Investors with a lot of money to spend have taken a bullish stance on Procter & Gamble (NYSE:PG).

And retail traders should know.

We noticed this today when the trades showed up on publicly available options history that we track here at Benzinga.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PG, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with PG, it often means somebody knows something is about to happen.

So how do we know what these investors just did?

Today, Benzinga's options scanner spotted 8 uncommon options trades for Procter & Gamble.

This isn't normal.

The overall sentiment of these big-money traders is split between 50% bullish and 50%, bearish.

Out of all of the special options we uncovered, 3 are puts, for a total amount of $129,745, and 5 are calls, for a total amount of $168,322.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $150.0 to $180.0 for Procter & Gamble over the last 3 months.

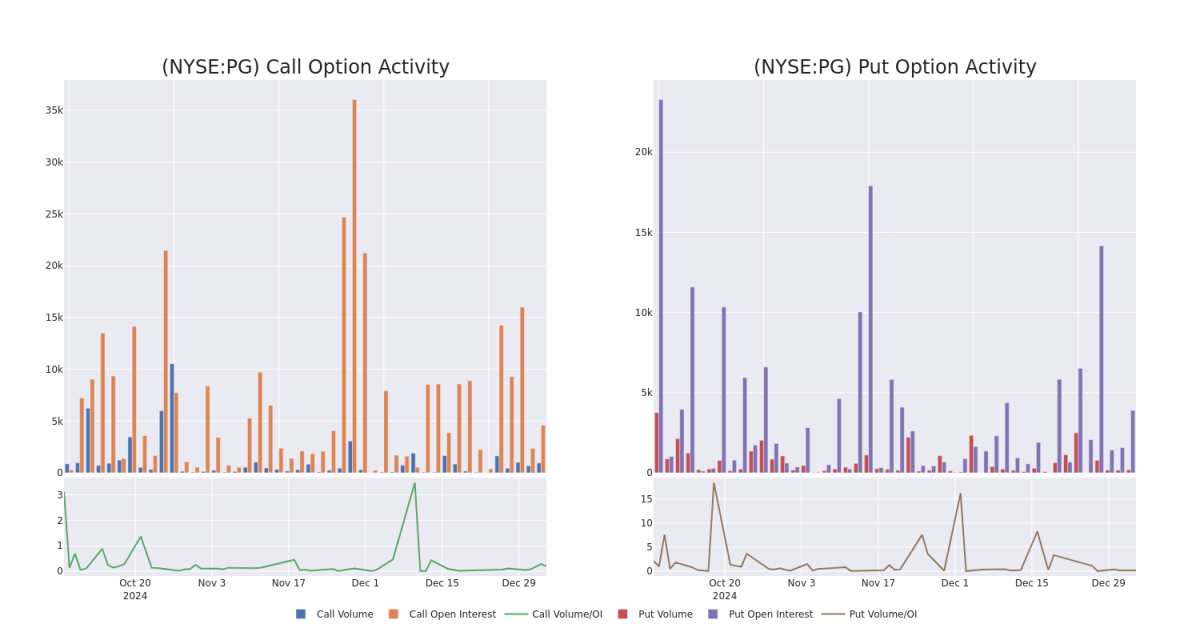

Insights into Volume & Open Interest

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Procter & Gamble's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Procter & Gamble's substantial trades, within a strike price spectrum from $150.0 to $180.0 over the preceding 30 days.

Procter & Gamble Option Activity Analysis: Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| PG | PUT | TRADE | BULLISH | 06/20/25 | $7.3 | $7.15 | $7.15 | $165.00 | $59.3K | 1.0K | 85 |

| PG | PUT | TRADE | BULLISH | 06/20/25 | $5.3 | $5.2 | $5.2 | $160.00 | $39.5K | 1.2K | 76 |

| PG | CALL | TRADE | BEARISH | 03/21/25 | $3.7 | $3.55 | $3.61 | $170.00 | $36.1K | 1.8K | 390 |

| PG | CALL | TRADE | BULLISH | 01/16/26 | $24.45 | $22.8 | $24.0 | $150.00 | $36.0K | 351 | 15 |

| PG | CALL | TRADE | BEARISH | 06/20/25 | $2.81 | $2.69 | $2.69 | $180.00 | $35.7K | 2.3K | 133 |

About Procter & Gamble

Since its founding in 1837, Procter & Gamble has become one of the world's largest consumer product manufacturers, generating more than $80 billion in annual sales. It operates with a lineup of leading brands, including more than 20 that generate north of $1 billion each in annual global sales, such as Tide laundry detergent, Charmin toilet paper, Pantene shampoo, and Pampers diapers. Sales outside its home turf represent more than half of the firm's consolidated total.

Current Position of Procter & Gamble

- With a volume of 1,175,610, the price of PG is up 0.08% at $166.1.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 19 days.

Expert Opinions on Procter & Gamble

1 market experts have recently issued ratings for this stock, with a consensus target price of $209.0.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from DA Davidson has decided to maintain their Buy rating on Procter & Gamble, which currently sits at a price target of $209.

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Procter & Gamble with Benzinga Pro for real-time alerts.