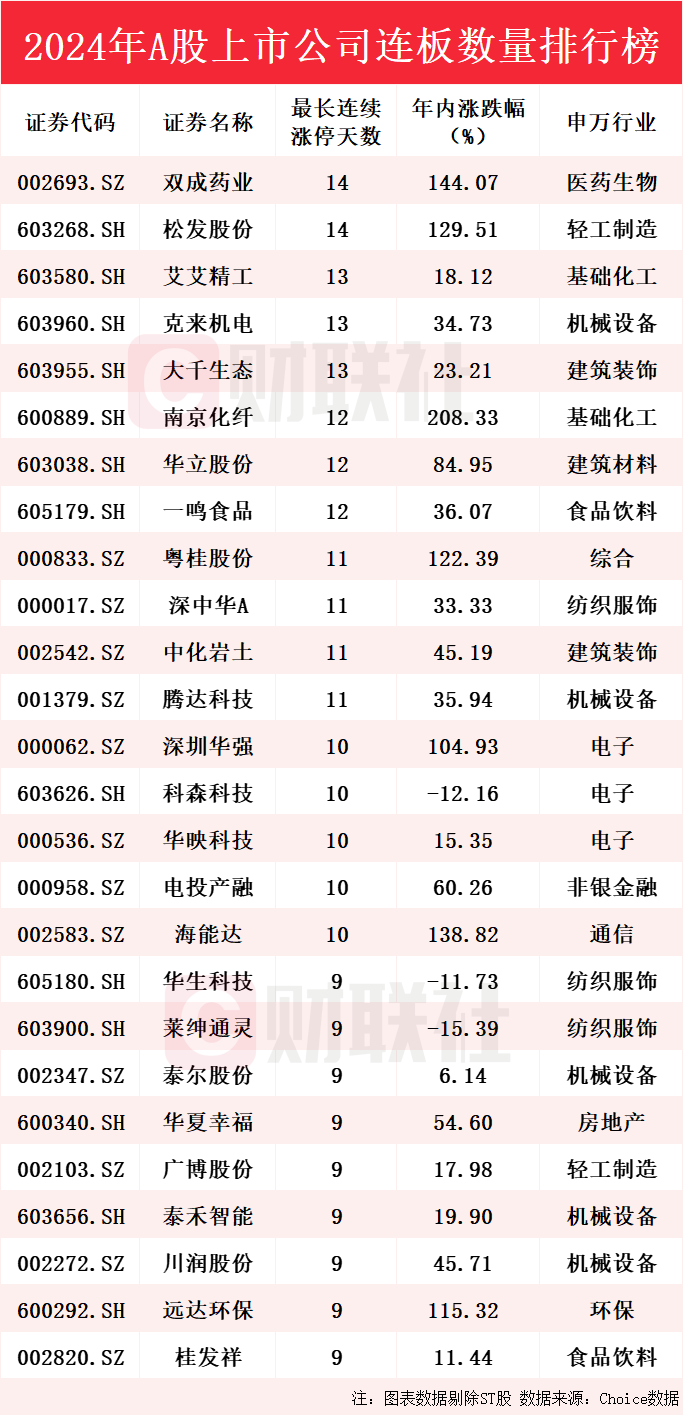

①The 2024 A-share market officially concludes, with a number of strong stocks and the merger and reorganization concept stocks Hainan Shuangcheng Pharmaceuticals and Guangdong Songfa Ceramics achieving a maximum of 14 consecutive trading limit days; ②Attached is the ranking list of A-share listed companies' consecutive trading days in 2024 (attached table).

According to Caixin News on January 1 (editor: Li Chen), the 2024 A-share market has officially concluded, with popular concepts being showcased one after another and several strong stocks emerging. Data from Choice shows that throughout 2024, Hainan Shuangcheng Pharmaceuticals, which plans to acquire Aura Co., Ltd. and transition to the semiconductor industry, and Guangdong Songfa Ceramics, which intends to acquire 100% equity of Hengli Heavy Industry at a valuation of 8.006 billion yuan, both achieved 14 consecutive trading limit days, the most in the market, while new industrialization concept stocks AA Industrial Belting, flexible automation equipment and industrial robot system supplier Shanghai Kelai Mechatronics Engineering, and the company Daqian Ecology & Environment Group, whose major shareholder changed to Suzhou Bubugao, each achieved 13 consecutive trading limit days, ranking closely behind; Nanjing Chemical Fibre, which intends to purchase 100% of Nanjing Industrial Equipment Manufacturing Co., Ltd., and Dongguan HuaLi Industries, which is acquiring 51% of Shangyuan Intelligent, as well as Zhejiang Yiming Food, primarily dealing in dairy and baked goods, all recorded 12 consecutive trading limit days. Additionally, Guangxi Yuegui Guangye Holdings, Shenzhen China Bicycle, China Zhonghua Geotechnical Engineering Group, and Tengda Technology achieved consecutive trading limit days of 11 in 2024. For details, see the figure below:

It is worth mentioning that the 2024 stocks with the highest consecutive trading days Hainan Shuangcheng Pharmaceuticals and Guangdong Songfa Ceramics are both merger and reorganization concept stocks. Hainan Shuangcheng Pharmaceuticals, which primarily deals in pharmaceutical injections, announced on December 6, 2024, the progress and risk warning for its major asset restructuring, stating that it plans to purchase 100% of Aura's shares held by 25 trading counterparts, including Hong Kong Aura Investment Co. Limited and WinAiming Limited, through issuing shares and cash payment, with plans to raise matching funds through issuing shares to no more than 35 specific investors. According to data, Aura Co., Ltd. primarily focuses on the field of analog chips and mixed-signal chips. The company successfully broke the foreign technology monopoly through the successful wafer production and mass production of its first de-jitter clock chip, and established cooperative relationships with several renowned international integrated circuit design companies, including SiTime, Renesas Electronics, and NXP Semiconductors. Analysts indicate that if Hainan Shuangcheng Pharmaceuticals successfully acquires Aura Semiconductors, it will not only facilitate the company's strategic transformation but also broaden its profit margins, as the infusion of high-quality semiconductor assets will lay a solid foundation for sustainable business development.

Guangdong Songfa Ceramics, whose main products include household ceramics and custom ceramics, disclosed its major asset restructuring plan on December 1, 2024. The company intends to engage in a significant asset swap and issue shares to purchase equity in Hengli Heavy Industry while raising matching funds: the company plans to swap all its assets and operational liabilities with an equivalent portion of the 50% equity held by Zhongkun Investment in Hengli Heavy Industry, with the transaction price of the assets being 0.513 billion yuan, and the transaction price for the 100% equity of Hengli Heavy Industry being 8.006 billion yuan, with the difference of 7.493 billion yuan to be acquired by the company through issuing shares; simultaneously, the company plans to issue shares to no more than 35 specific investors to raise matching funds not exceeding 5 billion yuan. After the completion of this restructuring transaction, Hengli Heavy Industry will become a wholly-owned subsidiary of the company, and the company's main business will transition from ceramics to ships and high-end equipment.

Guangdong Songfa Ceramics, whose main products include household ceramics and custom ceramics, disclosed its major asset restructuring plan on December 1, 2024. The company intends to engage in a significant asset swap and issue shares to purchase equity in Hengli Heavy Industry while raising matching funds: the company plans to swap all its assets and operational liabilities with an equivalent portion of the 50% equity held by Zhongkun Investment in Hengli Heavy Industry, with the transaction price of the assets being 0.513 billion yuan, and the transaction price for the 100% equity of Hengli Heavy Industry being 8.006 billion yuan, with the difference of 7.493 billion yuan to be acquired by the company through issuing shares; simultaneously, the company plans to issue shares to no more than 35 specific investors to raise matching funds not exceeding 5 billion yuan. After the completion of this restructuring transaction, Hengli Heavy Industry will become a wholly-owned subsidiary of the company, and the company's main business will transition from ceramics to ships and high-end equipment.

Daqian Ecology & Environment Group, whose main business is ecological landscape planning and design, announced on December 25, 2024, the election of Zhang Yuan as the chairman of the company's fifth Board of Directors, and Duan Liping as the vice chairman of the fifth Board of Directors. At the same time, Zhang Yuan was elected as a member of the Board's Strategy Committee. Earlier, on November 22, 2024, Daqian Ecology announced that it had received the 'Securities Transfer Registration Confirmation Letter' from its controlling shareholder Daqian Investment, informing that the transfer registration procedures for Daqian Investment's agreement to transfer 24.5489 million shares of Daqian Ecology (accounting for 18.09% of the total shares issued) to Suzhou Bubugao Investment Development Co., Ltd. had been completed. After the completion of this share transfer, the controlling shareholder of the company changed to Suzhou Bubugao, and the actual controller changed to Zhang Yuan. Additionally, details of AA Industrial Belting and Shanghai Kelai Mechatronics Engineering's consecutive trading days can be found in Caixin's previous in-depth report 'Review of the A-share's First Quarter Consecutive Trading Kings: AA Industrial Belting and Shanghai Kelai Mechatronics Engineering Both Achieve 13 Consecutive Trading Days to Share the Top Spot, While Shenzhen China Bicycle Secures 11 Consecutive Trading Days in Third Place.'

Nanjing Chemical Fibre, which primarily produces viscose staple fiber, PET structural core materials, and urban ecological replenishment, issued an announcement about unusual stock price fluctuations on December 30, 2024, stating that the company is planning a major asset restructuring. The company intends to purchase 100% of Nanjing Industrial Equipment Manufacturing Co., Ltd. through asset swaps, issuing shares, and cash payments, and plans to issue shares to no more than 35 specific investors to raise matching funds. Zhejiang Yiming Food's chairman, Zhu Like, mentioned in an earnings call that in 2024, the company will closely follow consumer trends, understand consumer needs, and insist on building a core brand connotation centered on fresh and healthy, launching more trustworthy, delicious, and fashionable product and service labels like 'nutritious breakfast right at home, becoming a healthy relay meal for young white-collar workers, and the Starbucks for kids.' Dongguan HuaLi Industries, whose main products are edge banding strips and decorative panels, announced on November 6, 2024, that it acquired 51% of Shangyuan Intelligent for a total price of 0.358 billion yuan in cash. Recently, Shangyuan Intelligent has completed the relevant industrial and commercial change registration procedures, and the company holds 51% of Shangyuan Intelligent's shares. After this transaction is completed, Shangyuan Intelligent will become a controlling subsidiary of Dongguan HuaLi Industries and included in the company’s consolidated financial statements.

主要产品包括家瓷、定制瓷等的松发股份2024年12月1日披露重大资产重组方案,公司拟进行重大资产置换及发行股份购买恒力重工股权并募集配套资金:

主要产品包括家瓷、定制瓷等的松发股份2024年12月1日披露重大资产重组方案,公司拟进行重大资产置换及发行股份购买恒力重工股权并募集配套资金: