Financial giants have made a conspicuous bearish move on Walt Disney. Our analysis of options history for Walt Disney (NYSE:DIS) revealed 10 unusual trades.

Delving into the details, we found 10% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $127,750, and 8 were calls, valued at $3,454,680.

Expected Price Movements

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $50.0 and $140.0 for Walt Disney, spanning the last three months.

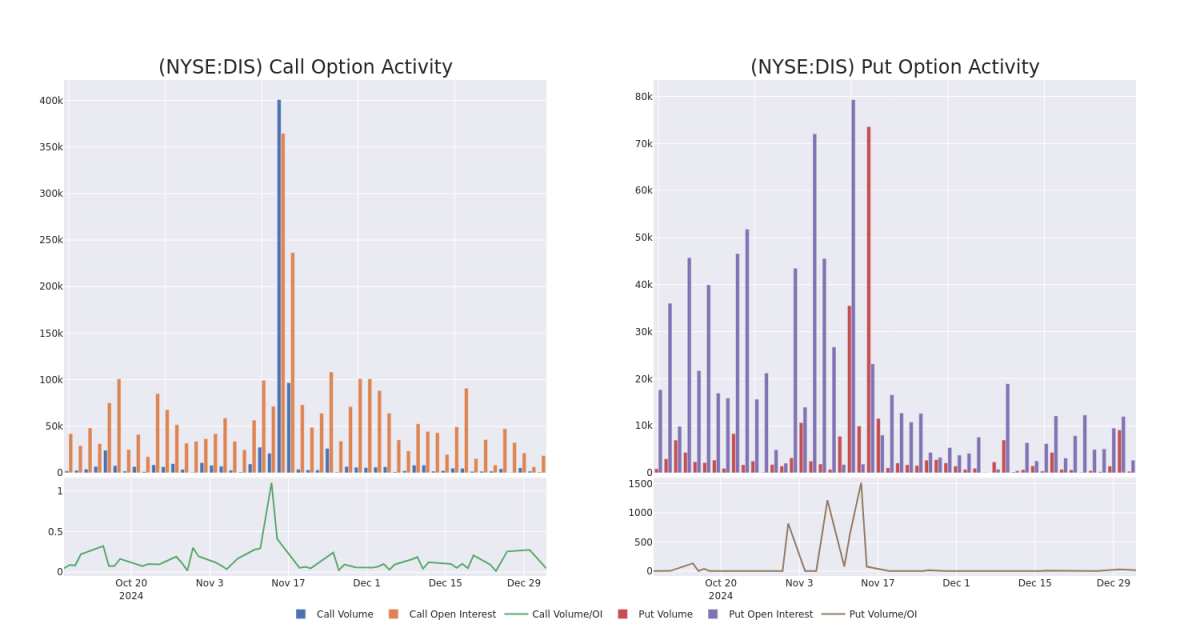

Volume & Open Interest Development

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walt Disney's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walt Disney's whale trades within a strike price range from $50.0 to $140.0 in the last 30 days.

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Walt Disney's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Walt Disney's whale trades within a strike price range from $50.0 to $140.0 in the last 30 days.

Walt Disney Option Volume And Open Interest Over Last 30 Days

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DIS | CALL | SWEEP | BEARISH | 12/19/25 | $62.65 | $62.6 | $62.6 | $50.00 | $3.1M | 1.0K | 500 |

| DIS | PUT | TRADE | BEARISH | 02/21/25 | $28.25 | $28.0 | $28.25 | $140.00 | $84.7K | 2 | 30 |

| DIS | CALL | TRADE | NEUTRAL | 01/17/25 | $31.8 | $31.4 | $31.58 | $80.00 | $78.9K | 537 | 25 |

| DIS | CALL | TRADE | BEARISH | 06/20/25 | $16.25 | $15.9 | $16.0 | $100.00 | $56.0K | 3.8K | 37 |

| DIS | CALL | TRADE | NEUTRAL | 02/21/25 | $3.75 | $3.6 | $3.68 | $115.00 | $55.2K | 8.2K | 206 |

About Walt Disney

Disney operates in three global business segments: entertainment, sports, and experiences. Entertainment and experiences both benefit from the firm's ownership of iconic franchises and characters. Entertainment includes the ABC broadcast network, several cable television networks, and the Disney+ and Hulu streaming services. Within the segment, Disney also engages in movie and television production and distribution, with content licensed to movie theaters, other content providers, or, increasingly, kept in-house for use on Disney's own streaming platform and television networks. The sports segment houses ESPN and the ESPN+ streaming service. Experiences contains Disney's theme parks and vacation destinations, and also benefits from merchandise licensing.

In light of the recent options history for Walt Disney, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of Walt Disney

- With a volume of 2,163,823, the price of DIS is up 0.22% at $111.6.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 34 days.

Expert Opinions on Walt Disney

In the last month, 2 experts released ratings on this stock with an average target price of $127.5.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access.* An analyst from Jefferies has revised its rating downward to Hold, adjusting the price target to $120. * Consistent in their evaluation, an analyst from Rosenblatt keeps a Buy rating on Walt Disney with a target price of $135.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Walt Disney with Benzinga Pro for real-time alerts.