iFly Medical will conduct an initial public offering from December 18 to 23, 2024, with a Global offering of 7.03555 million shares Listed in Hong Kong. The offering price will be 82.8 HKD per share, with a minimum purchase of 50 shares, requiring an initial investment of 4,140 HKD. It officially listed on December 30, becoming the first Medical large model stock on the Main Board of the Hong Kong Stock Exchange.

Since ChatGPT has pushed generative AI into the investment spotlight, the AI strategy has gradually risen to a national level, with policies promoting AI technology to flourish in many aspects. In 2024, the wave of AI applications will sweep across various industries, especially in the Medical, Education, and Autos sectors, where the industry application market is growing rapidly.

According to Frost & Sullivan data, the overall market application scale of AI solutions in China reached 121 billion yuan in 2023, with a compound annual growth rate of 30.1% over the past five years, expected to reach 1.84 trillion yuan by 2033. The Medical sector is a significant application market for AI, with a market size of 8.8 billion yuan in 2023, an application share of 7.27%, and projected to reach a market size of 315.7 billion yuan by 2033, with an application share increasing to 17.2%.

In the AI application race, choosing the right investment track is very important. Clearly, the applications in the Medical sector have huge prospects and are in a high-growth phase. However, ordinary investors have limited investment channels, primarily exploring the secondary market. As the industry is at an initial stage, investment symbols are scarce. Coincidentally, Iflytek Co.,ltd. (02506), a leading player in China's medical AI sector, is listed in Hong Kong, which may bring investment opportunities for investors.

In the AI application race, choosing the right investment track is very important. Clearly, the applications in the Medical sector have huge prospects and are in a high-growth phase. However, ordinary investors have limited investment channels, primarily exploring the secondary market. As the industry is at an initial stage, investment symbols are scarce. Coincidentally, Iflytek Co.,ltd. (02506), a leading player in China's medical AI sector, is listed in Hong Kong, which may bring investment opportunities for investors.

iFly Medical will conduct an initial public offering from December 18 to 23, 2024, with a Global offering of 7.03555 million shares Listed in Hong Kong. The offering price will be 82.8 HKD per share, with a minimum purchase of 50 shares, requiring an initial investment of 4,140 HKD. It officially listed on December 30, becoming the first Medical large model stock on the Main Board of the Hong Kong Stock Exchange.

According to Zhitong Finance APP, as a provider focused on AI-enabled medical solutions, Iflytek Medical has become a leader in China's medical AI industry, relying on its deep layout and innovative capacity in the medical sector.

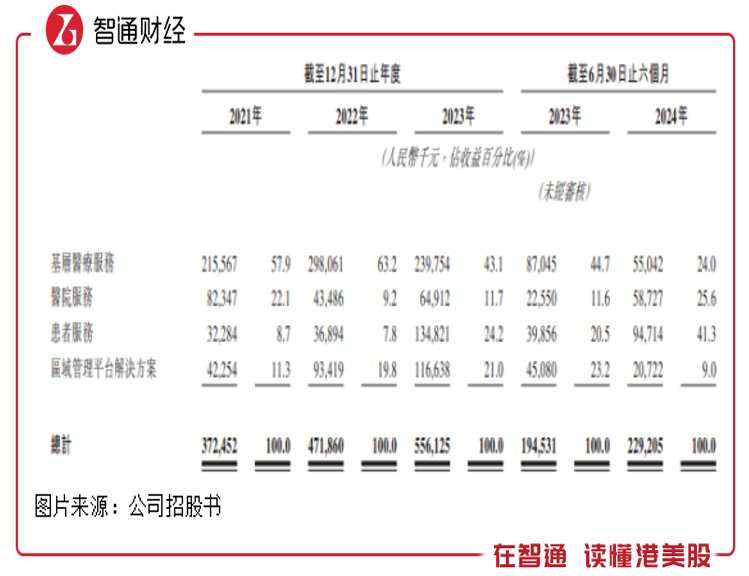

The prospectus shows that by independently developing AI technologies that support the company's products and solutions, Iflytek Medical primarily provides solutions for grassroots medical care, hospital services, patient services, and regional management platforms. The company maintains high growth, with a compound annual growth rate of 29.55% in revenue from 2021 to 2023, and ranks first in revenue scale in China's medical AI industry; in the first half of 2024, revenue continues to maintain high growth, with this figure at 19.6%.

The company has fully developed the AI + Medical market in G-end + B-end + C-end, especially in the C-end market, accelerating layout in 2024 to promote high-speed growth of the business. In the first half of 2024, the company's hospital services revenue grew by 160.3%, while patient services revenue increased by 137.6%, with the shares of the two main business revenues rising to 25.6% and 41.3%, respectively.

In terms of grassroots medical services, Smart Medical Assistant has been applied in over 610 counties across more than 30 provinces nationwide, providing over 0.877 billion AI-assisted diagnosis suggestions and standardizing 0.34 billion medical records. In hospital services, hospital services now cover over 500 ranked hospitals, including more than 40 of China's top 100 hospitals and seven of China's top 10 hospitals. In improving the medical services obtained by patients and residents, the post-diagnosis management platform has served over 0.263 million patients. In smart imaging, over 1,970 medical institutions and more than 3,200 experts have registered on the imaging cloud platform, providing nearly 8.4 million remote consultation services and recording data upload service usage exceeding 0.112 billion times.

Iflytek Medical targets individual customer needs, providing smart hospital patient services and post-diagnosis management, imaging cloud platform, and medical instruments. From 2021 to 2023, the expansion of individual customers progressed rapidly, with patient services revenue showing a triple-digit compound growth rate. In the first half of 2024, the revenue share reached 41.3%, significantly increasing by 32.6% compared to the annual figure in 2021, highlighting the success of its individual customer strategy. In specific products, For example, the Iflytek Xiao Yi App and mini-programs are typical applications of Iflytek's Spark Medical large model, creating personal digital health spaces covering three major health scenarios: before seeing a doctor, during medication, and after examination, providing services such as symptom self-check, drug inquiry, report interpretation, and personalized health record management. Currently, the Iflytek Xiao Yi APP can assist in diagnosing over 1,600 common diseases, covering more than 2,000 common symptoms, identifying over 4,000 common drugs, and understanding over 6,000 common examination and testing items.

In the field of smart imaging, the imaging cloud platform is the largest medical imaging cloud platform in Anhui Province, allowing remote retrieval of medical imaging data from other medical institutions with shared access permissions and assisting in the implementation of a graded diagnosis and treatment system.

Iflytek Medical's medical instruments mainly include hearing aids, and in 2022 began providing digital smart hearing aids to individuals. After more than two years, three series have been launched to meet the needs of different user groups. On December 31, 2024, the industry's first professional-grade smart behind-the-ear hearing aid Pro 'Moon Series', integrating multi-modal subtitle technology, was launched. Currently, Iflytek's smart hearing aids have over 0.11 million registered users.

The medical industry is a career full of humanistic care and warmth. Iflytek Medical's innovative products consistently incorporate the concept of 'Technology for Good' into their business strategy and product development. In response to the challenges of an aging population, the company already has the foundation and experience to provide smarter and warmer medical services for the silver economy.

With the B-end and C-end accelerating penetration, the company will solidify its leading position in the AI applications within the medical industry and drive high growth through this 'dual engine'.

In fact, Iflytek Co.,ltd. Medical has gained recognition from both B-end and C-end customers thanks to efficient R&D, maintaining a leading position in the industry. As a R&D-driven high-tech enterprise, the company's R&D expense ratio has remained high, being 42.9%, 51.2%, 47.5%, and 59% for 2021-2023 and the first half of 2024 respectively.

Thanks to its R&D investment, the company has achieved several technological breakthroughs. The company has established a core technology framework centered around deep neural networks, deep learning, and medical knowledge graphs, successfully applying voice recognition, image recognition, and natural language understanding technologies in the medical field. The continuous progress of these technologies and the ongoing expansion of the medical knowledge graph have laid a solid foundation for the company's proprietary medical large model - Iflytek Spark Medical Large Model.

The Iflytek Spark Medical Large Model is another significant breakthrough for Iflytek Co.,ltd. in the AI healthcare field. This model, designed for over 300 medical scene applications, has surpassed GPT-4 Turbo in several dimensions of medical-related natural language processing tasks, becoming an industry-recognized leader. Additionally, the company has developed a series of innovative products and services, including a Clinical Decision Support System (CDSS) based on Big Data analysis and machine learning algorithms, an intelligent outbound calling service utilizing speech synthesis and automated response technology, an imaging cloud platform offering medical image storage, management, and analysis functions, and patient service packages covering various aspects such as health management, disease monitoring, and rehabilitation guidance. Furthermore, Iflytek Co.,ltd. is the only company in the nation involved in formulating the 'technical evaluation system and standards specification for medical large models.'

It is noteworthy that the company has a high gross margin that is also on an upward trend, with a gross margin of 52.9% in the first half of 2024, an increase of 0.8 percentage points year-on-year, and a rise of 2.5 percentage points compared to 2021.

The company places great importance on tapping into C-end customers, as the gross margin for C-end customers is higher than that for B-end customers. In the first half of 2024, the gross margin for patient services was 59.8%, which is higher by 4.1 percentage points, 11.7 percentage points, and 32.4 percentage points compared to the gross margins of grassroots medical services, hospital services, and regional management platform solutions, respectively. The high growth of C-end customers and revenue also brings expectations for the improvement of the company's gross margin.

Iflytek Co.,ltd. Medical's Net income is affected by R&D expenses. If R&D expenses are disregarded, the Net income of Iflytek Co.,ltd. Medical would be profitable, which is closely related to the company's long-term strategy. Iflytek Co.,ltd. Medical insists on fully investing in the underlying technology of AI, not pursuing short-term results, but instead focusing on long-term technology accumulation and market leadership.

This long-term strategy of Iflytek Co.,ltd. Medical is similar to the growth paths of early Internet giants such as Alibaba and PDD Holdings, aiming to capture larger market shares through R&D-driven approaches and ultimately achieving profitability through scaling. Although Iflytek Co.,ltd. Medical's emphasis on long-termism and R&D has impacted its Net income in the short term, it has laid a solid foundation for the company's long-term development and market leadership in the field of AI in healthcare. Through its deep exploration in core technology and adherence to long-termism, Iflytek Co.,ltd. Medical is actively preparing for the industry's explosion period and is expected to further expand its market share through its R&D-driven strategy.

In fact, for the Capital Markets, turning losses into profits is a positive signal and an important indicator of a significant improvement in the operation of platform-based technology enterprises. For example, after achieving profitability, Amazon (AMZN.US), Facebook (FB.US), and others have grown into industry giants. The same example can be applied to Iflytek Co.,ltd. Medical.

From an investment perspective, Iflytek Medical is a subsidiary of Iflytek Co.,ltd., the A-share AI leader, which is the only company in 2024 approved by the China Securities Regulatory Commission for A-share spin-off listings in Hong Kong. It is also the first stock of medical large models listed on the Main Board of HKEX, and as a leader in AI + Medical, its rarity is self-evident. At the same time, its high growth industry fundamentals significantly enhance investment attractiveness.

Before its listing, the company introduced several investment institutions, including Venture Capital and Guokai Ruihua, among others. These investment institutions are prohibited from trading stocks within one year after the company's listing. This listing has also brought in more cornerstone investors, including Star Group, Da'an, Hengqin Guiding Fund, Ifly Medical Limited, and Costone China Growth, all of whom also have a six-month lock-up period. The institutions and cornerstone investors have lock-up periods, providing reassurance to the secondary market.

In the secondary market, Iflytek Medical is favored by investors, reaching a high of 95.15 HKD on the first day of listing, an increase of 15% from the issue price, and closing with a 5% rise. It continued to rise over the next two trading days, with a cumulative increase of 10% over three trading days. As 2025 has arrived, the company saw an increase of nearly 4% on its first trading day, achieving a strong start to the year. With the continuous expansion of the AI + Medical market and the release of performance, the company is expected to continue to attract value investors.

在人工智能应用风口上,选择投资的赛道非常重要,显然医疗领域的应用拥有巨大前景且处于高成长阶段的市场。不过普通投资者投资渠道较窄,主要在二级市场挖掘,加之行业处于初始阶段投资标的稀缺,恰巧,中国医疗人工智能行业龙头,讯飞医疗(02506)在港上市,或为投资者带来投资机会。

在人工智能应用风口上,选择投资的赛道非常重要,显然医疗领域的应用拥有巨大前景且处于高成长阶段的市场。不过普通投资者投资渠道较窄,主要在二级市场挖掘,加之行业处于初始阶段投资标的稀缺,恰巧,中国医疗人工智能行业龙头,讯飞医疗(02506)在港上市,或为投资者带来投资机会。