Financial giants have made a conspicuous bullish move on Palantir Technologies. Our analysis of options history for Palantir Technologies (NASDAQ:PLTR) revealed 39 unusual trades.

Delving into the details, we found 41% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 12 were puts, with a value of $669,116, and 27 were calls, valued at $3,069,290.

Predicted Price Range

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $10.0 and $120.0 for Palantir Technologies, spanning the last three months.

Analyzing Volume & Open Interest

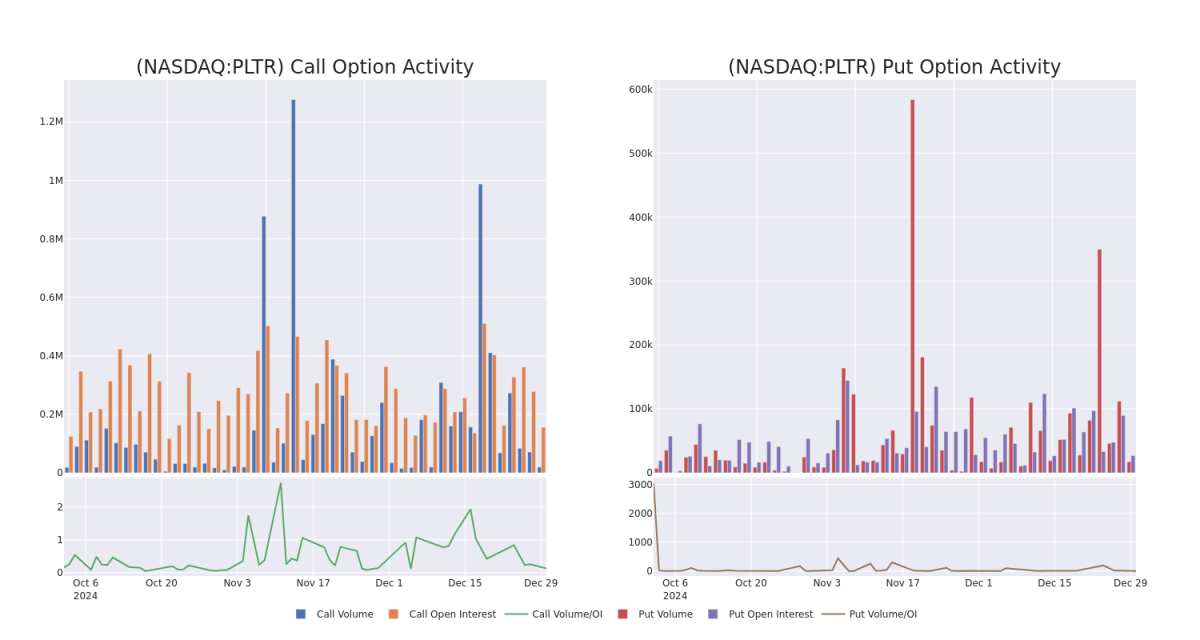

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $10.0 to $120.0, over the past month.

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Palantir Technologies's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Palantir Technologies's significant trades, within a strike price range of $10.0 to $120.0, over the past month.

Palantir Technologies Option Volume And Open Interest Over Last 30 Days

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PLTR | CALL | TRADE | BULLISH | 03/21/25 | $29.05 | $28.45 | $29.05 | $50.00 | $581.0K | 6.5K | 0 |

| PLTR | CALL | TRADE | BULLISH | 01/17/25 | $27.7 | $26.8 | $27.4 | $50.00 | $548.0K | 14.8K | 205 |

| PLTR | PUT | SWEEP | BULLISH | 09/19/25 | $12.0 | $11.9 | $11.9 | $70.00 | $239.1K | 1.0K | 209 |

| PLTR | CALL | TRADE | BULLISH | 12/18/26 | $21.2 | $20.9 | $21.2 | $105.00 | $235.3K | 187 | 111 |

| PLTR | CALL | SWEEP | BULLISH | 01/16/26 | $11.2 | $11.15 | $11.2 | $115.00 | $174.7K | 744 | 1.0K |

About Palantir Technologies

Palantir is an analytical software company that focuses on leveraging data to create efficiencies in its clients' organizations. The firm serves commercial and government clients via its Foundry and Gotham platforms, respectively. The Denver-based company was founded in 2003 and went public in 2020.

Having examined the options trading patterns of Palantir Technologies, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

Present Market Standing of Palantir Technologies

- With a trading volume of 22,722,364, the price of PLTR is down by -1.5%, reaching $77.89.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 35 days from now.

Expert Opinions on Palantir Technologies

A total of 3 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $64.66666666666667.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Baird has revised its rating downward to Neutral, adjusting the price target to $70. * Consistent in their evaluation, an analyst from Mizuho keeps a Underperform rating on Palantir Technologies with a target price of $44. * In a cautious move, an analyst from UBS downgraded its rating to Neutral, setting a price target of $80.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Palantir Technologies with Benzinga Pro for real-time alerts.