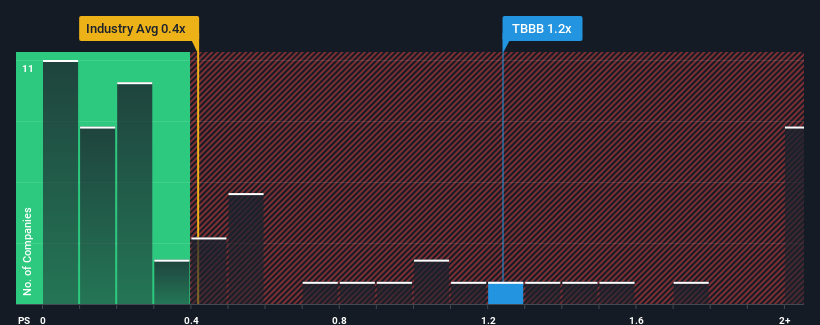

When close to half the companies in the Consumer Retailing industry in the United States have price-to-sales ratios (or "P/S") below 0.4x, you may consider BBB Foods Inc. (NYSE:TBBB) as a stock to potentially avoid with its 1.2x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

How Has BBB Foods Performed Recently?

BBB Foods certainly has been doing a good job lately as it's been growing revenue more than most other companies. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BBB Foods.Is There Enough Revenue Growth Forecasted For BBB Foods?

In order to justify its P/S ratio, BBB Foods would need to produce impressive growth in excess of the industry.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The strong recent performance means it was also able to grow revenue by 131% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Taking a look back first, we see that the company grew revenue by an impressive 30% last year. The strong recent performance means it was also able to grow revenue by 131% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 27% per annum as estimated by the eight analysts watching the company. With the industry only predicted to deliver 4.3% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why BBB Foods' P/S is high relative to its industry peers. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

What Does BBB Foods' P/S Mean For Investors?

Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As we suspected, our examination of BBB Foods' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for BBB Foods with six simple checks.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.