Whales with a lot of money to spend have taken a noticeably bearish stance on Autodesk.

Looking at options history for Autodesk (NASDAQ:ADSK) we detected 12 trades.

If we consider the specifics of each trade, it is accurate to state that 8% of the investors opened trades with bullish expectations and 83% with bearish.

From the overall spotted trades, 2 are puts, for a total amount of $74,200 and 10, calls, for a total amount of $412,130.

From the overall spotted trades, 2 are puts, for a total amount of $74,200 and 10, calls, for a total amount of $412,130.

Expected Price Movements

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $250.0 to $340.0 for Autodesk over the last 3 months.

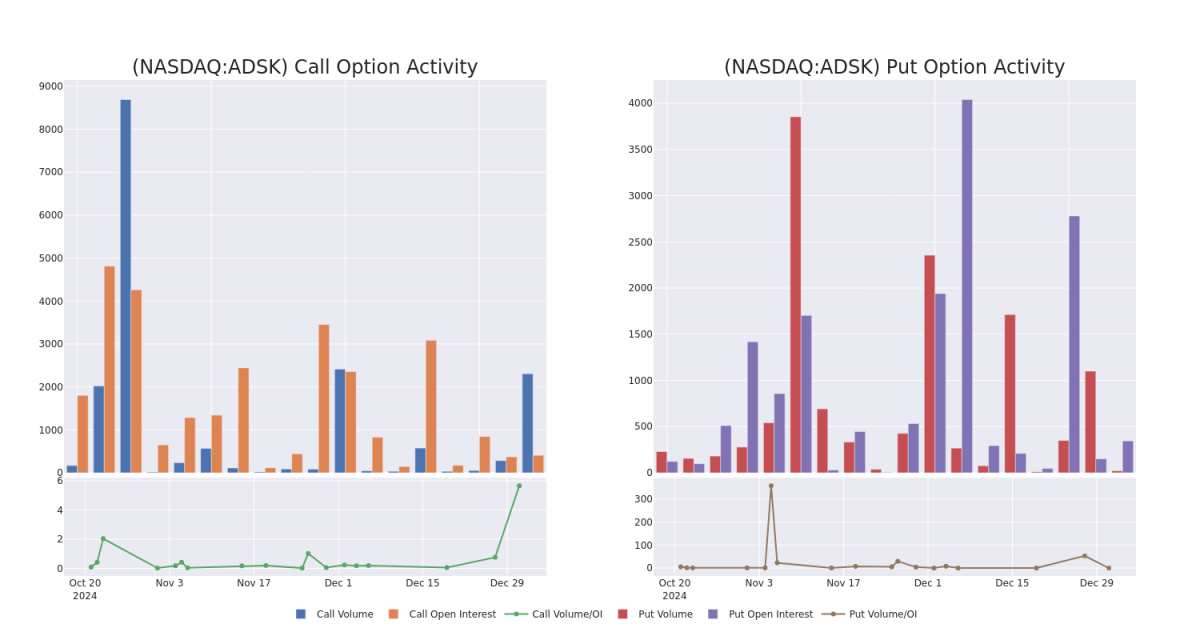

Insights into Volume & Open Interest

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Autodesk's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Autodesk's whale trades within a strike price range from $250.0 to $340.0 in the last 30 days.

Autodesk Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADSK | CALL | SWEEP | BEARISH | 06/20/25 | $12.1 | $11.6 | $11.6 | $340.00 | $76.5K | 408 | 228 |

| ADSK | PUT | TRADE | BULLISH | 06/20/25 | $24.0 | $23.0 | $23.0 | $300.00 | $46.0K | 169 | 20 |

| ADSK | CALL | TRADE | BEARISH | 06/20/25 | $12.1 | $11.8 | $11.9 | $340.00 | $45.2K | 408 | 38 |

| ADSK | CALL | TRADE | BEARISH | 06/20/25 | $11.8 | $11.2 | $11.3 | $340.00 | $42.9K | 408 | 525 |

| ADSK | CALL | SWEEP | BEARISH | 06/20/25 | $11.4 | $11.3 | $11.3 | $340.00 | $41.8K | 408 | 320 |

About Autodesk

Founded in 1982, Autodesk is an application software company that serves industries in architecture, engineering, and construction; product design and manufacturing; and media and entertainment. Autodesk software enables design, modeling, and rendering needs of these industries. The company has over 4 million paid subscribers across 180 countries.

After a thorough review of the options trading surrounding Autodesk, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of Autodesk

- With a trading volume of 224,476, the price of ADSK is up by 0.26%, reaching $298.29.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 58 days from now.

What The Experts Say On Autodesk

Over the past month, 3 industry analysts have shared their insights on this stock, proposing an average target price of $363.3333333333333.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* Reflecting concerns, an analyst from UBS lowers its rating to Buy with a new price target of $350.* In a cautious move, an analyst from Macquarie downgraded its rating to Outperform, setting a price target of $380. * Consistent in their evaluation, an analyst from Stifel keeps a Buy rating on Autodesk with a target price of $360.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Autodesk options trades with real-time alerts from Benzinga Pro.