Investors with a lot of money to spend have taken a bullish stance on KULR Tech Gr (AMEX:KULR).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KULR, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with KULR, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 14 uncommon options trades for KULR Tech Gr.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 35%, bearish.

Out of all of the special options we uncovered, 6 are puts, for a total amount of $379,860, and 8 are calls, for a total amount of $318,170.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $1.0 and $9.0 for KULR Tech Gr, spanning the last three months.

Volume & Open Interest Trends

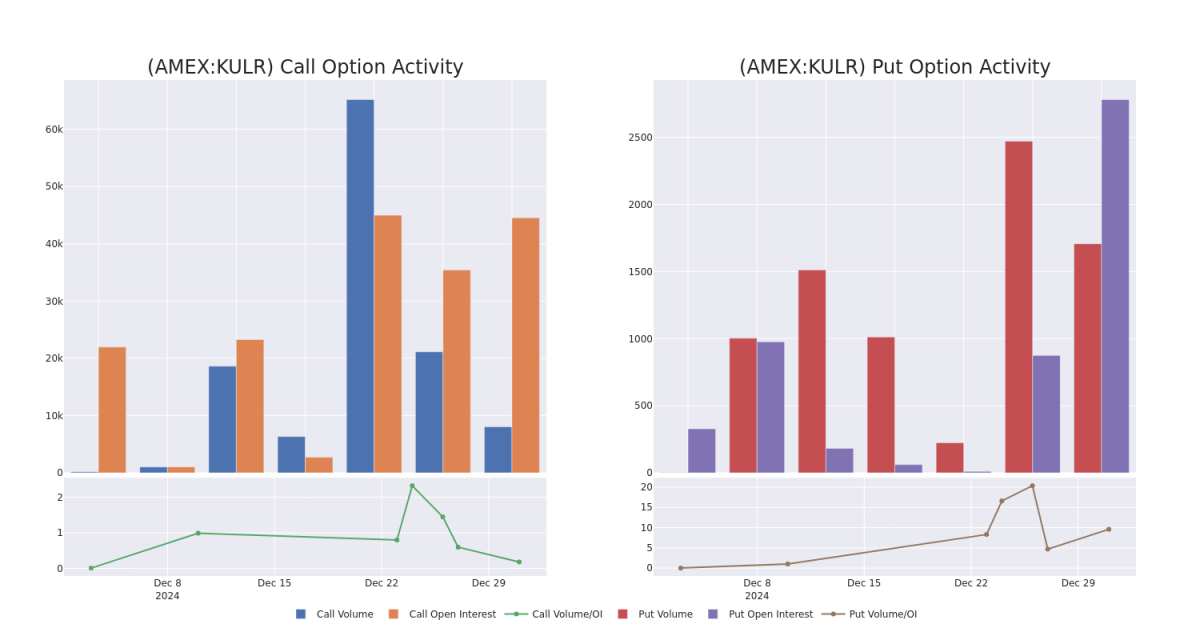

In today's trading context, the average open interest for options of KULR Tech Gr stands at 4301.27, with a total volume reaching 9,746.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in KULR Tech Gr, situated within the strike price corridor from $1.0 to $9.0, throughout the last 30 days.

KULR Tech Gr Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| KULR | PUT | SWEEP | BULLISH | 01/15/27 | $6.1 | $5.8 | $5.8 | $7.50 | $136.7K | 110 | 486 |

| KULR | PUT | SWEEP | BULLISH | 07/18/25 | $5.3 | $5.2 | $5.2 | $7.50 | $65.0K | 381 | 130 |

| KULR | CALL | SWEEP | BEARISH | 01/17/25 | $0.25 | $0.2 | $0.2 | $5.00 | $64.3K | 13.2K | 5.5K |

| KULR | PUT | SWEEP | BULLISH | 01/15/27 | $6.1 | $5.9 | $5.9 | $7.50 | $49.5K | 110 | 168 |

| KULR | PUT | SWEEP | BULLISH | 01/15/27 | $6.1 | $5.9 | $5.9 | $7.50 | $49.5K | 110 | 84 |

About KULR Tech Gr

KULR Technology Group Inc develops and commercializes high-performance thermal management technologies for electronics, batteries, and other components. The company is focused on targeting the following applications: electric vehicles and autonomous driving systems; artificial intelligence and Cloud computing; energy storage; and 5G communication technologies.

In light of the recent options history for KULR Tech Gr, it's now appropriate to focus on the company itself. We aim to explore its current performance.

KULR Tech Gr's Current Market Status

- Trading volume stands at 38,523,383, with KULR's price down by -21.01%, positioned at $3.27.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 101 days.

Expert Opinions on KULR Tech Gr

A total of 1 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $5.0.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* In a positive move, an analyst from Benchmark has upgraded their rating to Buy and adjusted the price target to $5.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.