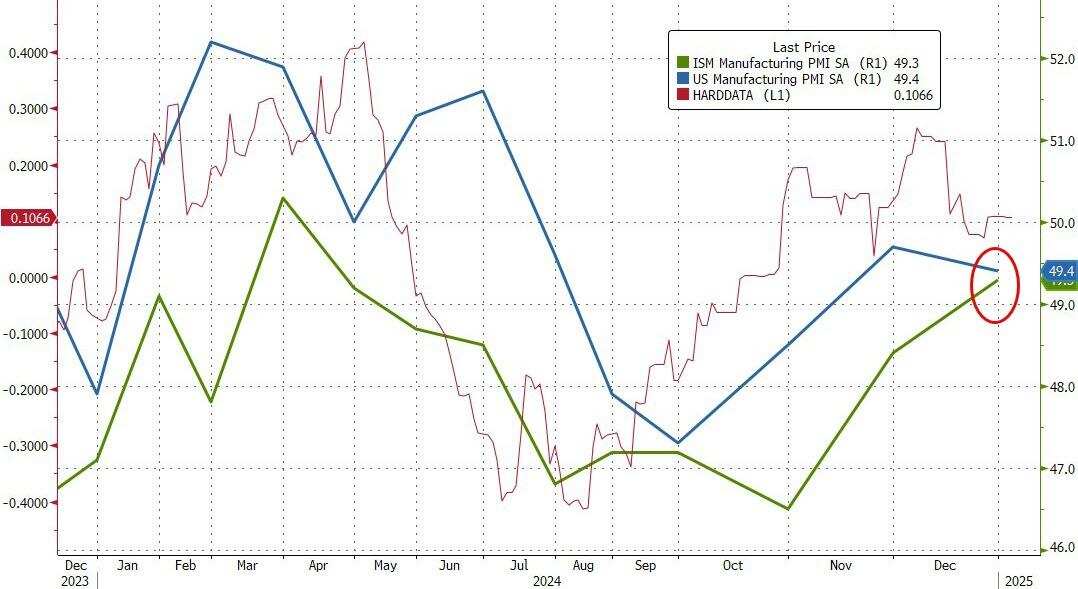

In December, the ISM manufacturing Index in the USA was 49.3, better than the expected 48.2, compared to 48.4 in November. The new Order Index was 52.5, reaching a new high since January 2024, while November was 50.4. The employment Index was 45.3, compared to the previous value of 48.1. The prices paid Index was 52.5, while November was 50.3. Analysts stated that this is a relatively robust manufacturing report.

On January 3rd, Friday, the data released by ISM showed that the USA's ISM Manufacturing Index for December reached a nine-month high, but it is still in a state of contraction. Overall, while the USA manufacturing sector continues to struggle, there are clear signs of improvement.

The USA's ISM Manufacturing Index for December is 49.3, better than the expected 48.2, with the previous value of 48.4 in November. The threshold for expansion is 50.

In March last year, the USA's ISM Manufacturing Index unexpectedly performed significantly better than expected, breaking above the 50 mark, reaching 50.3, ending a 16-month stretch of contraction. However, data from the following months showed that the USA manufacturing sector's monthly expansion was short-lived. The latest report indicates that the USA's ISM manufacturing data has contracted for nine consecutive months. Manufacturing activity has been shrinking almost every month over the past two years, except for one month.

In March last year, the USA's ISM Manufacturing Index unexpectedly performed significantly better than expected, breaking above the 50 mark, reaching 50.3, ending a 16-month stretch of contraction. However, data from the following months showed that the USA manufacturing sector's monthly expansion was short-lived. The latest report indicates that the USA's ISM manufacturing data has contracted for nine consecutive months. Manufacturing activity has been shrinking almost every month over the past two years, except for one month.

On the other hand, although the USA manufacturing sector is still in contraction, most of the sub-indices in the December ISM Manufacturing PMI data showed improvement, marking a general improvement for the second consecutive month. This is a highlight of the data from the past two months, and combined with the overall PMI data that reached a nine-month high, it indicates that the USA manufacturing sector is stabilizing after two years of sluggishness.

Regarding important sub-indices:

- The New Order Index is 52.5, reaching its highest level since January 2024, with the previous value in November being 50.4. This is the second consecutive month of growth in new orders. New export orders have also rebounded, rising by 1.3 points in a single month, reaching the 50 mark.

The backlog Order Index is 45.9, an increase of 4.1 points from November. Since September 2022, the backlog orders have been in a contraction phase each month, with the contraction rate slowing down in December.

- The production Index continues to rebound and accelerates into the expansion Range, reaching 50.3 in December, an increase of 3.5 points from November's 46.8.

- The employment Index is 45.3, down significantly from the previous value of 48.1 in November. This marks the seventh consecutive month that the employment Index has fallen below 50, indicating that manufacturers are laying off workers, and the labor market in this sector is weakening.

- The price payment Index is 52.5, with expectations at 51.8, and the previous value for November was 50.3. The latest data indicate that prices are rising at an accelerating pace.

The factory inventory Index increased by 0.3 points to 48.4, indicating that inventories are contracting, but the rate of contraction is slowing. This suggests that the significant inventory reductions made by manufacturers in September and October of last year may have come to a halt, or could help further increase Orders and stimulate production.

Timothy Fiore, chairman of the USA Supply Management Association Manufacturing Survey Committee, stated:

Manufacturing activity in the USA shrank again in December, but the pace of contraction slowed compared to November. There are signs of improved demand, stable output, and continued loose input conditions.

Analysts suggest that this is a relatively robust manufacturing PMI report. Although the labor sub-index data is weak, a glimmer of hope is that this will make it easier for the Federal Reserve to lower interest rates, which could help boost the USA economy in the future. Additionally, as the new year approaches, new Order data presents a Bullish outlook for manufacturing Stocks.

After the release of the USA December ISM Manufacturing PMI data:

- The 10-year USA Treasury yield rebounded from 4.555% to nearly 4.57%, reaching a new daily high, overall increasing more than 1.2 basis points during the day. The 2-year USA Treasury yield rose from above 4.24% to nearly 4.255%, also reaching a new daily high, with an overall increase of over 1.4 basis points during the day.

- The S&P 500 Index rose over 0.6%, the Dow Jones increased by 0.3%, and the Nasdaq was up by 1.1%.

- Spot Gold hit a new daily low of $2642.52 per ounce, with the decline expanding to over 0.5% after the data release.

Data released earlier on Thursday by S&P Global showed that the USA December Markit Manufacturing PMI final value was 49.4, better than the expected 48.3, closely aligning with the ISM Manufacturing PMI released on Friday, which had a previous value of 49.7 in November.

However, Chris Williamson, Chief Business Economist at S&P Global Market Intelligence, stated yesterday that optimism weakened in December as companies reported concerns over rising input prices and worries that inflation could rise again, intensifying speculation that interest rates may not be drastically lowered as previously anticipated over the coming year.

去年3月,美国ISM制造业指数意外大幅好于预期,突破50大关,达到50.3,结束了连续16个月的制造业收缩。不过从之后几个月的数据来看,美国制造业的单月扩张仅为昙花一现。最新报告意味着,美国ISM制造业数据已连续9个月萎缩。美国制造业活动在过去两年中的每个月几乎都在萎缩,除了一个月之外。

去年3月,美国ISM制造业指数意外大幅好于预期,突破50大关,达到50.3,结束了连续16个月的制造业收缩。不过从之后几个月的数据来看,美国制造业的单月扩张仅为昙花一现。最新报告意味着,美国ISM制造业数据已连续9个月萎缩。美国制造业活动在过去两年中的每个月几乎都在萎缩,除了一个月之外。