Lumentum (LITE.US) may not be well-known to the public, but the stock has performed well over the past four months.

According to Zhicheng Finance APP, Lumentum (LITE.US) may not be well-known to the public, but the stock has performed well over the past four months.

The company produces and sells optical and photonic components, modules, and systems that can achieve high-speed data transmission, as well as laser products for industrial use. Lumentum's optical products are deployed in datacenters for fast data transmission and benefit from the significant growth in demand for AI workloads.

Since the announcement of fiscal year 2024 results on August 14, 2024, Lumentum's stock price has soared by 84%.

Since the announcement of fiscal year 2024 results on August 14, 2024, Lumentum's stock price has soared by 84%.

Data shows that the company's revenue for fiscal year 2024 decreased by 23% year-on-year, to $1.36 billion, while the adjusted EPS fell from $4.56 last year to $1.01. This poor performance was due to a decline in demand from the industrial sector, which saw revenue drop by 38% to $0.274 billion.

The cloud and networking businesses account for nearly 80% of Lumentum's total revenue, but due to weak demand in the telecommunications industry, revenue for this segment also fell by 18% in fiscal year 2024. However, Lumentum's latest performance indicates that the business is improving.

For the first quarter of fiscal year 2025 ending September 28, 2024, the company reported a 6% year-on-year revenue increase, reaching $0.337 billion, exceeding the upper limit of the guidance range. Revenue from the cloud and networking business grew by 23% year-on-year, becoming a significant driver of the company's improved performance. Due to the increasing deployment of AI infrastructure, the demand for the company's connection modules is also on the rise.

Lumentum's management stated in August 2024 that its external modulation lasers (EML) - a technology for high-speed data transmission via fiber optic cables - have been selected for deployment by multiple cloud and AI customers. The company achieved a record EML shipment during the quarter and received ample orders, planning to complete by fiscal year 2025.

More importantly, Lumentum believes that the demand for EML could grow by 30% to 40% this fiscal year, and the company is actively increasing production capacity to meet this demand. Benefiting from the deployment of AI, management expects Lumentum's potential opportunities in the datacenter photonics market to leap from $4.5 billion in 2023 to $16 billion by 2028.

Lumentum's performance is expected to maintain robust growth. The company anticipates revenue of $0.39 billion for the second fiscal quarter, a 6% increase year-on-year; with earnings per share (EPS) expected to be $0.35, better than last year's $0.32.

The Motley Fool Analyst Harsh Chauhan stated that given the strong backlog of orders and rapid growth in the AI networking market, Lumentum is likely to exceed market expectations again when it releases its next set of performance results in 2025.

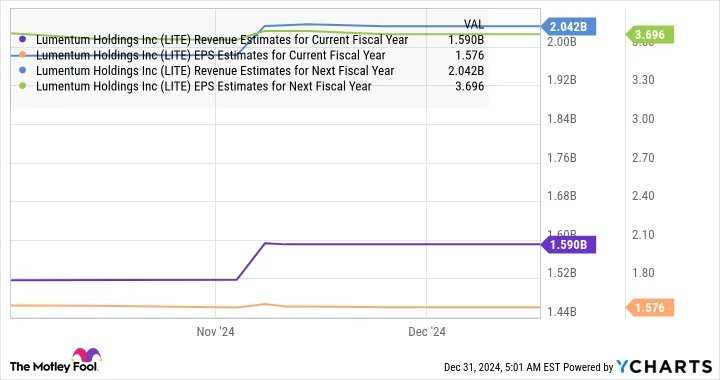

Although Lumentum's revenue and earnings per share dropped significantly in fiscal year 2024, the forecasts for the next two fiscal years remain robust.

Chauhan noted that Lumentum's earnings are expected to grow by 56% this fiscal year and by 134% in fiscal year 2026. Assuming the company's EPS can reach $3.70 in the coming years, and the PE remains in line with the NASDAQ 100 Index at 33 times, then its stock price could soar to $122. This would be 47% higher than the current stock price, suggesting that investors who missed the rise of this AI stock may still consider buying in, as the stock seems to have further upward potential.

自2024年8月14日公布2024财年业绩以来,Lumentum的股价已经飙升了84%。

自2024年8月14日公布2024财年业绩以来,Lumentum的股价已经飙升了84%。