Deep-pocketed investors have adopted a bullish approach towards Novo Nordisk (NYSE:NVO), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in NVO usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 22 extraordinary options activities for Novo Nordisk. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 50% leaning bullish and 31% bearish. Among these notable options, 9 are puts, totaling $571,820, and 13 are calls, amounting to $1,045,859.

Projected Price Targets

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $170.0 for Novo Nordisk over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $45.0 to $170.0 for Novo Nordisk over the recent three months.

Insights into Volume & Open Interest

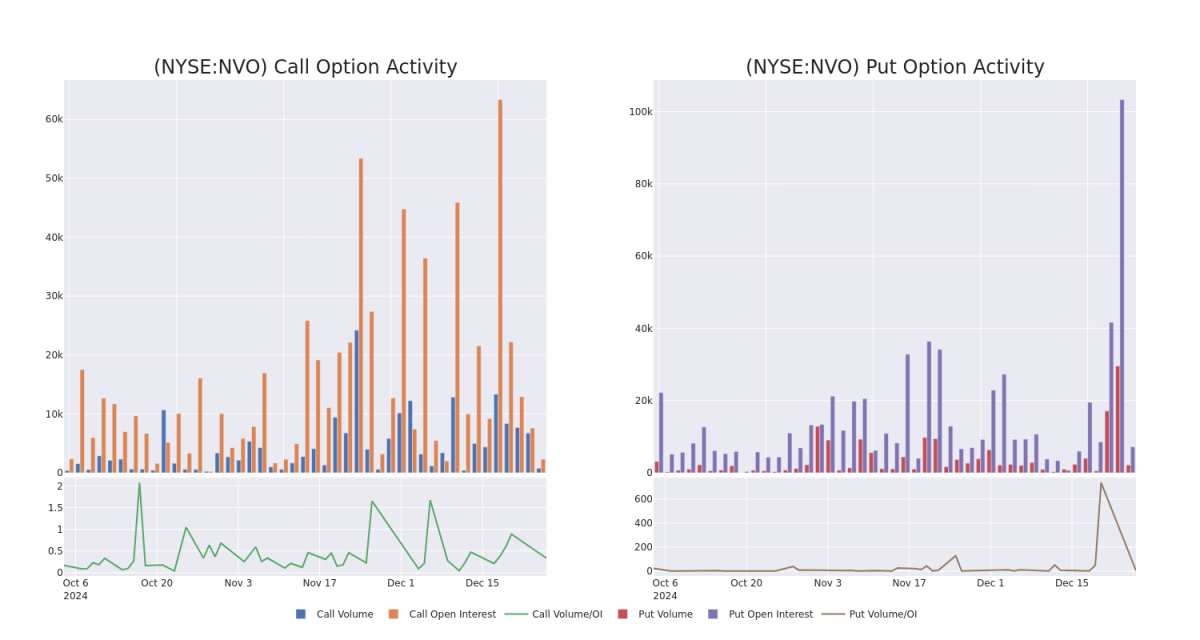

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Novo Nordisk's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Novo Nordisk's whale trades within a strike price range from $45.0 to $170.0 in the last 30 days.

Novo Nordisk Call and Put Volume: 30-Day Overview

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NVO | CALL | TRADE | BEARISH | 02/21/25 | $2.0 | $1.93 | $1.94 | $95.00 | $397.7K | 1.1K | 2.1K |

| NVO | CALL | SWEEP | BULLISH | 01/16/26 | $13.1 | $13.05 | $13.1 | $87.50 | $217.4K | 69 | 205 |

| NVO | PUT | SWEEP | BULLISH | 02/21/25 | $34.75 | $33.1 | $33.6 | $120.00 | $165.8K | 0 | 50 |

| NVO | CALL | SWEEP | BEARISH | 01/17/25 | $5.1 | $4.95 | $4.96 | $82.50 | $99.2K | 1.1K | 201 |

| NVO | PUT | TRADE | BULLISH | 01/16/26 | $85.2 | $83.65 | $83.68 | $170.00 | $83.6K | 10 | 10 |

About Novo Nordisk

With roughly one third of the global branded diabetes treatment market, Novo Nordisk is the leading provider of diabetes-care products in the world. Based in Denmark, the company manufactures and markets a variety of human and modern insulins, injectable diabetes treatments such as GLP-1 therapy, oral antidiabetic agents, and obesity treatments. Novo also has a biopharmaceutical segment (constituting roughly 10% of revenue) that specializes in protein therapies for hemophilia and other disorders.

After a thorough review of the options trading surrounding Novo Nordisk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Novo Nordisk's Current Market Status

- With a volume of 3,808,605, the price of NVO is down -1.21% at $86.31.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 37 days.

What The Experts Say On Novo Nordisk

1 market experts have recently issued ratings for this stock, with a consensus target price of $105.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from BMO Capital has decided to maintain their Outperform rating on Novo Nordisk, which currently sits at a price target of $105.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.