Crazy.

On the first trading day of 2025, the A-shares market continued its downward trend, while the new year for CSI Consumer 360 index had a "good start."

On January 2, the three major indexes opened low and moved lower. As of the time of writing, the Shanghai Index fell by 1.2%, the Chinext Price Index fell by 1.75%, and the Shenzhen Component Index fell by 1.27%.

The previously booming Copper cable high-speed connection and Semiconductors Sector have cooled down, but today the Consumer sectors such as food, Retail Trade, Hotel Dining, and tourism surged against the market trend, with sectors experiencing a wave of limit-up rises.

The previously booming Copper cable high-speed connection and Semiconductors Sector have cooled down, but today the Consumer sectors such as food, Retail Trade, Hotel Dining, and tourism surged against the market trend, with sectors experiencing a wave of limit-up rises.

Among them, companies like Debon Group, Wenfeng Great World Chain Development Corporation, Beijing Hualian Department Store, Juran Smart Home, and Shanghai Yimin Commercial Group saw their stocks hit the limit-up. Fujian Dongbai and Zhongbai Holdings Group both achieved six consecutive limit-ups.

The crazy retail leader.

The so-called "New Year's Eve stock" retail leader - Zhongbai Holdings Group has surged from the end of the year to the beginning of the year with a very strong momentum.

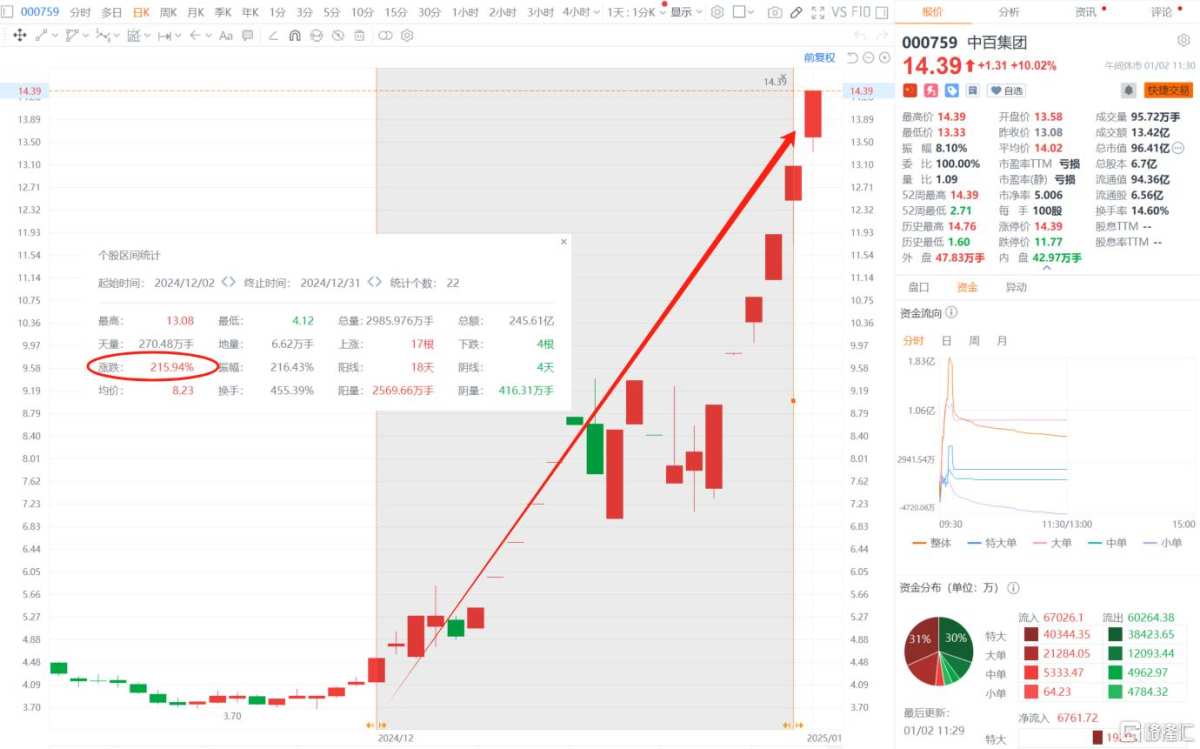

Currently, the stock has achieved 15 trading limits in 23 days, with a price of 14.39 and a total market value of 9.641 billion yuan.

During the 22 trading days of December, Zhongbai Holdings Group has achieved 14 trading limits.

During this period, it even created a ladder of consecutive limits, with a monthly increase of nearly 216%.

Zhongbai Holdings Group's main business is commercial retail, which includes hypermarkets, community supermarkets, convenience stores, appliance stores, department stores, and small shopping centers.

Riding the wave of CSI Consumer 360 index, Zhongbai Holdings Group's stock price has continued to see explosive trading, with the company issuing five risk warning announcements in December alone.

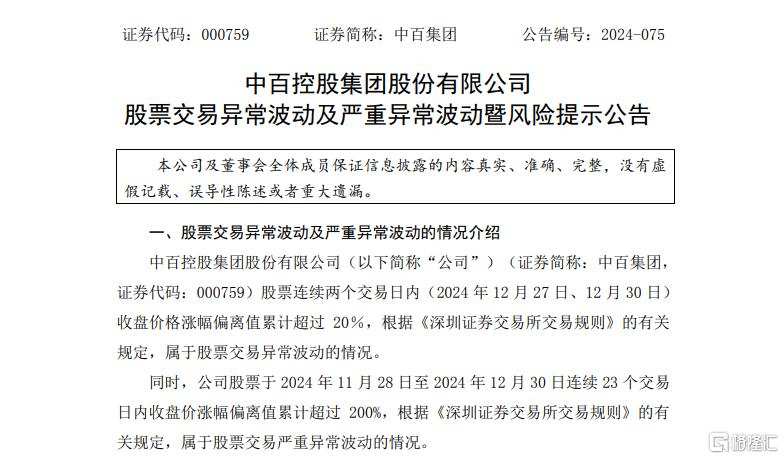

On the last day of 2024, the company announced that "stock trading has experienced severe abnormal fluctuations."

According to data released by China Securities Index Co., Ltd., as of December 27, 2024, the company's PB is 3.7; the PB of the Industry classification "F52 Retail Trade" to which the company belongs is 1.88.

The current PB is significantly higher than the industry average and deviates greatly from the SZSE A SHARE INDEX at the same period.

The consumer market is still booming.

Since December, top-level meetings have proposed to "actively develop the first issuance economy," and the A-share consumer concept has continued to be ignited.

Under the bullish policies, the retail sector has also repeatedly strengthened.

Recently, the Ministry of Commerce has intensively deployed policies to boost consumption, bringing significant bullish news to the retail trade.

The Ministry of Commerce recently held a video conference to promote the innovation and upgrading project for the retail sector, deploying the implementation plan from seven departments.

With the boost from Consumer policies, market confidence is continuing to strengthen.

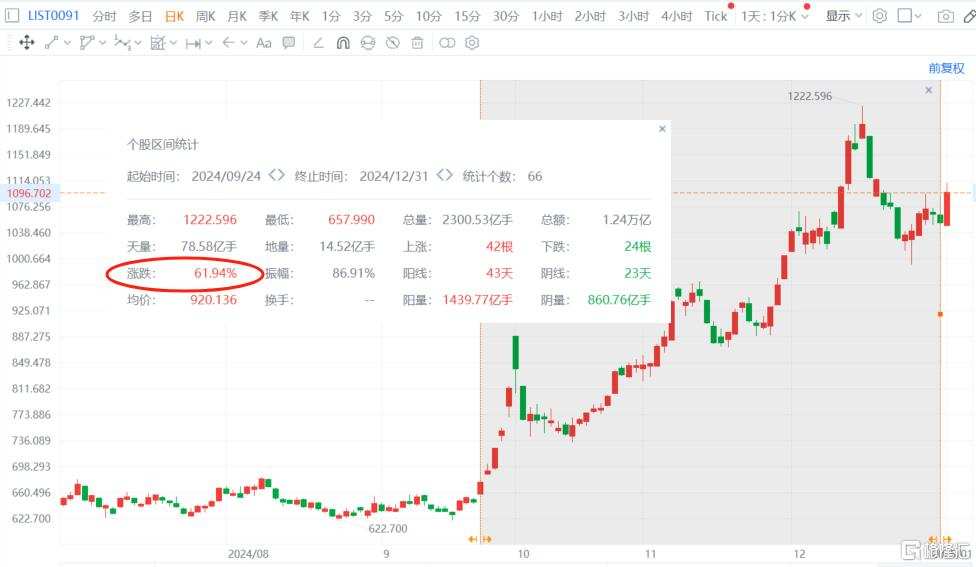

Since the "9·24" market trend, as of the close on December 31, the cumulative increase in the Retail Trade sector has exceeded 61%.

Looking ahead to 2025, Dongxing points out the importance of expanding domestic demand, with policies shifting towards greater Consumer focus, which is expected to invigorate the Consumer market.

Focus on sectors with high prosperity: around the "emotional consumption" sector, such as trendy toys and beauty products, as well as the offline Retail channels that will benefit from this, and around the "new" sector, including new Concepts, new Consumer demographics, and new technologies.

As for the A-share market, Zhang Yidong from Industrial Securities believes that under multidimensional resonance, the A-share bull market will enter the main upward wave phase in 2025.

It is expected that in the first half or even the entire year of 2025, A-shares will perform better than U.S. stocks and Hong Kong stocks.

Zhang Yidong emphasizes that the current bull market is in the primary stage, so many investors remain skeptical about the bull market, viewing it as a "bounce" rather than a "reversal."

He stated that in 2025, one must cherish the honeymoon period of A-shares and have confidence in the innovations and changes in the macro and micro fields of the Chinese economy.

前期火爆的

前期火爆的