Welcome to the weekly market review, this section is dedicated to providing Moomoo CAB members with key investment news and insights from this week, as well as a preview of significant events that may impact the market in the coming week.

Macroeconomic Trends

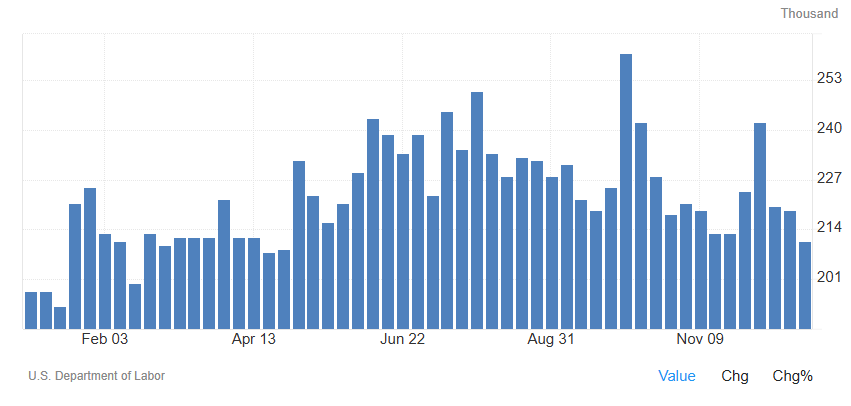

The number of initial jobless claims in the USA has dropped to an eight-month low.

In the last week of 2024, the number of initial jobless claims in the USA decreased by 9,000 from the previous week, to 211,000, which contrasts sharply with the expected increase to 222,000, marking the lowest initial jobless claims in eight months. The previous week saw continuing claims fall by 52,000 to 1,844,000, below the expected 1,890,000. This outcome aligns with the view that the US labor market remains tight by historical standards, and if inflation continues to not slow at the pace the Federal Reserve expects, there is room for the Fed to keep interest rates high.

US mortgage rates approach 7%.

US mortgage rates approach 7%.

As of January 2, the average interest rate for a 30-year fixed mortgage supported by Freddie Mac has risen to 6.91%, the highest level since July. Driven by the Federal Reserve's strong signals and robust economic data, this increase is consistent with the surge in long-term Treasury yields. Freddie Mac's chief economist Sam Khater stated, "Mortgage rates have edged up to just below 7%, reaching the highest point in nearly six months. In comparison to the same period last year, rates have increased, and there continues to be resistance to market affordability. However, as the number of homes for sale increases, buyers appear to be more inclined to wait."

Strong economic outlook keeps the dollar near a two-year high.

The USD index maintained above 109 on Friday, close to its highest level in two years, as investors bet on a strengthening US economy, which will reduce the number of interest rate cuts by the Federal Reserve this year. The US economy continues to demonstrate resilience, allowing it to outperform other global economies in the short term. The Fed has also indicated that due to persistent inflation, it will adopt a more cautious easing stance in 2025. The latest forecast shows only two interest rate cuts this year, each by 25 basis points, a significant reduction from the 100 basis points expected in September. Additionally, uncertainty surrounding the policies of the incoming Trump administration is driving capital inflow into the dollar. The dollar is currently at multi-year highs against the euro, Australian Dollar, and New Zealand Dollar, and at multi-month highs against the yen and British Pound.

Capital Flow

The PB of the S&P 500 Index has now surpassed the peak value during the Internet Plus-Related bubble.

As of the end of November, the total Assets of US ETFs reached a record high of 10.6 trillion USD, an increase of over 30% compared to the beginning of 2024.

The bubble of concentration in the USA stock market is rarely larger.

At the beginning of 2025, market concentration reached the highest level since the Great Depression. The top 10 stocks in the USA accounted for 38% of the total market capitalization.

Company News

Tesla's fourth-quarter delivery data reached a new high but still fell short of expectations, and the stock price dropped over 6%.

On Thursday, January 2, Eastern Time, Tesla released its vehicle delivery data for the full year and fourth quarter of 2024, after which its stock price fell by more than 6% during the day's trading. Tesla stated that it delivered a total of 1.79 million Autos in 2024, down from 1.8 million delivered in 2023, and below the Analysts' general expectation of 1.8 million. This marks the first annual sales decline for Tesla since its IPO in 2011. Despite the annual sales decline, Tesla achieved robust growth in the fourth quarter. As of December 31, Tesla delivered a total of 495,570 Autos in the fourth quarter, setting a new high for quarterly deliveries, but fell short of the Analysts' average expectations. Although electric vehicle sales saw almost no growth, Tesla's stock rose over 60% in 2024. Almost all of the increase occurred after the presidential election on November 5. Investors are certainly concerned about quarterly delivery numbers, but currently, they are more focused on the future developments in 2025, as well as how Elon Musk's close relationship with Trump will help this electric vehicle manufacturer.

Carvana's stock fell due to Hindenburg's accusations of "related party financial games."

On January 2nd Eastern Time, the well-known short-selling institution Hindenburg Research announced it is shorting the used car dealer Carvana, claiming that the recent improvement of this online used car retailer is supported by unstable loans and accounting manipulation. Carvana's stock price fell about 3% on Thursday. Hindenburg founder Nathan Anderson stated that after conducting "extensive document reviews and interviews with 49 industry experts, former Carvana employees, competitors, and related parties," the institution firmly believes that Carvana's "transformation is an illusion." The institution wrote in the report: "Our research found that the company sold a $0.8 billion loan to a suspected undisclosed related party while using accounting manipulation and loose loan approvals to drive temporary revenue growth, while insiders took the opportunity to cash out billions of dollars in stock."

This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any particular security or investment strategy. The information contained in this content is for illustrative purposes only and may not be suitable for all investors. This content does not consider the investment objectives, financial situation, or needs of any specific person and should not be regarded as individual investment advice. It is recommended that you consider the suitability of the information for your individual circumstance before making any investment decisions in any capital market product. Past investment performance is not indicative of future results. Investment involves risk and the possibility of loss of principal.

In the USA, investment products and services on moomoo are provided by Moomoo Financial Inc., a licensed entity regulated by the U.S. Securities and Exchange Commission (SEC). Moomoo Financial Inc. is a member of the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC).