It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Markel Group (NYSE:MKL). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

How Fast Is Markel Group Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. Therefore, there are plenty of investors who like to buy shares in companies that are growing EPS. We can see that in the last three years Markel Group grew its EPS by 8.4% per year. That's a good rate of growth, if it can be sustained.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Markel Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Markel Group shareholders is that EBIT margins have grown from 19% to 24% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. It's noted that Markel Group's revenue from operations was lower than its revenue in the last twelve months, so that could distort our analysis of its margins. The music to the ears of Markel Group shareholders is that EBIT margins have grown from 19% to 24% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

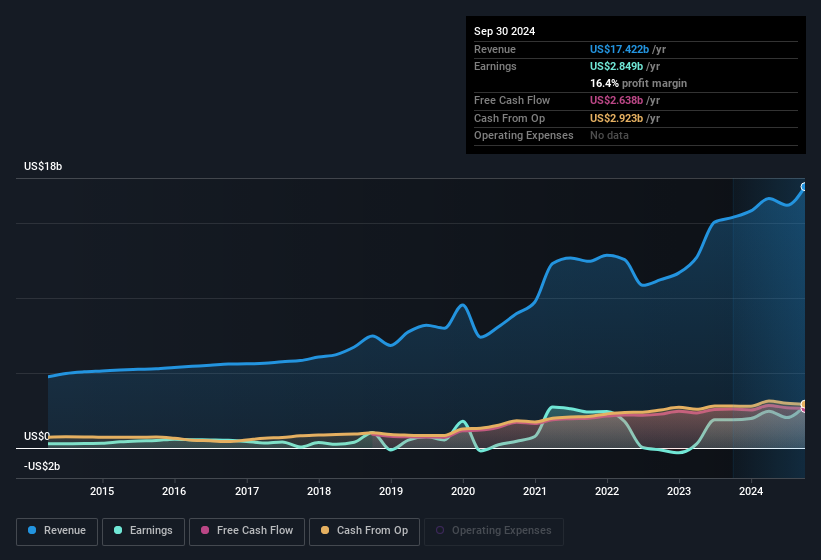

You can take a look at the company's revenue and earnings growth trend, in the chart below. To see the actual numbers, click on the chart.

Fortunately, we've got access to analyst forecasts of Markel Group's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Markel Group Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Despite US$198k worth of sales, Markel Group insiders have overwhelmingly been buying the stock, spending US$486k on purchases in the last twelve months. You could argue that level of buying implies genuine confidence in the business. We also note that it was the Chief Investment Officer, Thomas Gayner, who made the biggest single acquisition, paying US$155k for shares at about US$1,550 each.

On top of the insider buying, it's good to see that Markel Group insiders have a valuable investment in the business. Indeed, they have a considerable amount of wealth invested in it, currently valued at US$406m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

While insiders already own a significant amount of shares, and they have been buying more, the good news for ordinary shareholders does not stop there. That's because on our analysis the CEO, Tom Gayner, is paid less than the median for similar sized companies. The median total compensation for CEOs of companies similar in size to Markel Group, with market caps over US$8.0b, is around US$13m.

Markel Group's CEO took home a total compensation package worth US$8.1m in the year leading up to December 2023. That is actually below the median for CEO's of similarly sized companies. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Markel Group Deserve A Spot On Your Watchlist?

One important encouraging feature of Markel Group is that it is growing profits. Better yet, insiders are significant shareholders, and have been buying more shares. These factors alone make the company an interesting prospect for your watchlist, as well as continuing research. However, before you get too excited we've discovered 1 warning sign for Markel Group that you should be aware of.

Keen growth investors love to see insider activity. Thankfully, Markel Group isn't the only one. You can see a a curated list of companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.