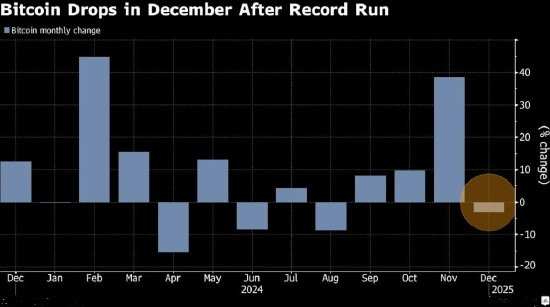

The record-breaking rise of Bitcoin faltered before the end of 2024, leading to its first monthly decline since August.

Bitcoin fell by 3.2% last month. After a rebound triggered by Trump's victory in the USA elections pushed Bitcoin to a historic high of $108,315 in mid-December, investors began to take profits. Meanwhile, with expectations for a rate cut by the Federal Reserve weakening, interest in high-risk assets diminished, and the speculative frenzy in the crypto market has cooled down.

Data shows that since December 19, net outflows from several Bitcoin Exchange Traded Funds (ETFs) in the USA have amounted to around $1.8 billion. The open interest in Bitcoin Futures, which is viewed as an Indicator of interest from USA Institutions, fell by nearly 20% from its peak in December.

Despite this, Bitcoin is up 120% in 2024, outperforming Gold and the Global stock market.

Despite this, Bitcoin is up 120% in 2024, outperforming Gold and the Global stock market.

QCP Capital stated in a report to clients: "We believe that as Institutions readjust their asset allocation, key catalysts could emerge in January." "With Bitcoin now widely adopted by Institutions — including university endowment funds this year — Bitcoin's allocation might increase, thereby strengthening its dominance, stabilizing spot trends, and bringing volatility closer to that of Stocks."

尽管如此,比特币在2024年还是上涨了120%,跑赢了黄金和全球股市。

尽管如此,比特币在2024年还是上涨了120%,跑赢了黄金和全球股市。