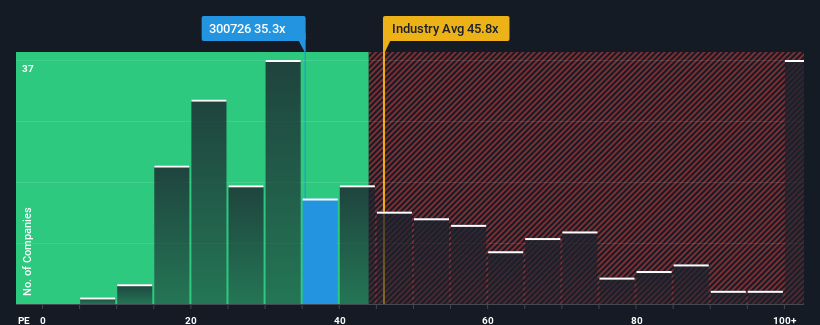

It's not a stretch to say that Zhuzhou Hongda Electronics Corp.,Ltd.'s (SZSE:300726) price-to-earnings (or "P/E") ratio of 35.3x right now seems quite "middle-of-the-road" compared to the market in China, where the median P/E ratio is around 35x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

With earnings that are retreating more than the market's of late, Zhuzhou Hongda ElectronicsLtd has been very sluggish. One possibility is that the P/E is moderate because investors think the company's earnings trend will eventually fall in line with most others in the market. If you still like the company, you'd want its earnings trajectory to turn around before making any decisions. Or at the very least, you'd be hoping it doesn't keep underperforming if your plan is to pick up some stock while it's not in favour.

Is There Some Growth For Zhuzhou Hongda ElectronicsLtd?

There's an inherent assumption that a company should be matching the market for P/E ratios like Zhuzhou Hongda ElectronicsLtd's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. The last three years don't look nice either as the company has shrunk EPS by 57% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 40%. The last three years don't look nice either as the company has shrunk EPS by 57% in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 125% during the coming year according to the three analysts following the company. Meanwhile, the rest of the market is forecast to only expand by 38%, which is noticeably less attractive.

In light of this, it's curious that Zhuzhou Hongda ElectronicsLtd's P/E sits in line with the majority of other companies. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

The Final Word

While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Zhuzhou Hongda ElectronicsLtd currently trades on a lower than expected P/E since its forecast growth is higher than the wider market. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

You always need to take note of risks, for example - Zhuzhou Hongda ElectronicsLtd has 3 warning signs we think you should be aware of.

If you're unsure about the strength of Zhuzhou Hongda ElectronicsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.