospitals, patients, and other individual clients as well as regional management agencies, meeting the needs of different customer groups.

These products and solutions not only support health risk warnings, early screening, auxiliary diagnosis, and treatment but also cover various Medical Services from treatment effect evaluation to post-management and chronic disease management. Through such comprehensive layout, Iflytek Medical has established solid competitive barriers and a moat, paving a strong foundation for the company's long-term development.

From the perspective of industry competition, compared to other competitors providing AI applications for medical institutions in China, Iflytek Medical offers a more comprehensive product set aimed at medical institutions. Frost & Sullivan data indicates that the company is not only one of the earliest market participants in promoting and implementing large models in the Chinese medical industry, but is also the only company involved in formulating the "technical evaluation system and standard specifications for medical large models," demonstrating the company's competitiveness and industry leadership in the AI medical sector.

Based on such product layout and market performance, there is reason to believe that in a rapidly growing industry environment, Iflytek Medical will have the opportunity to further benefit from economies of scale, gain more market share and resources, thereby driving the company to form a virtuous cycle of wheel effect and continuously consolidate its position as a market leader.

Secondly, from a performance perspective, Iflytek Medical's revenue has maintained high growth for several consecutive years, and the profitability path is very clear. When categorized, both its B-end and C-end revenues are experiencing rapid growth, which may indicate the company's potential and prospects in the industry.

The prospectus shows that from 2021 to 2023, the company's revenue increased from 0.373 billion yuan to 0.556 billion yuan, with a compound annual growth rate of 22.09%, and in the first half of 2024, it grew by 17.8% year-on-year to 0.229 billion yuan.

In terms of profitability, the company's gross profit has also shown a continuous growth trend, achieving a gross profit of 0.121 billion yuan in the first half of 2024, an increase of 19.6% year-on-year.

Finally, focus on the judgment of Iflytek Medical's subsequent growth.

Undeniably, there are more and more players in the field of AI medical large models nowadays. In addition to Iflytek's Spark Medical large model, numerous AI medical large models such as JD HEALTH's Jingyi Qianxun and Baidu's Lingyi Zhihui have also emerged one after another, with market competition becoming increasingly fierce.

In such intense competition, Iflytek Medical enhances its potential for sustained growth by relying on its leading position in the industry, comprehensive products and services, as well as two significant advantages that cannot be overlooked.

On one hand, Iflytek Medical is backed by the strong AI technology resources of its parent company, Iflytek Co.,ltd. As a leading enterprise in China’s AI sector, Iflytek Co.,ltd.'s deep accumulation in areas such as speech recognition and synthesis, computer vision, cognitive intelligence, and natural language processing provides strong support for Iflytek Medical's innovation and development in the AI medical field.

For example, the proprietary Iflytek Co.,ltd. Medical Large Model can be applied to over 300 medical scenario applications, achieving levels beyond GPT-4 Turbo across six medical-related NLP task dimensions, including expert-level medical knowledge graph Q&A, clinical language understanding, medical document generation, diagnosis and treatment recommendations, multi-turn medical dialogue generation, and multimodal interaction.

For the Business, the Iflytek Co.,ltd. Medical Large Model provides intelligent solutions for Medical Services, enhancing the efficiency and quality of Medical Services. For example, its multi-turn medical dialogue generation and multimodal interaction capabilities offer users a more humanized and personalized service experience. This user-centered service model not only improves user satisfaction but also strengthens user loyalty, laying a solid foundation for the company's long-term development.

Further, the advantages of the Iflytek Co.,ltd. Medical Large Model extend beyond user experience enhancement. It has passed the evaluation of the first national application technical standard for large models in the Medical and Health field, highlighting the model's excellence in professionalism, standardization, and safety. These advantages ensure the high standards and quality of the company's products and earn greater trust and recognition in the market.

These advantages make the products of Iflytek Medical more attractive in the market, helping the company further expand its market share amid intense competition and consolidate its leadership position in the Medical and Health sector.

On the other hand, ample Orders on hand bring stable income expectations for Iflytek Medical and provide financial support for future expansion and R&D investments. In recent years, the company's Orders on hand have increased year by year. By the first half of 2024, there were 263 Orders, with a contract value of 0.193 billion yuan, fully demonstrating the market's high recognition and demand for Iflytek Medical's products and services.

It can be concluded that the growth logic and advantages of Iflytek Medical are already very clear.

03

Conclusion

With Iflytek Medical successfully listing on the Main Board of the Hong Kong Stock Exchange, the company can establish closer connections with international clients and partners, broaden its global vision, and seek more cooperation opportunities worldwide, greatly promoting the company's internationalization process. This will undoubtedly bring more innovative inspiration and business growth points, becoming an important driving force for its long-term development.

Recognition and support from the Capital Markets will provide the company with more resources and funds to support its R&D innovation and market expansion. This not only helps Iflytek Medical consolidate and expand its leading position in the Medical field but also opens up limitless imagination space for the company's future development.

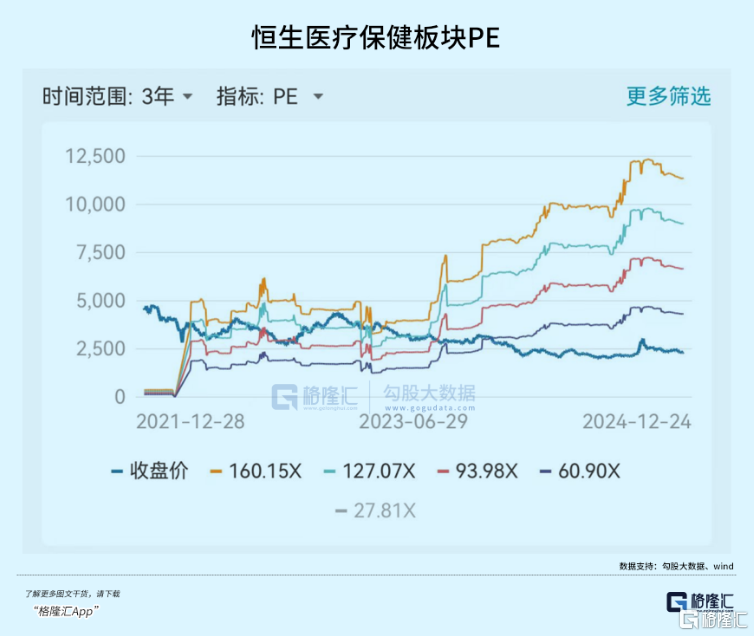

From the perspective of the Capital Markets, the current valuation of Iflytek Medical appears particularly attractive. Firstly, Wind data shows that the current valuation of the Hang Seng Medical Care Sector is relatively sluggish, with a high margin of safety. Secondly, the company's current issuance market cap is around 10 billion HKD, although it has increased compared to the last financing valuation at the end of 2023 (8.41 billion RMB, approximately 8.95 billion HKD), the increase is not significant, indicating the rationality of the market’s pricing of the company's current valuation.

Overall, Iflytek Medical's characteristics of being in a 'good sector, good company, and good price' lay a solid foundation for market performance. Against the backdrop of the gradual recovery of the medical sector market, the company's strategic choices, competitive advantages, reasonable valuation, and market potential make it highly noteworthy in the Capital Markets.

These factors may indicate that the company will be able to continually release its inherent value after going public, attracting more attention and participation from investors, and providing more support for the company's financing activities. Currently, the company has also attracted a group of high-quality Shareholders' support, further enhancing the market’s confidence in its business prospects.

The market's response is the best validation of a company's overall strength and future potential. As Iflytek Medical successfully lands on the Hong Kong stock market today, there is reason to believe that the market will gradually give its own judgment on the company.