① Iflytek Medical is derived from Iflytek Co.,ltd. Focusing on the field of AI, Liu Qingfeng's Iflytek Co.,ltd. has laid out multiple areas, including Education, Medical, and Siasun Robot&Automation. ② However, the AI Medical Business involves patient information. The 'Iflytek Xiao Yi' application developed by Iflytek Medical has been reported by the Ministry of Industry and Information Technology for collecting personal information beyond its scope.

According to the Star Daily on December 30 (reporter Chen Mei), Iflytek Medical (HK.02506) officially listed on the Hong Kong Stock Exchange today. On the market, Iflytek Medical opened high and fluctuated, closing at 87 HKD/share, up 5.07% from the issue price of 82.8 HKD/share.

The Star Daily reporter noted that Iflytek Medical is a subsidiary of Iflytek Co.,ltd. that has spun off its Medical business. Its cornerstone investors for this IPO are strong: Xingqun, Daan, Hengqin Investment Fund, Xunyi Co.,ltd., Costone China Growth, etc., collectively subscribing for 35.57 million USD.

Among them, Hefei State-owned Assets subscribed for 7.97 million USD through Xunyi, showing the support of state-owned assets for local enterprises.

Among them, Hefei State-owned Assets subscribed for 7.97 million USD through Xunyi, showing the support of state-owned assets for local enterprises.

Derived from Iflytek Co.,ltd., revenue growth is slowing.

As the main body for the expansion of Iflytek Co.,ltd. in the Smart Healthcare Sector, Iflytek Medical was established in 2016, relying on the technological accumulation of Iflytek Co.,ltd. in intelligent voice, image recognition, and natural language understanding, covering the entire medical process including disease warning, early screening, diagnosis, post-diagnosis, and chronic disease management.

With the growing demand for intelligentization in grassroots medical care, Iflytek Medical has also developed rapidly. From 2021 to the first half of 2024, Iflytek Medical achieved revenues of 0.372 billion yuan, 0.472 billion yuan, 0.556 billion yuan, and 2.29 million yuan respectively.

However, despite revenue growth, the Star Daily reporter noted that this company, which emerged from Iflytek Co.,ltd., shows signs of slowing revenue growth.

Data shows that Iflytek Co.,ltd. experienced revenue growth rates of 26.8% in 2022 and 17.7% in 2023. Meanwhile, the corresponding net losses during the reporting period were 0.089 billion yuan, 0.209 billion yuan, 0.154 billion yuan, and 1.34 billion yuan.

An investor told the Star Daily reporter that one of the biggest challenges faced by Medical AI during its development is the acquisition and utilization of data. "Medical data is scattered across various hospitals, laboratories, and Institutions, lacking unified data standards and sharing mechanisms, making it difficult to integrate and utilize. On the other hand, due to serious data silo problems, insufficient standardization, and prominent privacy and security issues, these all limit the effective use of data."

Another AI investor indicated that when investing in AI application companies, aside from the underlying model applications, data is one of the most valued elements. "Patient data is stored in hospital databases, but each hospital operates independently. For AI in healthcare to provide high-quality medical assistance, a vast amount of supporting data is essential, and currently, bridging the data from various hospitals remains challenging."

"Based on this, we recently abandoned an AI medical project," the investor mentioned.

At present, relevant laws have clear regulations on patient information protection. According to relevant laws and regulations, medical institutions and their medical staff should keep patients' privacy and personal information confidential. Without the patient's consent, disclosing their medical records or leaking personal information will incur liability for infringement.

Iflytek Co.,ltd.'s business involves the collection of patient information. The reporter noted that it had previously been reported by relevant departments for overreaching in data collection.

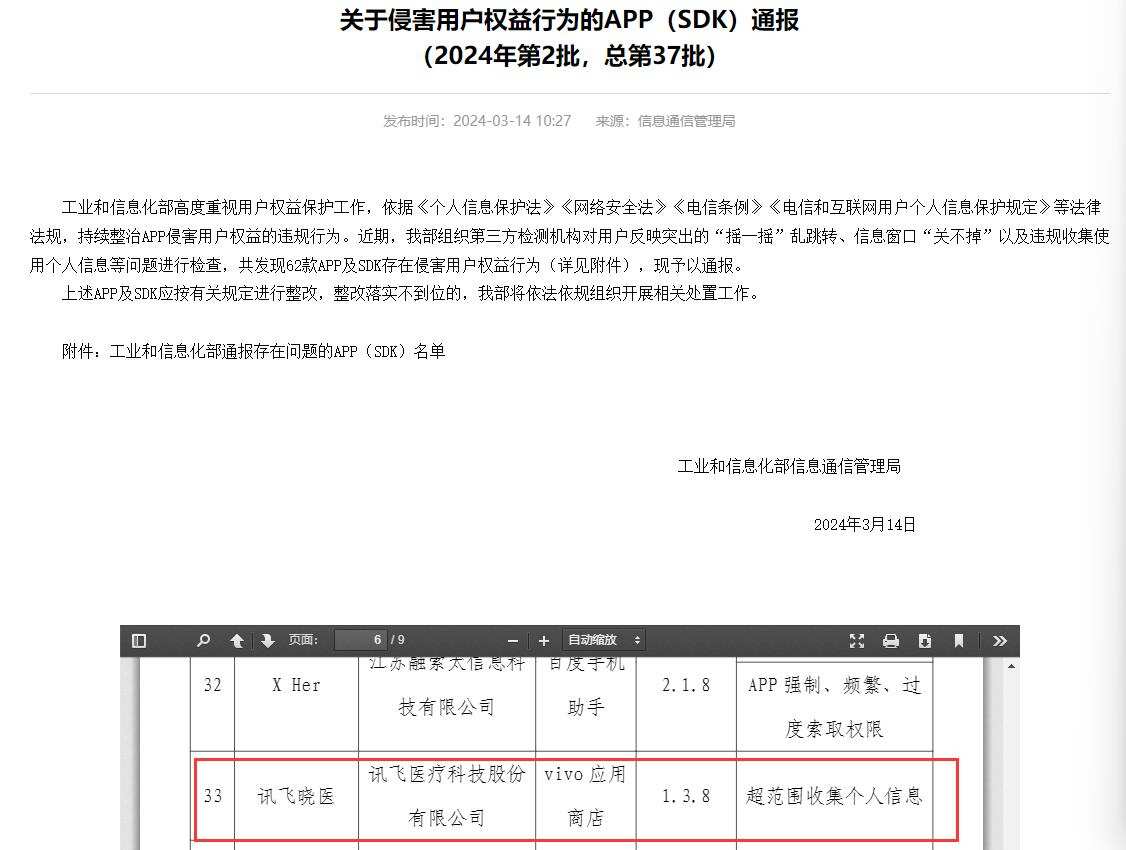

In March of this year, the Ministry of Industry and Information Technology released a report on APP (SDK) behaviors infringing on user rights (2024 the 2nd batch, the 37th batch in total), which included the Iflytek Co.,ltd. application "Iflytek Xiaoyi (version number: 1.3.8)" for the issue of "overreaching in collecting personal information."

With a Market Cap of 10.5 billion Hong Kong dollars, Hefei is celebrating an IPO.

With the listing of Iflytek Medical, Hefei officially gains an IPO.

The prospectus shows that Iflytek Medical was jointly funded by Iflytek Co.,ltd., Kexun Venture Capital, Zhao Zhiwei, Lu Xiaoliang, and other 8 Shareholders, originally founded as Anhui Pujin Information Technology Co., Ltd. During its development, the company has experienced multiple rounds of financing.

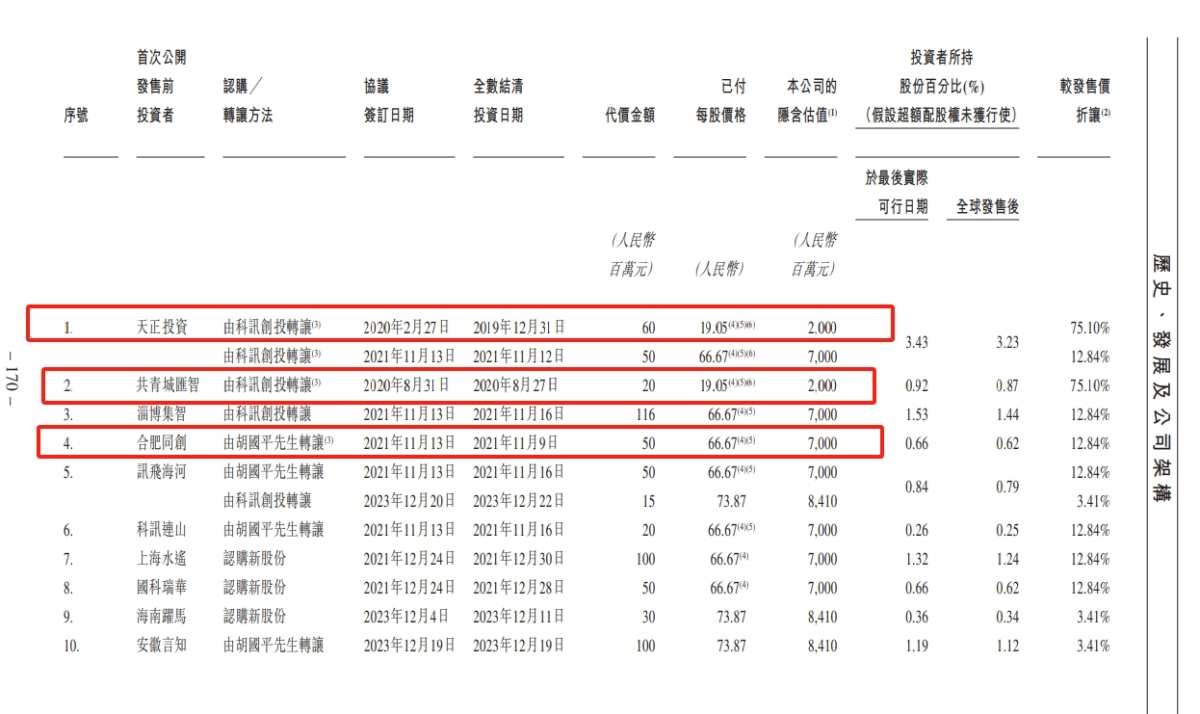

In November 2021, Kexun Venture Capital transferred 0.7143% and 1.6571% of Iflytek Medical's registered capital to Tianzheng Investment and Zibo Jizhi at prices of 0.05 billion yuan and 0.116 billion yuan respectively; during the same period, individual Shareholder Hu Guoping transferred his holding of Iflytek Medical's registered capital to Hefei Tongchuang, Iflytek Haihe, and Kexun Lianshan.

Among them, as the earliest external institutional investor, Tianzheng Investment had the lowest entry cost at 19.05 yuan; the second was Gongqingcheng Huizhi, with an entry cost of 19.05 yuan; the entry cost for local state-owned Hefei Tongchuang was 66.67 yuan.

On its first day of listing, Iflytek Medical closed at 87 HKD, with a Market Cap of 10.5 billion HKD, which means investors before the IPO have achieved a floating profit.

After the IPO, Iflytek Co.,ltd., as the actual controller of Iflytek Medical, holds 49.42% directly. The equity penetration shows that Liu Qingfeng is the Chairman of both Iflytek Co.,ltd. and Iflytek Medical, and is also the ultimate beneficiary.

The resume shows that Liu Qingfeng was born in February 1973 in Jing County, Anhui, and holds a Ph.D. in Signal and Information Processing from the University of Science and Technology of China. In addition to leading both listed companies Iflytek Co.,ltd. and Iflytek Medical, Liu Qingfeng is also involved in external investments through multiple platforms, including Anhui Yanzhi Technology Co., Ltd. and Anhui Iflytek Venture Capital Partnership (Limited Partnership).

Strategically, Liu Qingfeng also emphasized Iflytek's "1+N" development layout, which aims to enhance product competitiveness through a general AI large model foundation while exploring the application potential of multi-modal capabilities. It can be seen that around the AI Sector, Iflytek has already laid out in several fields, including Education, Medical, and Robot.

**Recently, new developments have emerged regarding Iflytek Co.,ltd.'s layout in the robot sector. According to business information, Anhui Lingdong General Robot Technology Co., Ltd. has been established recently, with a business scope that includes the manufacturing and sales of industrial robots and the research and development of smart robots. After equity penetration, the company's shareholders include Anhui Xunfei Cloud Innovation Technology Co., Ltd., Anhui Yanzhi Technology Co., Ltd., and Anhui Lingji Wangu Technology Partnership (Limited Partnership) under Iflytek.

It can be anticipated that if Iflytek's "1+N" Global Strategy layout proceeds smoothly, Liu Qingfeng's AI capital landscape will continue to expand.