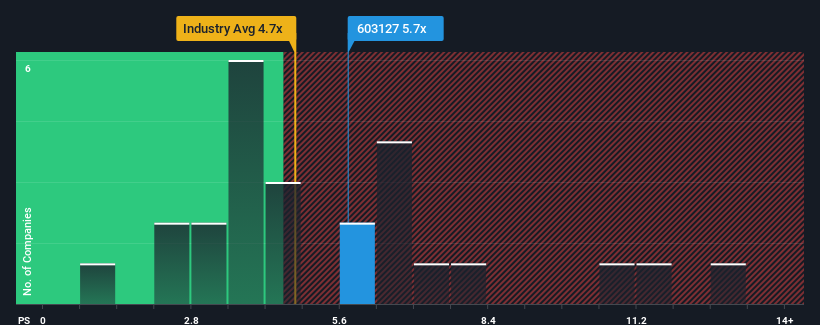

When close to half the companies in the Life Sciences industry in China have price-to-sales ratios (or "P/S") below 4.7x, you may consider Joinn Laboratories(China)Co.,Ltd. (SHSE:603127) as a stock to potentially avoid with its 5.7x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Has Joinn Laboratories(China)Co.Ltd Performed Recently?

Recent times haven't been great for Joinn Laboratories(China)Co.Ltd as its revenue has been falling quicker than most other companies. Perhaps the market is predicting a change in fortunes for the company and is expecting them to blow past the rest of the industry, elevating the P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Keen to find out how analysts think Joinn Laboratories(China)Co.Ltd's future stacks up against the industry? In that case, our free report is a great place to start.How Is Joinn Laboratories(China)Co.Ltd's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as high as Joinn Laboratories(China)Co.Ltd's is when the company's growth is on track to outshine the industry.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Retrospectively, the last year delivered a frustrating 18% decrease to the company's top line. However, a few very strong years before that means that it was still able to grow revenue by an impressive 63% in total over the last three years. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 8.2% during the coming year according to the eight analysts following the company. Meanwhile, the rest of the industry is forecast to expand by 16%, which is noticeably more attractive.

With this information, we find it concerning that Joinn Laboratories(China)Co.Ltd is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Joinn Laboratories(China)Co.Ltd's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Joinn Laboratories(China)Co.Ltd currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. At these price levels, investors should remain cautious, particularly if things don't improve.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Joinn Laboratories(China)Co.Ltd that you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.