Unfortunately for some shareholders, the 2seventy bio, Inc. (NASDAQ:TSVT) share price has dived 28% in the last thirty days, prolonging recent pain. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 32% in that time.

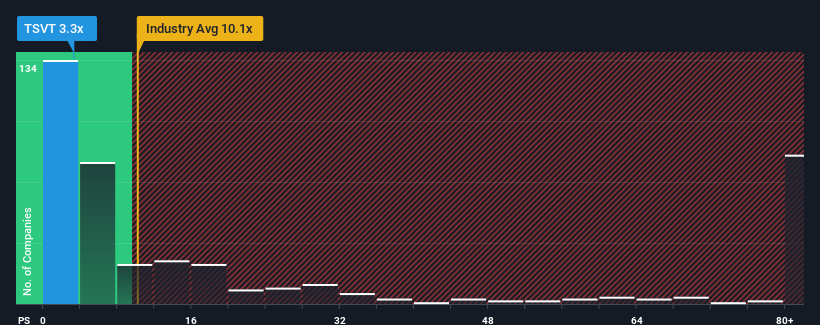

Following the heavy fall in price, 2seventy bio may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 3.3x, considering almost half of all companies in the Biotechs industry in the United States have P/S ratios greater than 10.1x and even P/S higher than 64x aren't out of the ordinary. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

How Has 2seventy bio Performed Recently?

While the industry has experienced revenue growth lately, 2seventy bio's revenue has gone into reverse gear, which is not great. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. So while you could say the stock is cheap, investors will be looking for improvement before they see it as good value.

Want the full picture on analyst estimates for the company? Then our free report on 2seventy bio will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For 2seventy bio?

2seventy bio's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

2seventy bio's P/S ratio would be typical for a company that's expected to deliver very poor growth or even falling revenue, and importantly, perform much worse than the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 69%. The last three years don't look nice either as the company has shrunk revenue by 5.7% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Looking ahead now, revenue is anticipated to climb by 21% per year during the coming three years according to the five analysts following the company. With the industry predicted to deliver 115% growth per annum, the company is positioned for a weaker revenue result.

With this information, we can see why 2seventy bio is trading at a P/S lower than the industry. It seems most investors are expecting to see limited future growth and are only willing to pay a reduced amount for the stock.

The Key Takeaway

Having almost fallen off a cliff, 2seventy bio's share price has pulled its P/S way down as well. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that 2seventy bio maintains its low P/S on the weakness of its forecast growth being lower than the wider industry, as expected. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. It's hard to see the share price rising strongly in the near future under these circumstances.

Many other vital risk factors can be found on the company's balance sheet. Take a look at our free balance sheet analysis for 2seventy bio with six simple checks on some of these key factors.

If these risks are making you reconsider your opinion on 2seventy bio, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.