As of December 30, 2024, the S&P 500 Index has risen for two consecutive years, with an increase of 23.3% in 2024 and 24.2% in 2023.

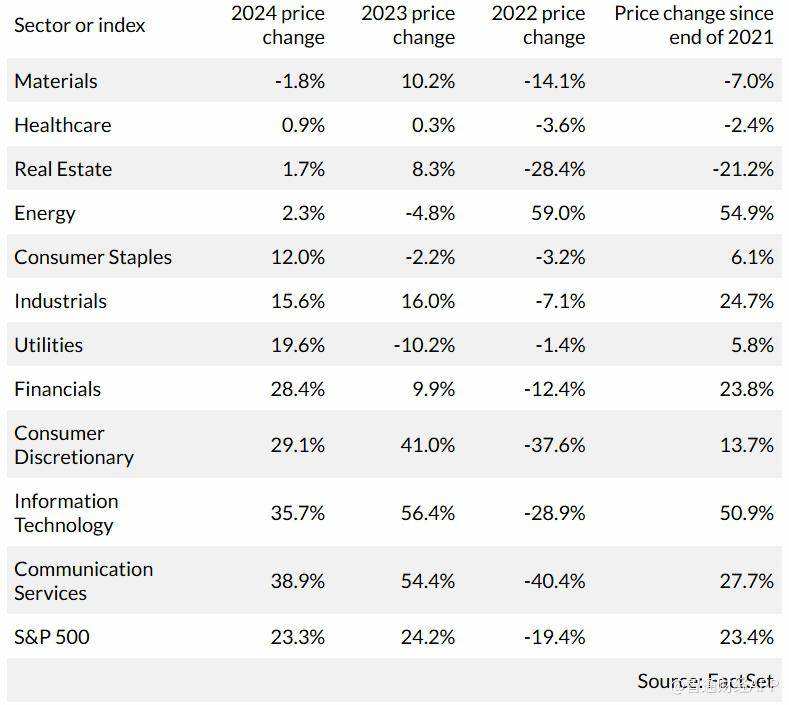

According to Zhito Finance APP, as of December 30, 2024, the S&P 500 Index has risen for two consecutive years, increasing by 23.3% in 2024 and 24.2% in 2023. However, the cumulative increase since the end of 2021 is only 23.4% due to a drop of 19.4% in 2022.

Despite the strong overall market performance, not all sectors and stocks have risen. In 2024, the Materials sector was the only sector to experience a decline, while the Medical Care and Real Estate sectors have also shown a downward trend since the end of 2021. Among the constituents of the S&P 500 Index, about 34% of stocks experienced a decline in 2024, with 96 stocks falling more than 10% and 57 stocks falling more than 20%.

Among these declining stocks, Walgreens Boots Alliance (WBA.US) and Intel (INTC.US) led the losses. Walgreens' stock price fell by approximately 64% in 2024, primarily due to the company's performance not meeting expectations, as well as facing intense market competition and industry challenges. Intel's stock price also fell by about 60%, related to the fierce competition and market share decline faced in the Semiconductors Industry.

Among these declining stocks, Walgreens Boots Alliance (WBA.US) and Intel (INTC.US) led the losses. Walgreens' stock price fell by approximately 64% in 2024, primarily due to the company's performance not meeting expectations, as well as facing intense market competition and industry challenges. Intel's stock price also fell by about 60%, related to the fierce competition and market share decline faced in the Semiconductors Industry.

It is important to note that the S&P 500 Index is market-cap weighted, which means that the performance of large companies has a greater impact on the overall movement of the index. Therefore, even if a considerable number of stocks decline, the rise of a few large companies can still push the overall index upward.

On Tuesday, the last trading day of 2024, the S&P 500 Index closed down 0.43%.

在这些下跌的股票中,Walgreens Boots Alliance(WBA.US)和英特尔(INTC.US)领跌。Walgreens的股价在2024年下跌了约64%,主要原因是公司业绩未达预期,以及面临激烈的市场竞争和行业挑战。英特尔的股价也下跌了约60%,这与其在半导体行业中面临的激烈竞争和市场份额的下降有关。

在这些下跌的股票中,Walgreens Boots Alliance(WBA.US)和英特尔(INTC.US)领跌。Walgreens的股价在2024年下跌了约64%,主要原因是公司业绩未达预期,以及面临激烈的市场竞争和行业挑战。英特尔的股价也下跌了约60%,这与其在半导体行业中面临的激烈竞争和市场份额的下降有关。