Financial giants have made a conspicuous bullish move on Shopify. Our analysis of options history for Shopify (NYSE:SHOP) revealed 22 unusual trades.

Delving into the details, we found 50% of traders were bullish, while 27% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $190,124, and 18 were calls, valued at $1,410,142.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $45.0 to $175.0 for Shopify over the last 3 months.

Analyzing Volume & Open Interest

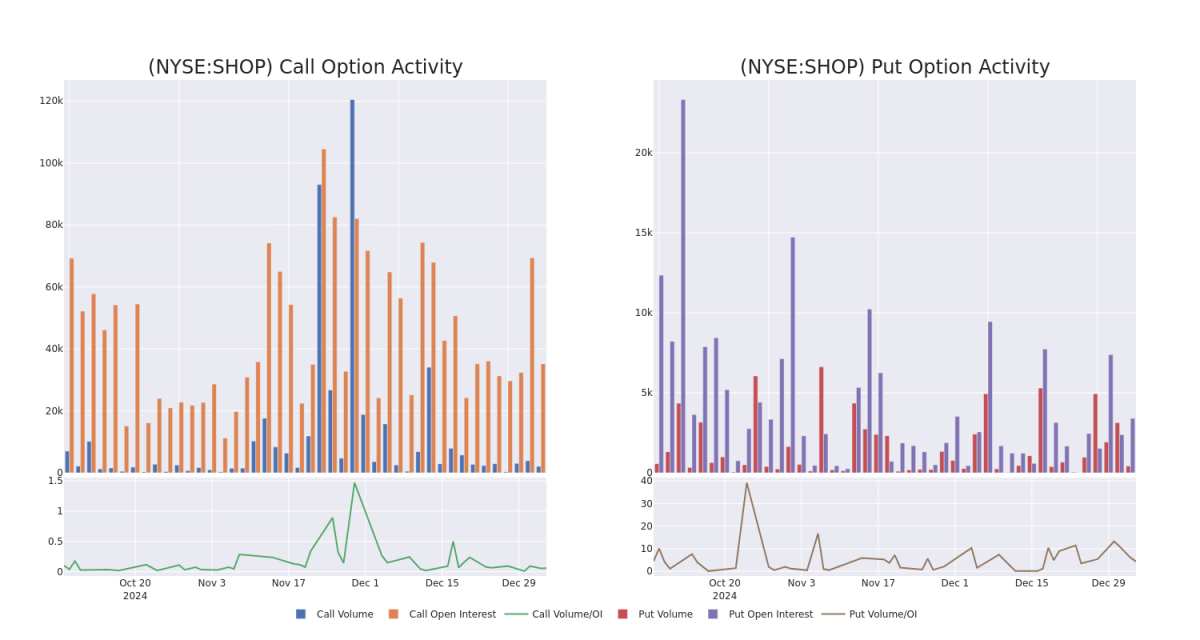

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

This data can help you track the liquidity and interest for Shopify's options for a given strike price.

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Shopify's whale activity within a strike price range from $45.0 to $175.0 in the last 30 days.

Shopify Call and Put Volume: 30-Day Overview

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SHOP | CALL | TRADE | BEARISH | 09/19/25 | $3.9 | $3.75 | $3.8 | $175.00 | $228.0K | 63 | 600 |

| SHOP | CALL | SWEEP | BULLISH | 06/20/25 | $16.95 | $16.8 | $16.95 | $105.00 | $220.3K | 2.9K | 140 |

| SHOP | CALL | SWEEP | NEUTRAL | 03/21/25 | $18.5 | $18.1 | $18.38 | $95.00 | $165.4K | 1.6K | 91 |

| SHOP | CALL | TRADE | NEUTRAL | 06/20/25 | $12.7 | $12.55 | $12.62 | $115.00 | $112.3K | 4.6K | 110 |

| SHOP | CALL | TRADE | BULLISH | 01/17/25 | $3.15 | $3.1 | $3.15 | $109.00 | $94.5K | 371 | 348 |

About Shopify

Shopify offers an e-commerce platform primarily to small and medium-size businesses. The firm has two segments. The subscription solutions segment allows Shopify merchants to conduct e-commerce on a variety of platforms, including the company's website, physical stores, pop-up stores, kiosks, social networks (Facebook), and Amazon. The merchant solutions segment offers add-on products for the platform that facilitate e-commerce and include Shopify Payments, Shopify Shipping, and Shopify Capital.

After a thorough review of the options trading surrounding Shopify, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Shopify's Current Market Status

- With a volume of 1,745,179, the price of SHOP is up 1.26% at $108.89.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 39 days.

Professional Analyst Ratings for Shopify

3 market experts have recently issued ratings for this stock, with a consensus target price of $126.66666666666667.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.* An analyst from JMP Securities downgraded its action to Market Outperform with a price target of $120. * Reflecting concerns, an analyst from JMP Securities lowers its rating to Market Outperform with a new price target of $120.* Showing optimism, an analyst from Loop Capital upgrades its rating to Buy with a revised price target of $140.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.