2024 is destined to be an extraordinary year in the history of the US stock market.

2024 is destined to be an extraordinary year in the history of the US stock market.

According to Zhito Finance APP, although global politics and the economy face multiple challenges this year, the three major U.S. stock indexes have continuously refreshed their historical records. From the S&P 500 Index reaching a historical new high nearly 60 times this year, to the Nasdaq Index breaking the 0.02 million point mark for the first time, and the Dow Jones Industrial Average standing above 0.045 million points for the first time, the U.S. stock market has displayed extraordinary vitality and resilience.

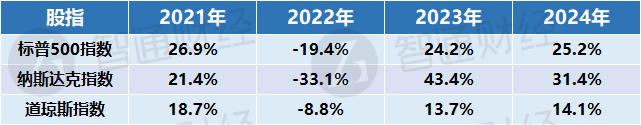

As of the time of writing, the S&P 500 Index has risen 25% this year, expected to achieve a return rate of over 20% for two consecutive years—this has only occurred four times in the last 100 years. The Nasdaq Composite Index, which is dominated by technology stocks, has surged even more rapidly, with a year-to-date increase of over 31%. In contrast, the Dow Jones Index has seen a more moderate rise, with a year-to-date increase of 14%.

As of the time of writing, the S&P 500 Index has risen 25% this year, expected to achieve a return rate of over 20% for two consecutive years—this has only occurred four times in the last 100 years. The Nasdaq Composite Index, which is dominated by technology stocks, has surged even more rapidly, with a year-to-date increase of over 31%. In contrast, the Dow Jones Index has seen a more moderate rise, with a year-to-date increase of 14%.

Among them, the S&P 500 Index and the Nasdaq continue to benefit from the AI (Artificial Intelligence) boom, while events such as the Federal Reserve's interest rate cuts and Trump's victory in the U.S. elections have also fueled the upward momentum. The Dow, seen as a barometer of the health of the U.S. economy, is bolstered by the prospects of economic recovery and strong corporate earnings.

Although the overall performance of the U.S. stock market is strong in 2024, there is a clear divergence in performance among different sectors and individual stocks. Next, let's revisit the market dynamics of U.S. stocks this year.

2024 US Stock Review: The Bull Market Unexpectedly Continues, Breaking Wall Street's Doubts.

At the end of 2023, many economists predicted a slowdown in the US economy in 2024. The uncertainty surrounding inflation and monetary policy made Wall Street cautious about the US stock market. However, the performance of the US stock market in 2024 has completely shattered these doubts.

In the first half of the year, the US stock market performed excellently, driven by AI stocks, especially chip giant NVIDIA (NVDA.US), whose market cap once surpassed Microsoft (MSFT.US) and Apple (AAPL.US), becoming the highest valued company globally.

In August, the market experienced a sell-off due to concerns about US economic growth and Federal Reserve policy. NVIDIA's revenue guidance failed to meet Wall Street's most optimistic expectations, and the monetization of AI faced skepticism. Documents showed "stock god" Warren Buffett reduced his Apple holdings by 50% in the second quarter, exacerbating market risk aversion. However, this decline in the US stock market lasted less than a month and did not breach the technical adjustment threshold of "10%".

Entering September, the Federal Reserve cut interest rates by 50 basis points, marking the first rate cut since 2020, causing the US stock market to rise. In November, Trump won the US election, igniting a new round of market frenzy. In December, although the Federal Reserve's hawkish stance on interest rates led to volatility in the US stock market, the overall upward trend remained solid.

Overall, the US stock market in 2024 experienced fluctuations and adjustments under multiple influences, but maintained a strong upward trend, repeatedly setting historical highs.

The US stock market's impressive performance is greatly aided by the "push" from technology stocks. In contrast, some sectors performed poorly. Next, let's review the performance of major sectors in the US stock market in 2024.

All 11 sectors achieved gains.

From the performance of the 11 sector ETFs in the S&P 500 Index, driven by the AI boom and interest rate cuts from the Federal Reserve, tech stocks like Meta (META.US) and Google (GOOGL.US) surged, helping the Communications Services Sector maintain last year's strong momentum. Additionally, led by Amazon (AMZN.US) and Tesla (TSLA.US), the Consumer Discretionary Sector also performed excellently. The optimism ignited by 'Trump 2.0' led to impressive performance in the Financial Sector, while Energy, Healthcare, and Materials Sectors lagged behind. However, all 11 sectors in the US stock market recorded gains in 2024.

Tech stocks remain the 'most attractive'.

Following 2023, tech giants continue to be the core driving force behind the US stock market's robust performance in 2024. In addition to Microsoft, other tech giants - Apple, Google, Amazon, Meta, NVIDIA, and Tesla - performed exceptionally well.

As the biggest winner of the AI boom, NVIDIA continues to lead the seven major tech giants this year. NVIDIA's stock price rose by 239% last year and soared another 177% this year. This year, NVIDIA has twice claimed the title of the world's most valuable listed company, although Apple has now returned to the top with a market cap close to 4 trillion USD, while NVIDIA stands at 3.4 trillion USD and Microsoft at 3.3 trillion USD.

In the past six quarters, NVIDIA's revenue has grown by at least 94% year-on-year, with three instances of growth exceeding 200%. Despite expectations for NVIDIA's revenue to maintain strong growth, analysts generally anticipate a slowdown in growth rates over the next few quarters, with growth rates expected to drop to around 45% by the second half of next year.

The electric vehicle leader Tesla has seen its stock price rise by 74% so far this year, second only to NVIDIA among the seven major tech giants. Tesla faced a severe sell-off this year due to slowing demand for electric vehicles, but following the win of Trump, strongly supported by Tesla CEO Elon Musk, in the U.S. presidential election, Tesla's stock price soared. The market is betting that Tesla will greatly benefit from Musk's relationship with Trump.

In contrast, Microsoft's stock has only risen by 15% this year, lagging far behind other tech giants and even underperforming benchmark indices such as the S&P 500 Index and Nasdaq. Microsoft's recent quarterly guidance fell short of market expectations, impacting investor confidence. Additionally, Microsoft's hefty investments in AI startups have weighed on profits.

Overall, global investors continue to flock to the seven major tech giants in 2023 and 2024, betting that the giant market size and financial strength of tech titans will position them to leverage AI technology to increase revenue.

Notably, several U.S. tech companies, including Google and Meta, have launched quarterly dividend plans for the first time this year. Although the dividend yield is not high, the news of dividends and buybacks continues to ignite rallies in the U.S. stock market. Meanwhile, tech giants are continually adjusting operations to improve profits, making their fundamentals "as solid as a rock."

AI stocks are experiencing a sharp contrast in performance.

AI remains one of the strongest narratives in the tech sector; however, related trades seem to have entered a new phase. Investment and trading in the AI field are shifting from initial frenzy to a more rational and cautious attitude, meaning that investors and companies are paying more attention to the actual effectiveness and profitability of AI technology rather than just chasing concepts. It is therefore not surprising that there is a marked divergence in the performance of AI stocks.

Besides NVIDIA, the "strongest shovel seller," several semiconductor manufacturers have also seen their stock prices rise significantly this year, with Broadcom (AVGO.US) up 120%, Taiwan Semiconductor (TSM.US) up 97%, and Marvell Technology (MRVL.US) up 89%. However, due to slowing demand and political factors, the lithography giant ASML Holding (ASML.US) has fallen by 5% this year, Advanced Micro Devices (AMD.US) has dropped 15%, and Intel (INTC.US) has seen a plunge of 59%.

As technology continues to mature and application scenarios expand, investors are gradually shifting their focus from the traditional semiconductor industry to software companies.

The "AI super stock" AppLovin (APP.US) has seen its stock price rise by 741% this year, far outpacing other technology companies. The valuation of this advertising marketing giant has skyrocketed from about 13 billion USD at the beginning of the year to over 110 billion USD, surpassing Starbucks (SBUX.US), Intel, and Airbnb (ABNB.US).

AppLovin provides global enterprises with AI-based "AI + advertising marketing solutions". The latest earnings report shows that AppLovin's revenue in the third quarter was approximately 1.198 billion USD, a year-on-year increase of 39%; net income reached 0.434 billion USD, a staggering increase of 300% year-on-year.

Big data analytics software giant Palantir (PLTR.US) has seen its stock price rise by 360% this year. The company reported third quarter results that exceeded expectations and raised its full-year guidance, giving investors a positive outlook on the company's AI development.

Additionally, AI application software stocks like DocuSign (DOCU.US) and ServiceNow (NOW.US) have attracted investors' attention, with stock prices rising by 56% and 53%, respectively. In contrast, Adobe (ADBE.US), facing AI "competition for jobs", has seen its stock price plummet by 25%.

Nuclear power has also become one of the hottest investment themes this year. The rise of AI and the increasing electricity consumption of datacenters mean that the future of nuclear energy seems closely tied to the unstoppable rise of large tech companies. This year, NANO Nuclear Energy (NNE.US) has soared by 570%, NuScale Power (SMR.US) has risen nearly 500%, Vistra Energy (VST.US) and Talen Energy (TLN.US) have increased by over 200%, and Graham (GHM.US) and Oklo Inc (OKLO.US) have risen by over 100%.

"Trump trade" rises: Cryptos and financial stocks soar together.

With Trump's victory in the November US presidential election, the financial markets welcomed a "Trump trade" frenzy. The market reacted positively to clear commitments to economic growth and tax cuts, with the three major US stock indices repeatedly hitting historical highs, and the performance of the cryptocurrency and financial stocks sectors stood out.

In the cryptocurrency field, Trump's election victory has triggered a frenzy. The market anticipates that the Trump administration will adopt friendlier regulatory policies towards the cryptocurrency industry, which has pushed the price of Bitcoin to break historical highs, briefly challenging the 0.11 million USD mark. Several cryptocurrency-related stocks have also surged, among which "Bitcoin whale" MicroStrategy (MSTR.US) has skyrocketed by 420% this year, Hut 8 (HUT.US) has increased by 67%, Coinbase (COIN.US) has risen by 53%, and Robinhood (HOOD.US) has surged by 206%.

After Trump won the US election, US bank stocks surged significantly as investors bet that Trump would deliver on his promises of tax cuts and relaxed banking regulations. The KBW Bank Index, which tracks the 24 largest banks in the US, has risen 34% this year, with JPMorgan (JPM.US) up as much as 45% and Wells Fargo (WFC.US) nearly 50%, both of which reported third-quarter results that exceeded expectations. In contrast, Bank of America (BAC.US) only increased by 35%, lagging behind its peers. Bank of America’s net income fell 12% year-on-year in the third quarter, compounded by Berkshire Hathaway Inc. (BRK.A.US), led by Buffett, continuously reducing its stake in Bank of America stocks, which dragged down the stock's performance.

It is worth noting that during this round of "Trump trade" frenzy, Tesla has stood out, surging 39% since election day, adding over 300 billion USD to its market cap, primarily due to Musk's close relationship with Trump. The market widely believes that the Trump administration may reduce tax incentives for electric vehicles, while Tesla, leveraging its scale advantages, is expected to gain greater market share in a non-subsidized environment. Additionally, Trump's tariff policies may further enhance Tesla's competitiveness in the US market, as Tesla has a relatively complete supply chain in the United States.

The cruise sector is quietly making a fortune.

Despite US technology stocks and cryptocurrencies stealing the spotlight, the relatively low-profile cruise stocks have proven to have significant investment value due to their robust growth and outstanding market performance.

Viking Holdings (VIK.US) has seen its stock price increase by 85% since going public in May, while Royal Caribbean (RCL.US) has risen an additional 81% on top of last year's 162% increase. Norwegian Cruise (NCLH.US) and Carnival Cruise (CCL.US) have also maintained their upward trend, increasing by 35% and 29% respectively this year.

This trend reflects strong consumer demand for cruise travel, especially post-pandemic, as people’s desire for leisure travel has driven a rapid recovery in the cruise industry.

Additionally, the strong recovery in travel demand has propelled US aviation stocks to achieve their best performance in nearly a decade. So far this year, the S&P Super Comprehensive Airlines Index has risen 60%, far exceeding the 25% increase of the S&P 500 Index, marking the first time since 2014 that the aviation sector index has significantly outperformed the market. Among them, United Airlines (UAL.US) performed most outstandingly, with its stock price soaring 142% this year, making it the fifth-largest gainer in the S&P 500 Index.

Sectors such as Energy and Pharmaceuticals have dimmed considerably.

Although the overall market for US stocks is thriving, the performance of the Energy, Medical Care, and Materials sectors has lagged significantly behind the Large Cap, with year-to-date gains all below 5%.

In 2024, international oil prices are expected to show a downward trend, with the market taking a cautious stance on future oil prices, dragging down the performance of the energy sector. Among them, boosted by Trump's election victory, Exxon Mobil (XOM.US), the top holding in the Energy Index ETF (XLE), has seen its stock price increase by 10% this year, but the second largest holding, Chevron (CVX.US), has only risen by 0.7%, and the third largest holding, ConocoPhillips (COP.US), has plummeted by 14%.

The Medical Care sector continues its dismal performance from the past two years, but Eli Lilly and Co (LLY.US) has achieved a rise in stock price due to the success of its bestselling weight loss drug. The stock rose by 61% last year and has increased by 35% so far this year. However, due to intensified competition in the industry and sales of weight loss drugs falling short of expectations, Eli Lilly's stock price has seen a significant pullback after reaching a historical peak of $970.9, currently down 20% from its all-time high. Eli Lilly's main competitor, Novo-Nordisk A/S (NVO.US), has seen its share price fall by 15% this year, with disappointing results from the trials of the next-generation weight loss drug Cagrisema leading to a market sell-off of the stock.

The materials sector ETF (XLB) has become the "bottom performer". Major holdings such as Freeport-McMoRan (FCX.US), Newmont (NEM.US), and Nucor (NUE.US) have all declined this year, dragging down the overall performance of the sector. Fluctuating global demand, a near-recession in Europe, and US tariff policies have put pressure on industrial metals and other CSI Commodity Equity Index.

The IPO market is gradually recovering.

The US stock IPO market is gradually recovering in 2024. According to StockAnalysis data, a total of 224 companies have successfully gone public this year, a 45% increase from 154 in 2023, but still far below the historical peak set in 2021. In 2021, there were 1,035 IPOs throughout the year, setting a new record and breaking the previous record of 480 in 2020.

According to data from Renaissance Capital, there were a total of 148 IPOs in the US stock market throughout the year, excluding small IPOs with fundraising amounts not exceeding $5 million or companies with market capitalizations not exceeding $50 million, as well as special transactions like SPACs, raising $29.6 billion, with an increase of more than 50%. Due to the Federal Reserve slowing down its rate cuts and market turmoil, companies have repeatedly postponed their IPO timelines.

A recent report from Renaissance Capital shows that larger issuers are increasingly dominating the IPO activity, with 58 IPOs raising $100 million or more, nearly twice that of last year. Five companies raised $1 billion or more, with the world's largest cold storage operator, Lineage (LINE.US), raising $4.4 billion, the largest IPO in the US this year, followed by Viking Holdings (VIK.US) and StandardAero (SARO.US), which raised $1.5 billion and $1.4 billion, respectively. New stocks raising over $100 million performed excellently, with an average ROI of 26%, while the overall return of new stocks in 2024 was -3%.

As of December 27, here are this year's best-performing new stocks:

Among them, the nuclear energy company NANO Nuclear Energy has surged 570% since its IPO, while the MEME stock craze has propelled Reddit (RDDT.US) up 410%.

2025 US Stock Outlook

In 2024, the US stock bull market unexpectedly continued, breaking Wall Street's skepticism. Despite the intensifying global political and economic uncertainties, the three major US stock indices have continuously set historical records. Technology stocks continue to lead the market, AI stocks perform with a stark contrast, while the 'Trump trade' is highly sought after by the market. Meanwhile, sectors like energy and pharmaceuticals have faded. After a period of stagnation, the US IPO market is gradually recovering, bringing new investment opportunities for investors.

Looking ahead, analysts from Wall Street's major firms predict that the S&P 500 Index will rise by about 10% next year, which is in line with historical averages.

After Trump's election as President of the USA, he proposed radical trade policies and regulatory reforms, triggering business uncertainty and inflation concerns. Nevertheless, analysts believe the negative impact will be limited, as Trump's policies may be more moderate, and lower taxes and deregulation will offset adverse factors. The US economy is expected to continue growing, with rising corporate profit margins, especially for non-tech giant companies. Analysts acknowledge that US stock valuations are high, but returns in 2025 will rely more on earnings growth rather than valuation expansion.

Overall, despite uncertainties, the fundamentals of the US stock market remain solid, and analysts are optimistic about the outlook.

Which sectors and stocks are worth focusing on?

In terms of sectors and stocks, technology stocks remain the market focus, particularly the seven tech giants: Google, Amazon, Apple, Microsoft, Meta Platforms, NVIDIA, and Tesla. These companies are expected to continue to play a leading role in the market, thanks to their leadership in the AI field and significant influence on global macro trends.

Well-known analyst Dan Ives from Wedbush optimistically predicts that Apple may reach a market value of $4 trillion first by 2025, followed by NVIDIA and Microsoft. Ives stated that globally, there are 0.3 billion iPhones that have not been upgraded for over four years, presenting Apple with an unprecedented opportunity for upgrade demand.

After the US election day, Ives raised his target price for Tesla from $400 to $515. He stated, 'We estimate that the opportunities in AI and autonomous driving are worth at least $1 trillion for Tesla, and we firmly believe that under Trump's administration, these key plans will accelerate.' Ives believes that in a 'bull market' scenario, Tesla's stock price could soar to $650 by 2025, which is 50% higher than the current level.

Generative AI will continue to be the dominant theme in the Technology Sector. Against this backdrop, chip stocks are attracting attention. Bank of America Analyst Vivek Arya recently stated that US chip stocks are likely to continue attracting funds in 2025, potentially starting a new round of vigorous upward momentum. Bank of America expects the sales of the AI chip industry to grow by 15% in 2025, reaching $725 billion. Based on this prediction, Bank of America believes that AI chip stocks will maintain strong momentum in the first half of next year, while in the second half, market focus will shift to Automotive and Industrial chip stocks, favoring NVIDIA, Broadcom, and Marvell Technology.

However, as it has been over two years since the launch of ChatGPT, the market will shift its focus from infrastructure to specific use cases and the efficiency improvements brought by AI. Goldman Sachs is optimistic about companies like CommVault Systems (CVLT.US), Cloudflare (NET.US), Datadog (DDOG.US), Gartner (IT.US), and MasterCard (MA.US), as these companies are generating revenue from AI and improving their income streams. UBS Group emphasizes that effective generative AI applications will emerge in areas such as Medical Care, Cybersecurity, and CNI Xiangmi Lake Fintech Index.

In addition, under the backdrop of the Trump administration potentially loosening regulations, the Financial Sector is expected to become the biggest beneficiary industry. At the same time, the Manufacturing and Energy sectors are also likely to gain bullish momentum due to policy changes. UBS Group specifically points out that the Energy Sector is worth investors' attention, as the demand for electricity from AI datacenters continues to grow.

截至发稿,标普500指数年内上涨25%,有望连续两年实现20%以上的回报率——在过去100年里,这种情况只出现过四次。以科技股为主的纳斯达克综合指数涨势更为迅猛,年内涨幅超过31%。相比之下,道琼斯指数涨势较为平缓,年内涨幅达14%。

截至发稿,标普500指数年内上涨25%,有望连续两年实现20%以上的回报率——在过去100年里,这种情况只出现过四次。以科技股为主的纳斯达克综合指数涨势更为迅猛,年内涨幅超过31%。相比之下,道琼斯指数涨势较为平缓,年内涨幅达14%。