High-rolling investors have positioned themselves bullish on Rigetti Computing (NASDAQ:RGTI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in RGTI often signals that someone has privileged information.

Today, Benzinga's options scanner spotted 11 options trades for Rigetti Computing. This is not a typical pattern.

The sentiment among these major traders is split, with 36% bullish and 36% bearish. Among all the options we identified, there was one put, amounting to $26,000, and 10 calls, totaling $497,424.

Predicted Price Range

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $4.5 to $20.0 for Rigetti Computing during the past quarter.

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $4.5 to $20.0 for Rigetti Computing during the past quarter.

Analyzing Volume & Open Interest

In terms of liquidity and interest, the mean open interest for Rigetti Computing options trades today is 2299.09 with a total volume of 4,518.00.

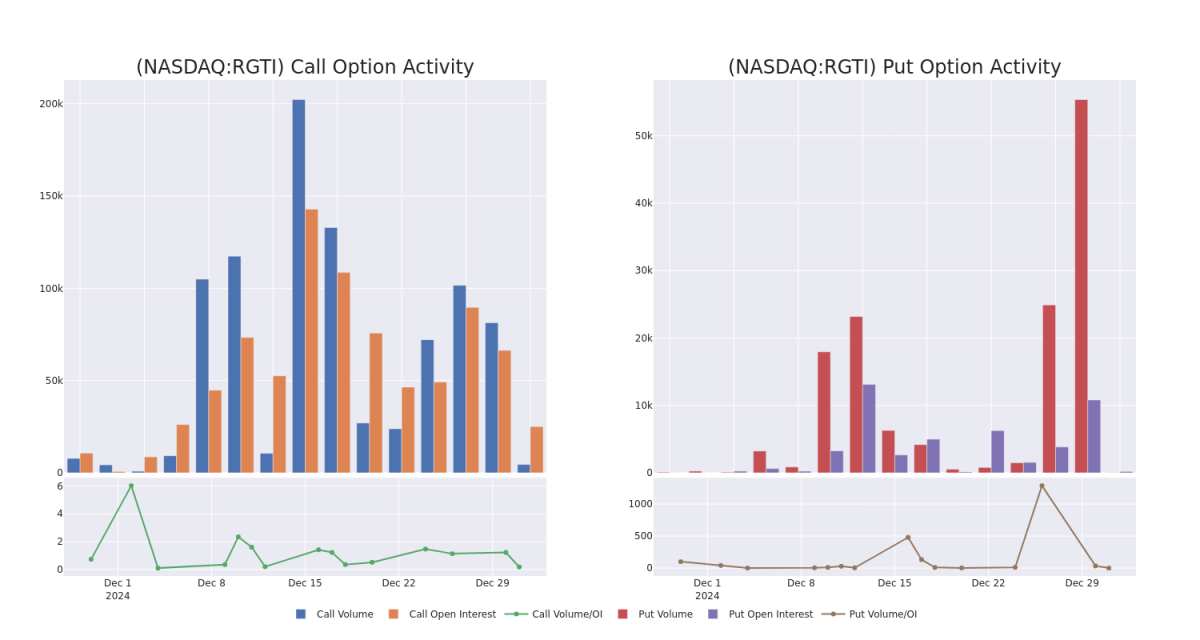

In the following chart, we are able to follow the development of volume and open interest of call and put options for Rigetti Computing's big money trades within a strike price range of $4.5 to $20.0 over the last 30 days.

Rigetti Computing Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| RGTI | CALL | TRADE | NEUTRAL | 01/03/25 | $1.4 | $1.1 | $1.23 | $17.50 | $98.4K | 1.7K | 902 |

| RGTI | CALL | SWEEP | BULLISH | 01/03/25 | $0.8 | $0.75 | $0.8 | $19.00 | $80.1K | 2.9K | 1.0K |

| RGTI | CALL | SWEEP | BEARISH | 01/17/25 | $1.7 | $1.65 | $1.67 | $20.00 | $66.2K | 9.6K | 1.0K |

| RGTI | CALL | TRADE | NEUTRAL | 01/16/26 | $13.1 | $12.5 | $12.8 | $4.50 | $51.2K | 359 | 0 |

| RGTI | CALL | SWEEP | BEARISH | 01/03/25 | $1.3 | $1.2 | $1.2 | $16.50 | $47.1K | 2.5K | 509 |

About Rigetti Computing

Rigetti Computing Inc is engaged in the business of full-stack quantum computing. Its proprietary quantum-classical infrastructure provides ultra-low latency integration with public and private clouds for high-performance practical quantum computing. The company has developed the industry's first multi-chip quantum processor for scalable quantum computing systems. Geographically, it derives a majority of its revenue from the United States.

After a thorough review of the options trading surrounding Rigetti Computing, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Rigetti Computing's Current Market Status

- Trading volume stands at 10,798,753, with RGTI's price up by 3.74%, positioned at $17.64.

- RSI indicators show the stock to be may be overbought.

- Earnings announcement expected in 72 days.

What Analysts Are Saying About Rigetti Computing

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $12.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from Craig-Hallum lowers its rating to Buy with a new price target of $12.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Rigetti Computing with Benzinga Pro for real-time alerts.