Welcome to the Markets Weekly Update, the column committed to delivering essential investing insights for the week and key events that could move markets in the week ahead.

Macro Matters

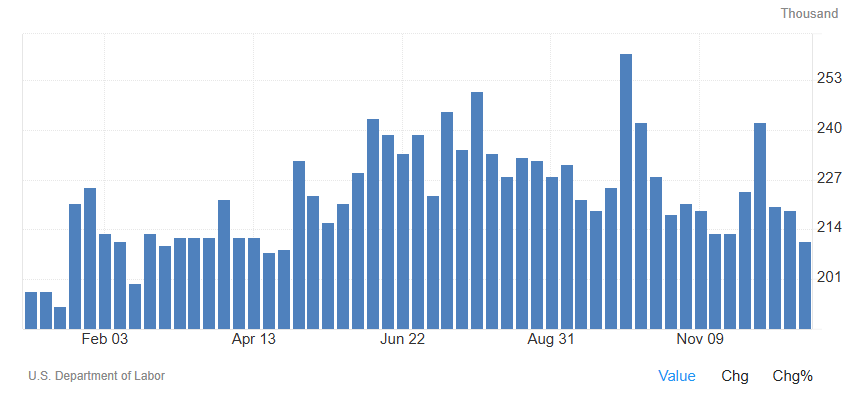

US Initial Jobless Claims Fall to 8-Month Low

In the final week of 2024, the number of first-time unemployment claims in the US dropped unexpectedly by 9,000 to 211,000, which is a significant decrease from the anticipated rise to 222,000, and represents the fewest initial claims seen in eight months. This is according to data from the U.S. Department of Labor. The week before, continuing claims for unemployment benefits decreased by 52,000 to 1,844,000, which was lower than the expected 1,890,000. These figures suggest that the US job market is still very competitive compared to historical norms. This situation could give the Federal Reserve the flexibility to maintain higher interest rates if inflation doesn't slow down at the rate they want.

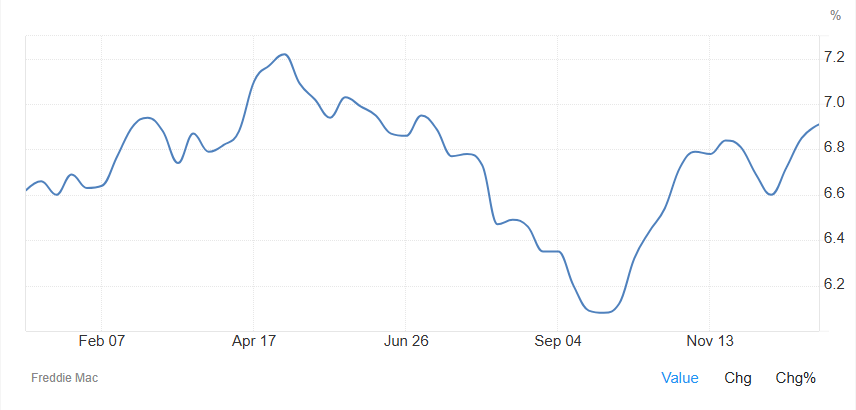

US Mortgage Rate Approaches 7%

US Mortgage Rate Approaches 7%

As of January 2, the average interest rate for 30-year fixed mortgages backed by Freddie Mac rose to 6.91%, the highest level since July. This increase aligns with the surge in long-term Treasury yields, driven by the Federal Reserve's hawkish signals and strong economic data. Freddie Mac's Chief Economist, Sam Khater, stated, "Mortgage rates have slightly increased to just below 7%, reaching their highest point in nearly six months. Compared to the same period last year, rates have risen, and the headwind of affordability persists. However, with the rise in pending home sales, it appears that buyers are more inclined to wait and see".

Dollar Holds Near 2-Year Highs Amid Strong US Outlook

The US dollar index remained above 109 on Friday, hovering near its highest level in two years as investors are placing bets on a strengthening US economy and anticipating fewer interest rate cuts by the Federal Reserve this year. The American economy continues to demonstrate resilience, which is setting it up to outperform other economies worldwide in the short term. The Federal Reserve has signaled that it will adopt a more cautious approach to easing monetary policy in 2025, in light of persistent inflation. The latest forecasts suggest that there will be just two interest rate cuts of 0.25 percentage points each this year, marking a significant decrease from the 1 percentage point (four 0.25 percentage point cuts) that was expected back in September.

Furthermore, uncertainties surrounding the policies of the incoming Trump administration have driven investors to seek the safety of the US dollar. As a result, the dollar is currently trading at multi-year highs against the euro, the Australian dollar, and the New Zealand dollar, and at multi-month highs against the Japanese yen and the British pound.

Smart Money Flow

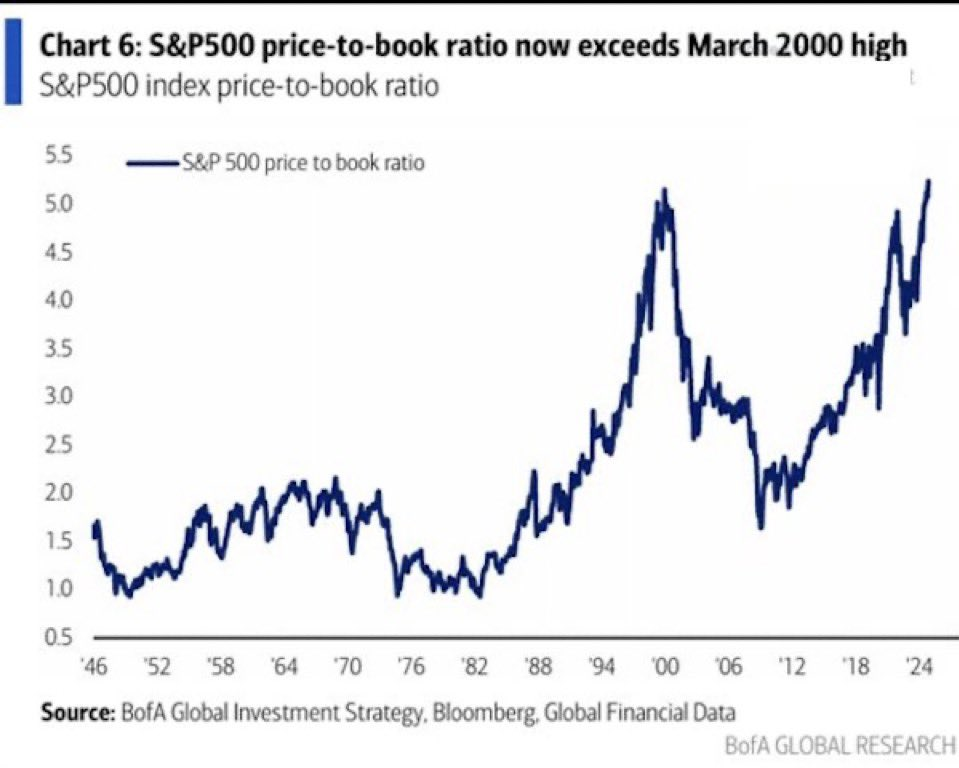

The price-to-book ratio of the S&P 500 Index has now surpassed its peak during the dot-com bubble era.

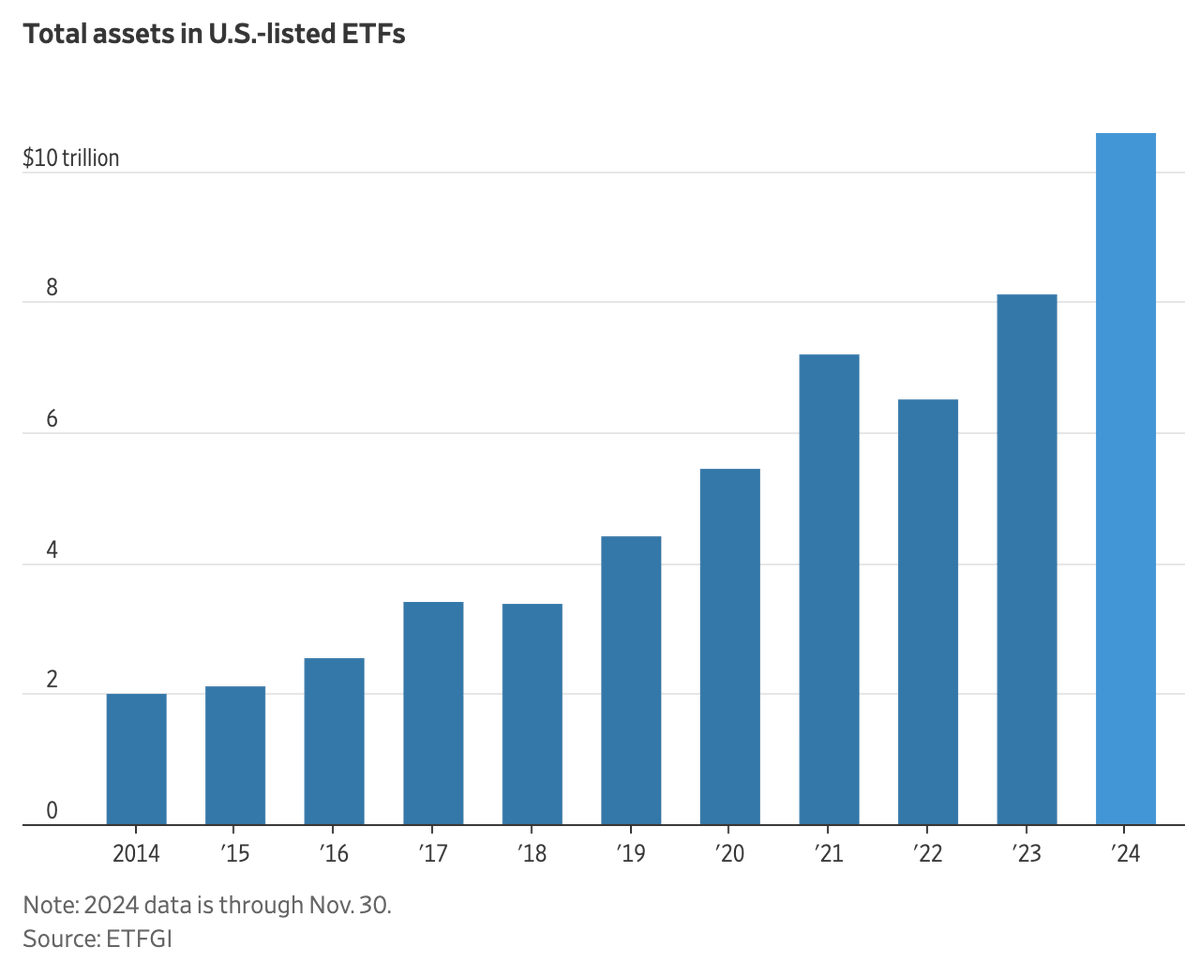

By the end of November, the total assets of Exchange Traded Funds (ETFs) in the United States had reached a record high of $10.6 trillion, marking an increase of over 30% since the beginning of 2024.

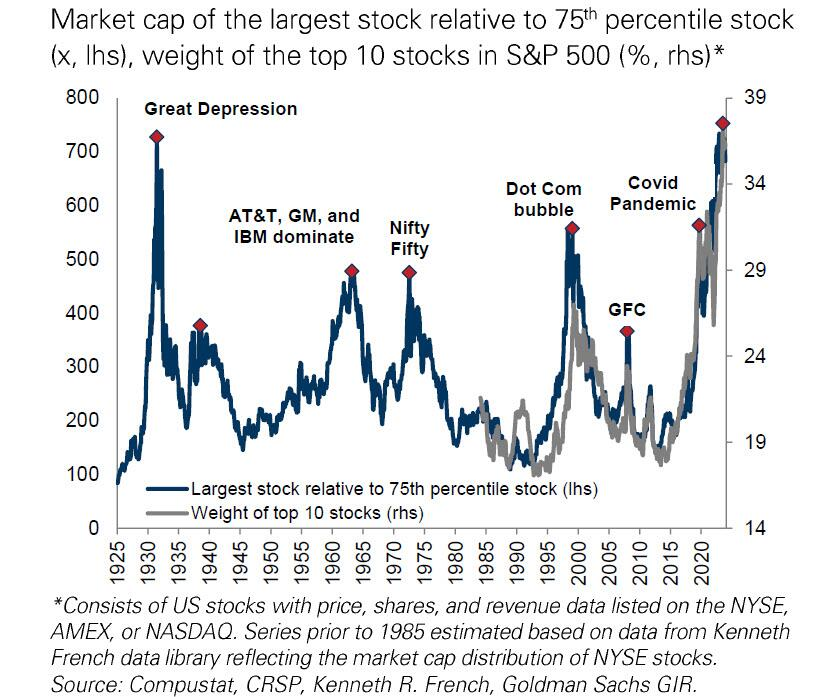

The concentration bubble in the U.S. stock market is rarely bigger

The market concentration at the start of 2025 has reached its highest level since the Great Depression. The top 10 U.S. stocks account for 38% of the total market capitalization.

Top Corporate News

Tesla's Q4 delivery data missed expectations, Stock price drops by over 6%

On Thursday, January 2nd, Eastern Time, Tesla released its vehicle delivery data for the full year and fourth quarter of 2024. Subsequently, its stock price fell by more than 6% during the day's trading. Tesla said that 1.79 million vehicles were delivered in 2024, less than the 1.8 million vehicles delivered in 2023 and lower than the analysts' general forecast of 1.8 million. This marks the first annual sales decline since Tesla went public in 2011.

Despite the annual sales decline, Tesla still achieved strong growth in the fourth quarter. In the fourth quarter ending December 31st, Tesla delivered 495,570 vehicles, setting a new quarterly delivery record but falling short of the analysts' average expectations. Although the sales of electric vehicles hardly grew, Tesla's stock price rose by more than 60% in 2024. Almost all of the increase occurred after the presidential election on November 5th.

Investors are certainly concerned about quarterly delivery volumes, but currently, they are more focused on the future development in 2025 and how Elon Musk's close relationship with Trump will help the electric vehicle manufacturer.

Carvana Slips as Hindenburg Alleges 'Related-Party Accounting Games'

Hindenburg Research has announced that it is shorting Carvana, a used car dealer. It claims that the recent turnaround of this online used car retailer is propped up by shaky loans and accounting manipulations. Carvana's share price dropped approximately 3% on Thursday.

Nathan Anderson, the founder of Hindenburg, said that after conducting extensive document reviews and interviewing 49 industry experts, former Carvana employees, competitors, and relevant parties, the institution firmly believes that Carvana's "transformation is an illusion".

The institution wrote in its report, "Our research has found that the company sold $800 million in loans to suspected undisclosed related parties. Meanwhile, it has utilized accounting manipulations and loose loan approval processes to drive temporary revenue growth, while insiders have taken the opportunity to cash out billions of dollars' worth of stocks."

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.