For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Vimeo (NASDAQ:VMEO). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Vimeo with the means to add long-term value to shareholders.

How Fast Is Vimeo Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So for many budding investors, improving EPS is considered a good sign. It's an outstanding feat for Vimeo to have grown EPS from US$0.051 to US$0.20 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While revenue is looking a bit flat, the good news is EBIT margins improved by 4.8 percentage points to 6.0%, in the last twelve months. That's something to smile about.

It's often helpful to take a look at earnings before interest and tax (EBIT) margins, as well as revenue growth, to get another take on the quality of the company's growth. While revenue is looking a bit flat, the good news is EBIT margins improved by 4.8 percentage points to 6.0%, in the last twelve months. That's something to smile about.

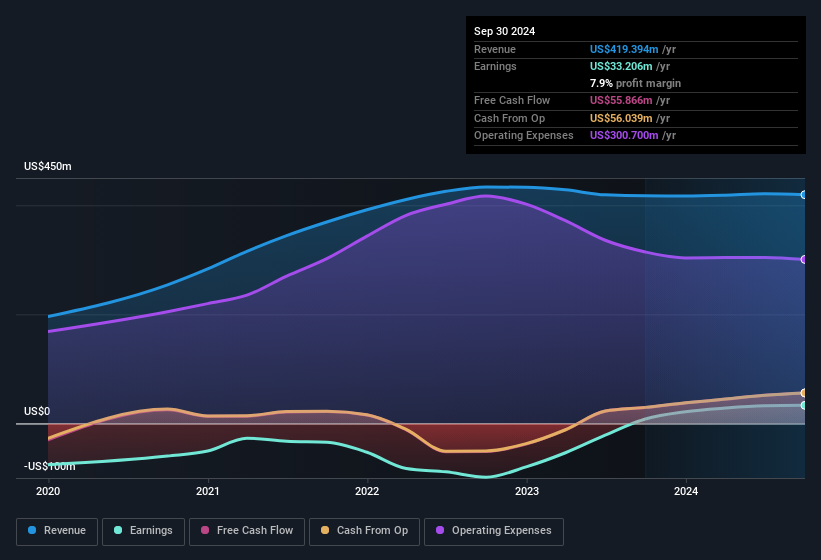

The chart below shows how the company's bottom and top lines have progressed over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Vimeo.

Are Vimeo Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Any way you look at it Vimeo shareholders can gain quiet confidence from the fact that insiders shelled out US$515k to buy stock, over the last year. And when you consider that there was no insider selling, you can understand why shareholders might believe that there are brighter days ahead. We also note that it was the Director, Adam Gross, who made the biggest single acquisition, paying US$250k for shares at about US$5.01 each.

On top of the insider buying, it's good to see that Vimeo insiders have a valuable investment in the business. Holding US$99m worth of stock in the company is no laughing matter and insiders will be committed in delivering the best outcomes for shareholders. Amounting to 9.1% of the outstanding shares, indicating that insiders are also significantly impacted by the decisions they make on the behalf of the business.

Should You Add Vimeo To Your Watchlist?

Vimeo's earnings have taken off in quite an impressive fashion. What's more, insiders own a significant stake in the company and have been buying more shares. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Vimeo belongs near the top of your watchlist. It is worth noting though that we have found 1 warning sign for Vimeo that you need to take into consideration.

Keen growth investors love to see insider activity. Thankfully, Vimeo isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.