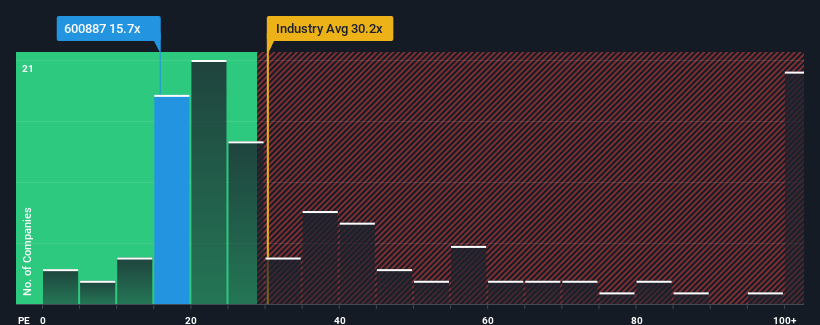

With a price-to-earnings (or "P/E") ratio of 15.7x Inner Mongolia Yili Industrial Group Co., Ltd. (SHSE:600887) may be sending very bullish signals at the moment, given that almost half of all companies in China have P/E ratios greater than 35x and even P/E's higher than 68x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

With its earnings growth in positive territory compared to the declining earnings of most other companies, Inner Mongolia Yili Industrial Group has been doing quite well of late. It might be that many expect the strong earnings performance to degrade substantially, possibly more than the market, which has repressed the P/E. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Does Growth Match The Low P/E?

There's an inherent assumption that a company should far underperform the market for P/E ratios like Inner Mongolia Yili Industrial Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. The latest three year period has also seen a 27% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Taking a look back first, we see that the company managed to grow earnings per share by a handy 11% last year. The latest three year period has also seen a 27% overall rise in EPS, aided somewhat by its short-term performance. So we can start by confirming that the company has actually done a good job of growing earnings over that time.

Turning to the outlook, the next three years should generate growth of 3.7% per annum as estimated by the analysts watching the company. With the market predicted to deliver 21% growth per annum, the company is positioned for a weaker earnings result.

With this information, we can see why Inner Mongolia Yili Industrial Group is trading at a P/E lower than the market. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Final Word

Typically, we'd caution against reading too much into price-to-earnings ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that Inner Mongolia Yili Industrial Group maintains its low P/E on the weakness of its forecast growth being lower than the wider market, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. It's hard to see the share price rising strongly in the near future under these circumstances.

The company's balance sheet is another key area for risk analysis. You can assess many of the main risks through our free balance sheet analysis for Inner Mongolia Yili Industrial Group with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.