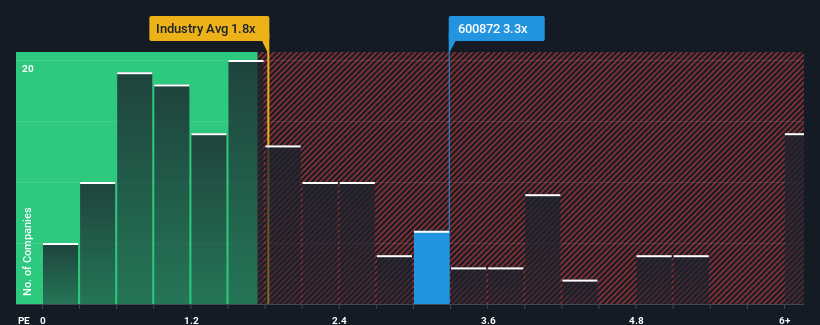

Jonjee Hi-Tech Industrial and Commercial Holding Co.,Ltd's (SHSE:600872) price-to-sales (or "P/S") ratio of 3.3x may not look like an appealing investment opportunity when you consider close to half the companies in the Food industry in China have P/S ratios below 1.8x. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Jonjee Hi-Tech Industrial and Commercial HoldingLtd Has Been Performing

While the industry has experienced revenue growth lately, Jonjee Hi-Tech Industrial and Commercial HoldingLtd's revenue has gone into reverse gear, which is not great. It might be that many expect the dour revenue performance to recover substantially, which has kept the P/S from collapsing. If not, then existing shareholders may be extremely nervous about the viability of the share price.

Keen to find out how analysts think Jonjee Hi-Tech Industrial and Commercial HoldingLtd's future stacks up against the industry? In that case, our free report is a great place to start.Do Revenue Forecasts Match The High P/S Ratio?

Jonjee Hi-Tech Industrial and Commercial HoldingLtd's P/S ratio would be typical for a company that's expected to deliver solid growth, and importantly, perform better than the industry.

Retrospectively, the last year delivered a frustrating 3.9% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Retrospectively, the last year delivered a frustrating 3.9% decrease to the company's top line. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 8.6% in total. So we can start by confirming that the company has generally done a good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 14% during the coming year according to the analysts following the company. With the industry predicted to deliver 15% growth , the company is positioned for a comparable revenue result.

With this in consideration, we find it intriguing that Jonjee Hi-Tech Industrial and Commercial HoldingLtd's P/S is higher than its industry peers. Apparently many investors in the company are more bullish than analysts indicate and aren't willing to let go of their stock right now. These shareholders may be setting themselves up for disappointment if the P/S falls to levels more in line with the growth outlook.

The Bottom Line On Jonjee Hi-Tech Industrial and Commercial HoldingLtd's P/S

Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Seeing as its revenues are forecast to grow in line with the wider industry, it would appear that Jonjee Hi-Tech Industrial and Commercial HoldingLtd currently trades on a higher than expected P/S. When we see revenue growth that just matches the industry, we don't expect elevates P/S figures to remain inflated for the long-term. Unless the company can jump ahead of the rest of the industry in the short-term, it'll be a challenge to maintain the share price at current levels.

And what about other risks? Every company has them, and we've spotted 3 warning signs for Jonjee Hi-Tech Industrial and Commercial HoldingLtd (of which 2 shouldn't be ignored!) you should know about.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.