The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Brookfield Infrastructure Corporation (NYSE:BIPC) makes use of debt. But should shareholders be worried about its use of debt?

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is Brookfield Infrastructure's Debt?

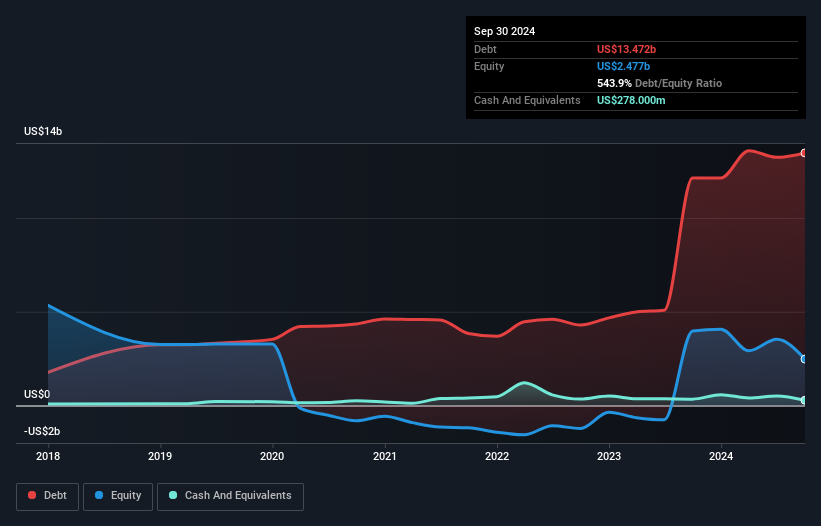

The image below, which you can click on for greater detail, shows that at September 2024 Brookfield Infrastructure had debt of US$13.5b, up from US$12.1b in one year. On the flip side, it has US$278.0m in cash leading to net debt of about US$13.2b.

A Look At Brookfield Infrastructure's Liabilities

We can see from the most recent balance sheet that Brookfield Infrastructure had liabilities of US$6.74b falling due within a year, and liabilities of US$14.9b due beyond that. Offsetting this, it had US$278.0m in cash and US$2.62b in receivables that were due within 12 months. So its liabilities total US$18.8b more than the combination of its cash and short-term receivables.

We can see from the most recent balance sheet that Brookfield Infrastructure had liabilities of US$6.74b falling due within a year, and liabilities of US$14.9b due beyond that. Offsetting this, it had US$278.0m in cash and US$2.62b in receivables that were due within 12 months. So its liabilities total US$18.8b more than the combination of its cash and short-term receivables.

The deficiency here weighs heavily on the US$5.47b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. At the end of the day, Brookfield Infrastructure would probably need a major re-capitalization if its creditors were to demand repayment.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

While Brookfield Infrastructure's debt to EBITDA ratio (4.4) suggests that it uses some debt, its interest cover is very weak, at 2.2, suggesting high leverage. It seems clear that the cost of borrowing money is negatively impacting returns for shareholders, of late. The good news is that Brookfield Infrastructure grew its EBIT a smooth 57% over the last twelve months. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Brookfield Infrastructure's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Finally, a company can only pay off debt with cold hard cash, not accounting profits. So we always check how much of that EBIT is translated into free cash flow. In the last three years, Brookfield Infrastructure's free cash flow amounted to 24% of its EBIT, less than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

We'd go so far as to say Brookfield Infrastructure's level of total liabilities was disappointing. But at least it's pretty decent at growing its EBIT; that's encouraging. It's also worth noting that Brookfield Infrastructure is in the Gas Utilities industry, which is often considered to be quite defensive. Looking at the bigger picture, it seems clear to us that Brookfield Infrastructure's use of debt is creating risks for the company. If all goes well, that should boost returns, but on the flip side, the risk of permanent capital loss is elevated by the debt. There's no doubt that we learn most about debt from the balance sheet. However, not all investment risk resides within the balance sheet - far from it. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for Brookfield Infrastructure (of which 1 shouldn't be ignored!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.